This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await NFP; ECB Cuts Rates by 25bp

June 7, 2024

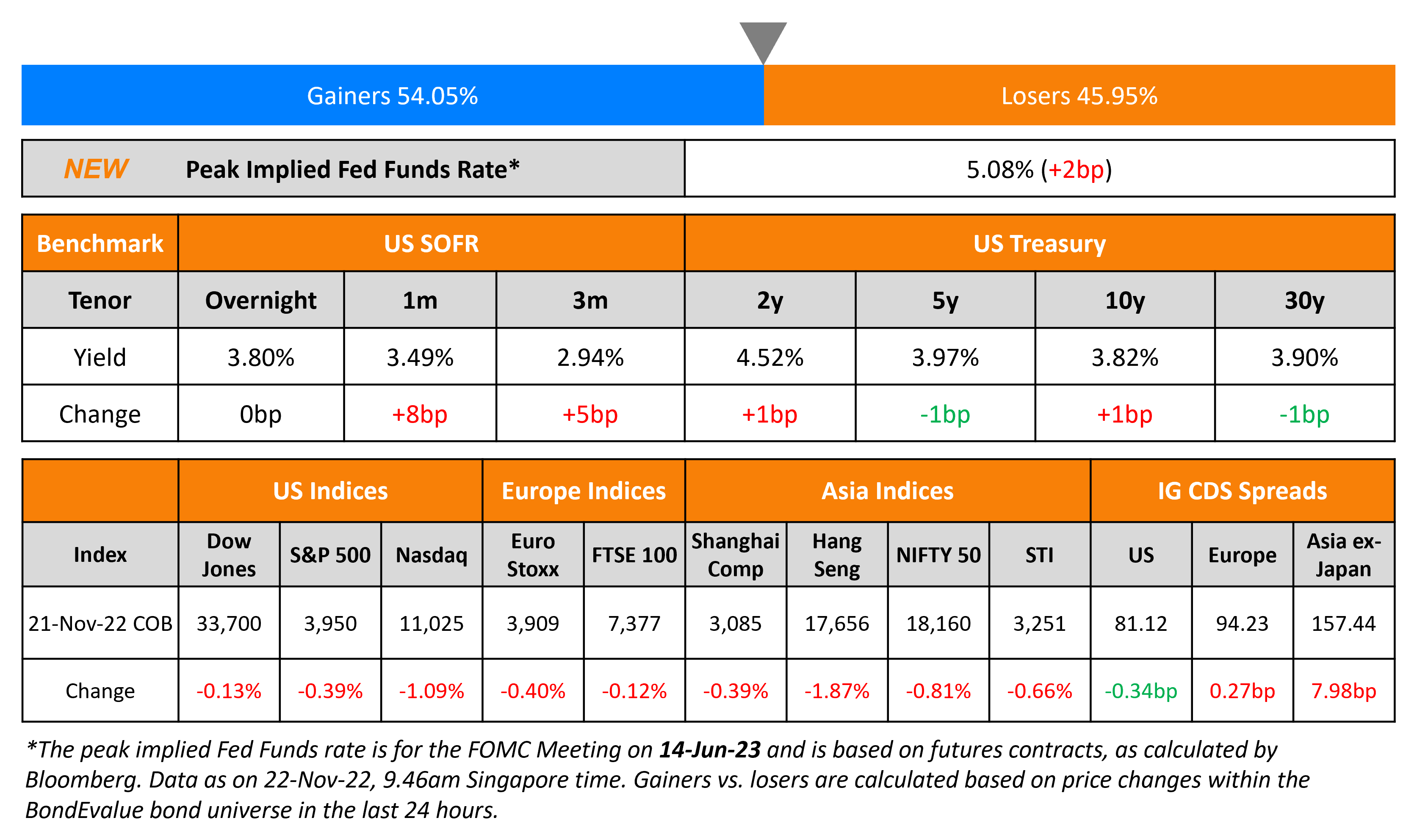

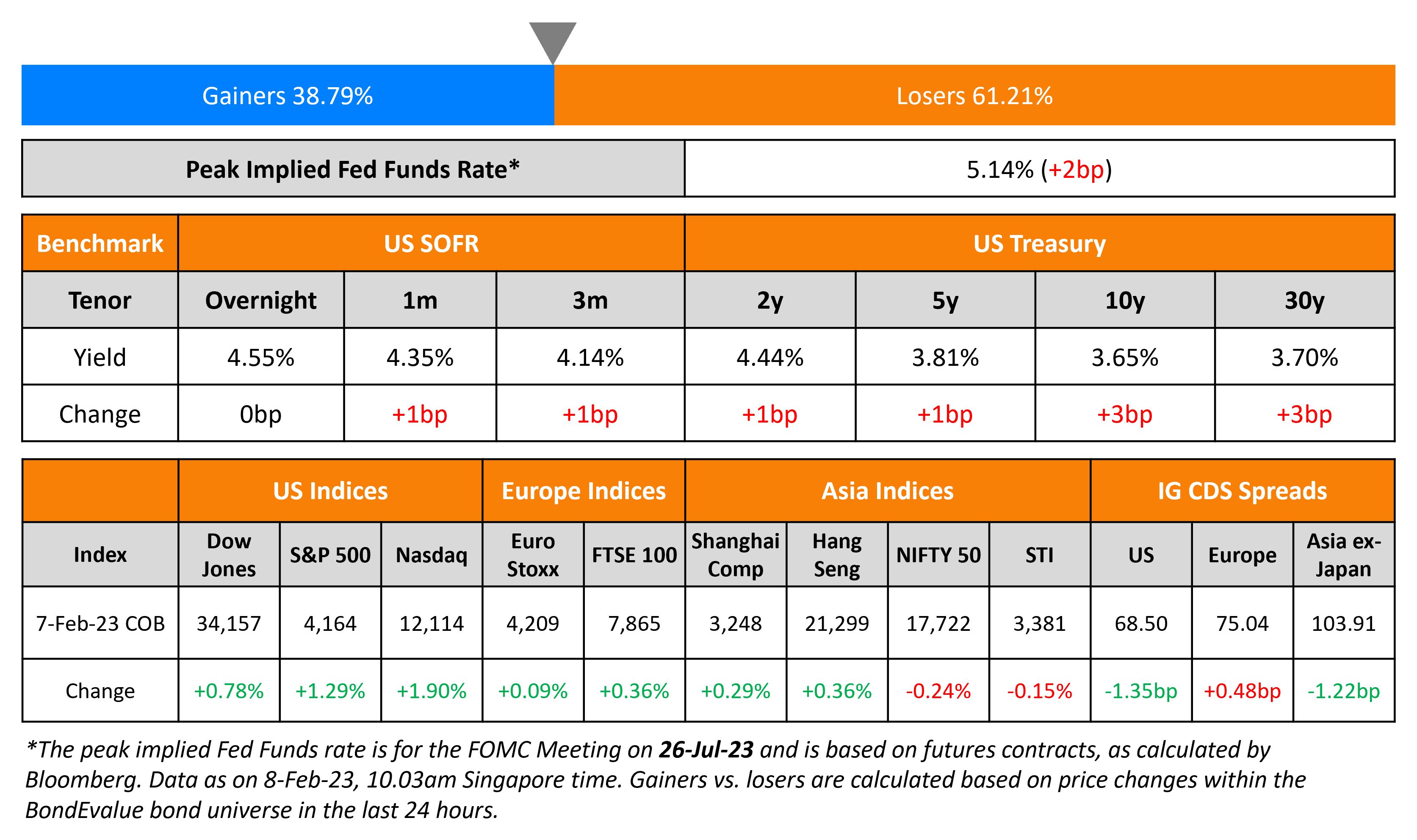

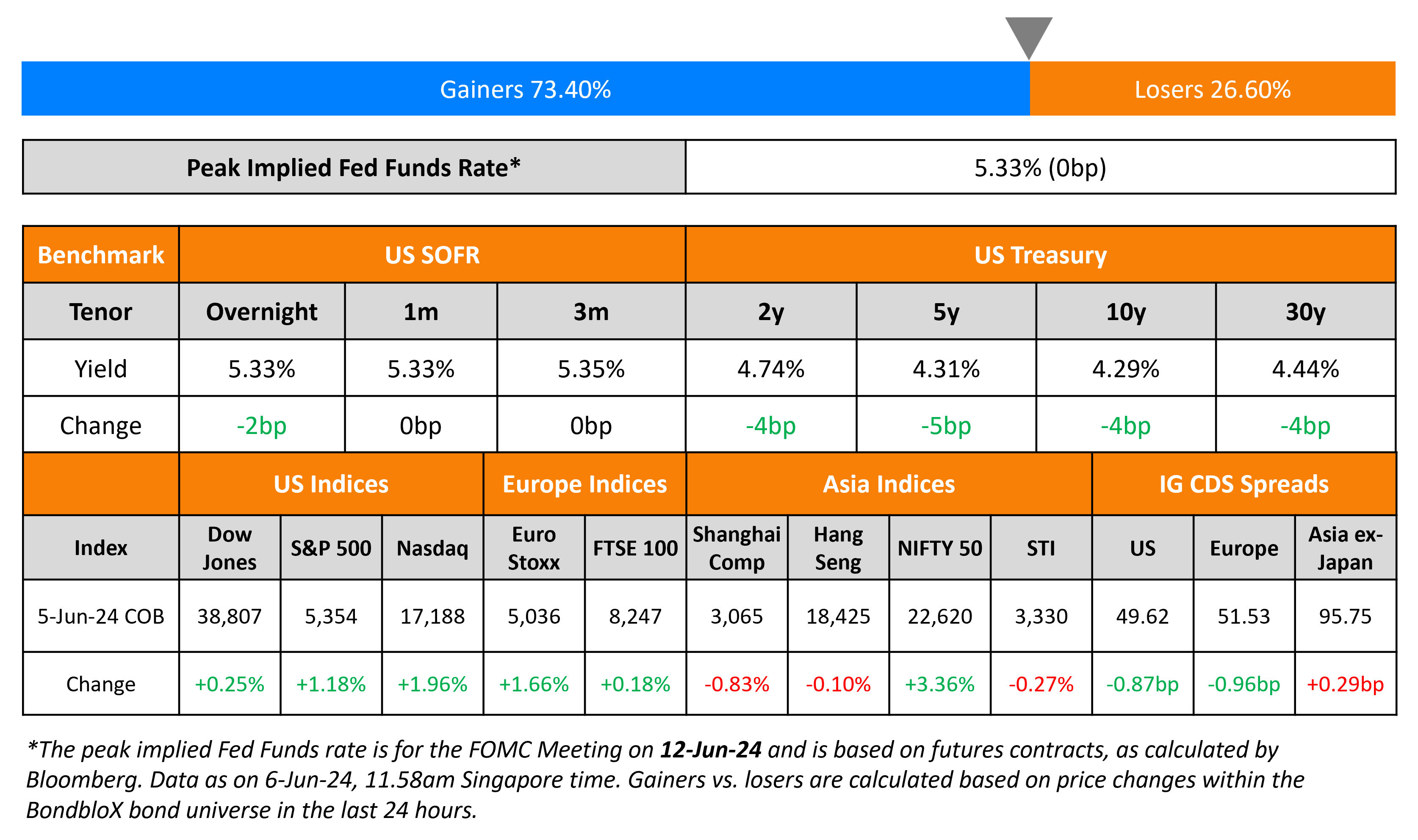

US Treasury yields were stable on Thursday with markets broadly muted ahead of the jobs report due later today. Markets await the jobs report later today where an increase of 175k is expected on the Non-Farm Payrolls, while the unemployment rate and average hourly earnings YoY are both, expected to stay unchanged at 3.9%. US Equity markets were rangebound. US IG CDS spreads widened 0.6bp and HY spreads were 2bp wider.

European equity markets ended higher. Europe’s iTraxx main CDS spreads were 0.1bp wider and crossover spreads were wider by 0.1bp. The ECB cut its policy rates by 25bp with the new deposit rate (DFR) at 3.75%. However, ECB President Christine Lagarde said that the inflation outlook has improved “markedly” and said there’s a “strong likelihood” that the ECB is shifting into a “dialing-back phase”. Markets now expect the ECB to keep rates on hold in July as compared to initial expectations of another rate cut. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads widened 1.1bp.

New Bond Issues

HSBC raised S$1.5bn via a PerpNC5.5 AT1 bond at a yield of 5.25%, 37.5bp inside the initial guidance of 5.625% area. The subordinated notes have expected ratings of Baa3/BBB (Moody’s/Fitch), and received orders over S$1.85bn, 1.2x issue size. The notes are callable on 14 June 2029 to 14 December 2029. If not called by 14 December 2029, the coupon will reset to the 5Y SGD Overnight Indexed Swap (OIS) plus 223.7bps then, and each fifth anniversary date thereafter. A trigger event will occur if the CET1 ratio falls below 7%, wherein the notes will be fully convertible into equity. Proceeds will be used for general corporate purposes, and to further strengthen the issuer’s capital base pursuant to requirements under UK CRR. 71% of the new notes were allocated to private banks, 20% to asset and fund managers, 6% to banks, and 3% to insurance companies. By region, Singapore took 80%, rest of Asia 18%, and EMEA 2%. This is the largest deal done by a bank in the SGD market, tied with the likes of DBS’s 5.75% Perp and OCBC’s 5.1% Perp, both of which were issued in 2008 and have since been redeemed by the issuers. Deals of such size were otherwise seen from sovereign and state-backed issuers such as the Land Transport Authority, Housing & Development Board, and Temasek. The second largest SGD AT1 deal seen was from DBS, which issued a 3.98% Perp in 2018. The new CoCo bonds are priced at a premium of 15bp to UBS’s 5.75% SGD Perps, callable on 21st August 2029, that yield 5.1%.

Phoenix Group Holdings raised $500mn via a PerpNC6 bond at a yield of 8.5%, unchanged from initial guidance. The junior subordinated notes have expected ratings of BBB+ (Fitch), and received orders over $775mn, 1.6x issue size. Proceeds will be used for general corporate purposes and to refinance existing debt, which may include a repurchase of its outstanding 5.625% Perps callable on 29 January 2025 and its 4.75% 2031s. The bonds are callable from 12 December 2029 until 12 June 2030 and any interest payment date thereafter. The coupon will be fixed at 8.50% until 12 June 2030, and if not redeemed, will reset every 5 years to the 5Y Treasury yield plus 418.9bps.

Bank of China/Sydney raised $800mn via a 3Y FRN at SOFFR+50bp, 45bp inside initial guidance of SOFR+90bp area. The senior unsecured notes are rated A1/A/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

Rating Changes

- Fitch Upgrades HPCL-Mittal Energy to ‘BB+’; Outlook Stable

- TransDigm Inc. Upgraded To ‘BB-‘ On Strengthening EBITDA; Outlook Stable

- Dominion Energy Inc. And Subsidiaries VEPCO, DESC Outlooks Revised To Stable Following Asset Sales; Ratings Affirmed

Phoenix Group Holdings raised $500mn via a PerpNC6 bond at a yield of 8.5%, unchanged from initial guidance. The junior subordinated notes have expected ratings of BBB+ (Fitch), and received orders over $775mn, 1.6x issue size. Proceeds will be used for general corporate purposes and to refinance existing debt, which may include a repurchase of its outstanding 5.625% Perps callable on 29 January 2025 and its 4.75% 2031s. The bonds are callable from 12 December 2029 until 12 June 2030 and any interest payment date thereafter. The coupon will be fixed at 8.50% until 12 June 2030, and if not redeemed, will reset every 5 years to the 5Y Treasury yield plus 418.9bps.

Bank of China/Sydney raised $800mn via a 3Y FRN at SOFFR+50bp, 45bp inside initial guidance of SOFR+90bp area. The senior unsecured notes are rated A1/A/A. Proceeds will be used for general corporate purposes.

Term of the Day

Trigger Event

Triggers, or trigger events are an important feature of contingent convertible (CoCo) or additional tier 1 (AT1) bonds and define when the loss absorption mechanism is activated. Triggers can either be mechanical or discretionary. Mechanical triggers are numerically defined and most commonly refer to the bank’s capital ratio level. Discretionary triggers, also known as point of non-viability (PONV) triggers are based on supervisors’ judgement of the bank’s solvency position. On occurrence of a trigger event, an AT1’s loss absorption mechanism kicks in, which may include a conversion to equity and/or a principal write-down, both of which boost the bank’s capital position.

Talking Heads

On Junk Bonds ‘Overvalued’ But Still Offering Bargains – Credit Guru, Marty Fridson

The market is “extremely overvalued”… there’s value in the bonds of companies in the building materials, diversified financial services, food, beverage and tobacco and utilities sectors… bonds from container and aerospace borrowers appear expensive compared with similarly-rated issuers”

On Forgetting US Yield Curve Bets, But Looking to Canada Instead – BofA

“The curve inversion is a function of Fed cutting expectations — the slower the Fed cuts, the longer markets can maintain expectations for additional cuts in the future… Prospects might be better on the Canadian curve vs the US curve as the BOC may be able to ease faster or guide more dovish”

On ECB governors seeing July rate cut as unlikely, focus now on Sept – Sources

Some governors, speaking on condition of anonymity, said they thought it was unlikely they would cut rates again next month in light of recent data, including strong wage growth and services inflation

Top Gainers & Losers- 07-June-24*

Go back to Latest bond Market News

Related Posts: