This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await US Jobs Report later Today

July 5, 2024

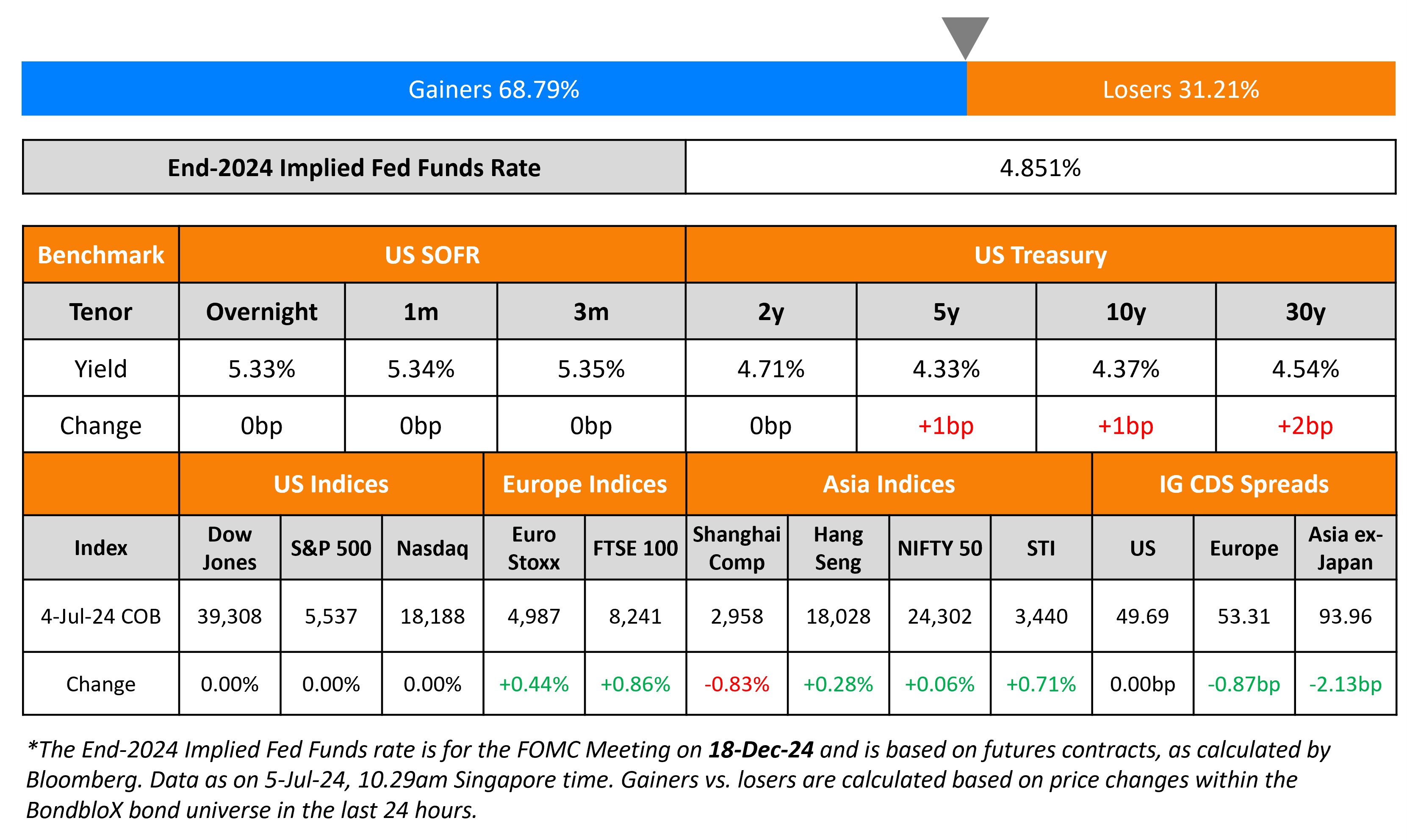

US Treasury yields are stable across the curve. Markets await the Non-Farm Payrolls (NFP) report later today, with expectations at 190k for June. Average Hourly Earnings (AHE) YoY is expected to slowdown to 3.9% while the Unemployment Rate is expected to hold steady at 4.0%. US markets were closed for Independence Day yesterday.

European equity indices ended higher. In credit markets, the iTraxx Main and Crossover spreads were tighter by 0.9bp and 3bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were 2.1bp tighter.

New Bond Issues

Ho Bee Land raised S$160mn via a 5Y green bond at a yield of 4.35%, 25bp inside initial guidance of 4.6% area. The senior unsecured bonds are unrated and are issued as part of the company’s S$800mn multicurrency medium term note program. Proceeds will be used for funding or refinancing, in whole/part, new or existing eligible projects under its green finance framework. Private banks received a 25-cent rebate.

New Bonds Pipeline

- Astrea 8 Pte. hires for S$ bond

- NongHyup Bank hires for $ 3Y/5Y bond

Rating Changes

- Moody’s Ratings upgrades Bridgestone to A1, changes outlook to stable from positive

- Fitch Revises Outlook on Banco Comercial Portugues to Positive; Affirms at ‘BBB-‘

- Positive Rating Actions Taken On Eight Greek Banks On Resilience To Economic Cycles And Improving Funding Profile

Term of the Day

Long Stop Date

Long Stop Date is a clause seen in mergers/acquisitions and is the date defined by contract as the latest point in time by which the transaction can be completed. All conditions to the transaction must be satisfied by this date. If not, the parties to the transaction can withdraw from the deal. The purpose of a Long Stop Date is to undo a transaction contract that is not completed.

Talking Heads

On Trump presidency causing spike in US bond yields

Benjamin Melman, CIO at Edmond de Rothschild AM

“What is true about Donald Trump, his programme, is significantly inflationary. Even if the environment is bullish in fixed income…the long end of the U.S. yield curve is less bullish in our view due to the U.S. political risk premium”

On ECB Still Having Some Concerns About Domestic Inflation – Chief Economist Philip Lane

“What we can mostly influence is domestic inflation… ability of European firms to raise prices depends on monetary conditions… goes back to why we still have some concerns. Domestic inflation is lower than at the peak around a year ago, but it’s still about 4%”

On US-Led Rising Debt Across G-7 Stoking S&P and Scope Concerns

“At the current stage in their electoral cycles, only a sharp step-up in market pressures could persuade these governments to implement a more resolute budgetary consolidation… sharp deterioration of borrowing conditions would also increase the size of the required fiscal adjustment… Broad, bipartisan support on proactive measures to meaningfully reduce high fiscal deficits and curtail the rise in government debt has been elusive”

Top Gainers & Losers- 05-July-24*

Go back to Latest bond Market News

Related Posts: