This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await US CPI Data

July 12, 2023

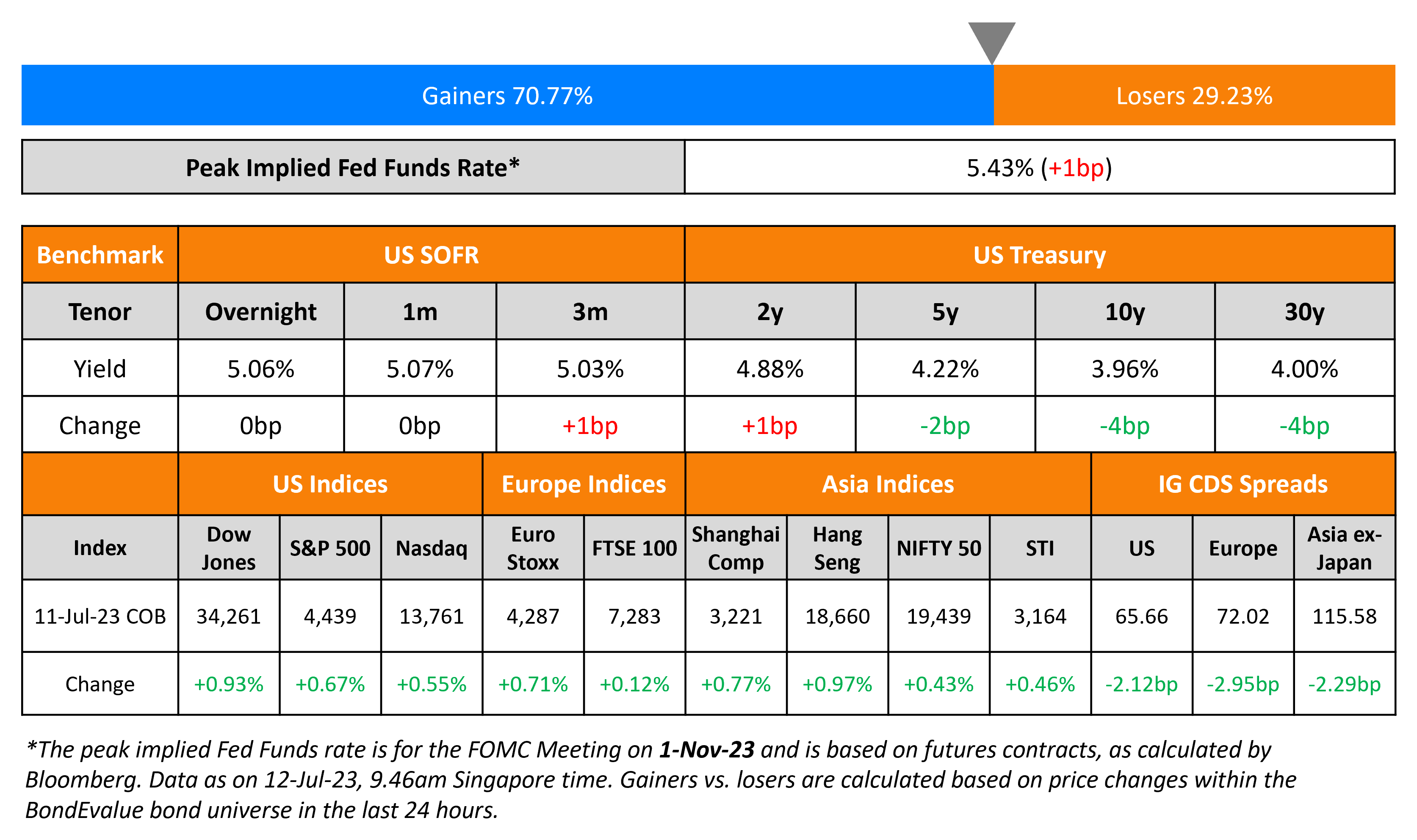

US Treasury yields were broadly flat with markets keenly keeping an eye on US inflation data due later today. US CPI for June is expected to come at 3.1% YoY and Core CPI at 5% YoY, a drop from 4% and 5.3% respectively in May. The peak Fed Funds rate rose 1bp to 5.43%. A broad risk-on sentiment was seen in markets as US equity indices were higher with the S&P and Nasdaq up 0.6-0.7% and credit spreads also tightened. US IG and HY CDS spreads tightened 2.1bp and 12.5bp respectively.

European equity indices closed higher too with European main CDS spreads 3bp tighter and Crossover CDS tighter by 12.2bp. Asia ex-Japan CDS spreads were 2.3bp tighter and Asian equity markets have opened broadly higher today.

New Bond Issues

- Telecom Italia € 5Y at 8.25% area

Rabobank raised $1.5bn in a two-part deal. It raised $850mn via a 2Y bond at a yield of 5.535%, 22.5bp inside initial guidance of T+87.5bp area. It also raised $650mn via a 2Y FRN bond at a yield of 5.793%. The FRN’s coupon will be set at the overnight SOFR+70bps, and will be paid quarterly. The bonds have expected ratings of Aa2/A+/AA-. Proceeds will be used for general corporate purposes. The deal, which issues a floater and fixed rate note of the same maturity, allows investors to take an investment position depending on their view of where rates are headed. Investors believing that rates will come down in the near term may opt for the fixed rate 2Y note whereas those that believe that rates would remain higher for longer may opt for the 2Y floater.

Abu Dhabi Commercial Bank (ADCB) raised $500mn via a 5Y bond at a yield of 5.452%, 10bp inside initial guidance of T+130bp area. The senior unsecured bonds have expected ratings of A/A+ (S&P/Fitch), and received orders over $730mn, 1.5x issue size. Proceeds will be used for general corporate purposes.

CICC Hong Kong raised $500mn via a 3Y bond at a yield of 5.442%, 35bp inside initial guidance of T+125bp area. The senior unsecured bonds have expected ratings of BBB+ (S&P) and are guaranteed by its parent, CICC International (CICCI), rated Baa1/BBB+/BBB+. CICCI has also provided a keepwell. Proceeds will be used to repay existing indebtedness and for working capital and other general corporate purposes of the guarantor and its subsidiaries. The new bonds are priced 13.8bp tighter to its existing 2% 2026s that yield 5.58%.

Korea Hydro & Nuclear Power (KHNP) raised $500mn via a 5Y green bond at a yield of 5.153%, 30bp inside initial guidance of T+120bp area. The senior unsecured bonds have expected ratings of Aa2/AA (Moody’s/S&P), and received orders over $2.45bn, 4.9x issue size. Asset and fund managers bought 44% of the deal, banks snapped up 30%, while other financial institutions took the remaining 26%. APAC made up 55%, EMEA 28% and the US 17%. Proceeds will be used to finance/refinance new or existing projects or assets in accordance with KHNP’s Green Bond Framework.

New Bond Pipeline

-

Hanhwa Q Cells hires for $ 5Y green bond

-

Shinhan Financial hires for $ 5Y social bond

Rating Actions

- Crescent Energy Co. Upgraded To ‘B+’ From ‘B’ On Increased Scale, Improved Leverage; Outlook Stable

- Fitch Downgrades Inversiones Latin America Power’s Notes to ‘D’

Term of the Day

Exchangeable Bonds

Exchangeable bonds are a type of debt that gets converted into the common stock of a target firm in which the issuing firm has an ownership position. It signifies a potential change in the issuing company’s asset composition via the divesting of its ownership stake in the target firm.

LG Chem is raising $2bn via exchangeable bonds that will exchange into common shares of LG Energy Solution

Talking Heads

On Inflationary Pressures and Interest Rates in the UK – IMF directors

“Should inflationary pressures show signs of further persistence, the policy rate may have to be raised further and would need to remain higher for longer to durably lower inflation and keep inflation expectations anchored.”

On Investors Adding Bonds to their Portfolio – CIO for Asia Pacific at HSBC Hu Yifan

“The consensus view is that the recession may occur in the third or fourth quarter after 10 consecutive interest-rate increases by the Fed, which would send bond yields down and pummel the US dollar…The bond market has become pretty attractive now and it may turn into the biggest bull market in a decade.”

“If investors haven’t been buying emerging market distressed debt, they should be…That’s because emerging market economies have used the crisis as an opportunity to pass difficult structural reforms, implement fiscal discipline and currency adjustments at a high inflation and political cost…Egypt, for example…have taken their time because they want to

make sure they are selling at the right price. We do think in the coming weeks, if not sooner, there will be positive announcements on Egypt.”

On the Extension of Loan Relief for Developers in China

Liu Shui, research director at China Index Holdings

“The move signals that regulators consider it’ll take a year and a half more for developers to see their fundraising and operations normalize…It means the housing market downturn and developer risks have been worse than they expected earlier.”

Raymond Cheng, head of China and Hong Kong research at CGS-CIMB Securities

Loans due by the end of 2024 account for about 30% to 40% of developers’ total debts…the measures may help ease developers’ liquidity in the short term if implemented.

Wang Qing, chief macro analyst at Golden Credit Rating

Policymakers may take further measures such as relaxing property purchase and mortgage rules as well as cutting home loan rates to achieve a soft landing of the real estate market.

Larry Hu, head of China economics at Macquarie

“Today’s easing, which focuses on developer financing, is far from enough to stabilize the sector…After all, credit risk for banks would remain elevated if the housing market stays weak…Looking ahead, we expect to see more easing on the demand side, such as lowering the down-payment ratio and easing purchase restrictions.”

Top Gainers & Losers – 12-July-23*

Other News

Adani Enterprises raises INR 1,250cr via NCDs

Go back to Latest bond Market News

Related Posts: