This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Price-In 50bp Cuts After Soft Jobs Report

July 8, 2024

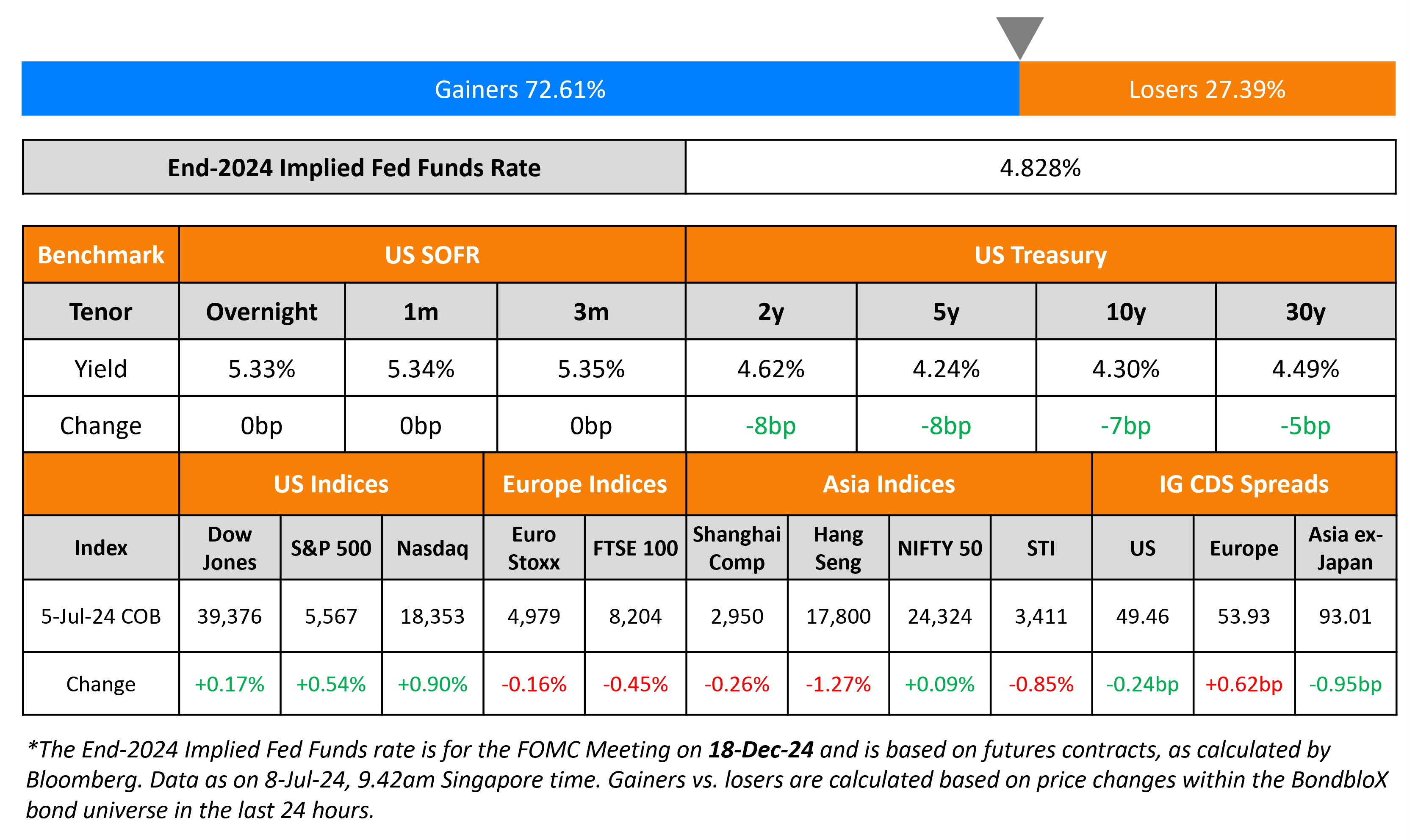

US Treasury yields dropped by 7-8bp across the curve following a soft employment report on Friday. US Non-Farm Payrolls (NFP) for June rose by 206k, higher than expectations of 190k, while May’s print was revised down to 218k from 272k. The Unemployment Rate was higher at 4.1% vs. expectations of 4.0%. Average Hourly Earnings (AHE) YoY was in-line with expectations at 3.9%, but also showing a decrease from 4.1% seen in May. Markets are currently fully pricing-in a 50bp rate cut by the Fed by end-2024, going by the Implied Fed Funds Rate as of the December FOMC meeting at 4.828%. Separately, New York Fed President John Williams said that the Fed is still “a way” from reaching their inflation goal. Looking at equity markets, S&P and Nasdaq were up 0.5% and 0.9%, respectively. US IG spreads were 0.2bp tighter and while HY CDS spreads widened by 0.5bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.6bp and 4bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 1bp tighter.

New Bond Issues

- CMB New York $ at SOFR+105bp area

- ANZ $ 3Y/3Y FRN at T+75bp/SOFR eq. area

New Bonds Pipeline

- Piramal Capital Plans Debut $ Bond Sale

- Astrea 8 Pte. hires for S$ bond

- NongHyup Bank hires for $ 3Y/5Y bond

- Panasonic Holdings hires for $ 3Y/10Y bond

Rating Changes

- Fitch Downgrades Sprint BidCo’s (Accell) IDR to ‘CCC-‘; Places on Rating Watch Negative

- Black Sea Trade and Development Bank Downgraded To ‘BBB’ On Reduced Policy Importance; Outlook Stable

- Moody’s Ratings changes Azerbaijan’s outlook to positive from stable, affirms Ba1 rating

Term of the Day

Formosa Bonds

A Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange.

Talking Heads

On Bond markets’ re-focus on US elections

Mary-Therese Barton, fixed income CIO, Pictet Asset Management

“The lens (is) really starting to turn to the fiscal and the debt dynamics. (The) rate-cutting cycle is perhaps shallower than expected with a focus more on the longer end”

John Velis, Americas macro strategist at BNY

“We feel the probability of (a) Trump election victory has risen. Our faith in lower yields going forward has been eroded and we wouldn’t be surprised to see a continuation of the very recent moves higher in yields”

On Government Reform Driving Biggest Returns in EM Bond Markets

Adriaan du Toit, director of EM credit research at AllianceBernstein

“Fiscal dynamics are moving to the center of investors’ radars… partly due to surprising election outcomes and the fact that politics and fiscal dynamics are intertwined.”

Yvette Babb, PM at William Blair

“Market participants are in our view likely to continue to focus on the credibility of macro-economic policies”

On Scrapping Bets Against UK Bonds on Labour Win, BOE Outlook – Mark Dowding, CIO, RBC BlueBay

“Starmer will probably have a honeymoon period and that should benefit gilts… in the short term, there is a window for a BOE rate cut in August… I think there will be another trade toward higher UK yields.. likely comes later in the third quarter after inflation moves up”

Top Gainers & Losers- 08-July-24*

Go back to Latest bond Market News

Related Posts: