This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await NFP Data Today

November 3, 2023

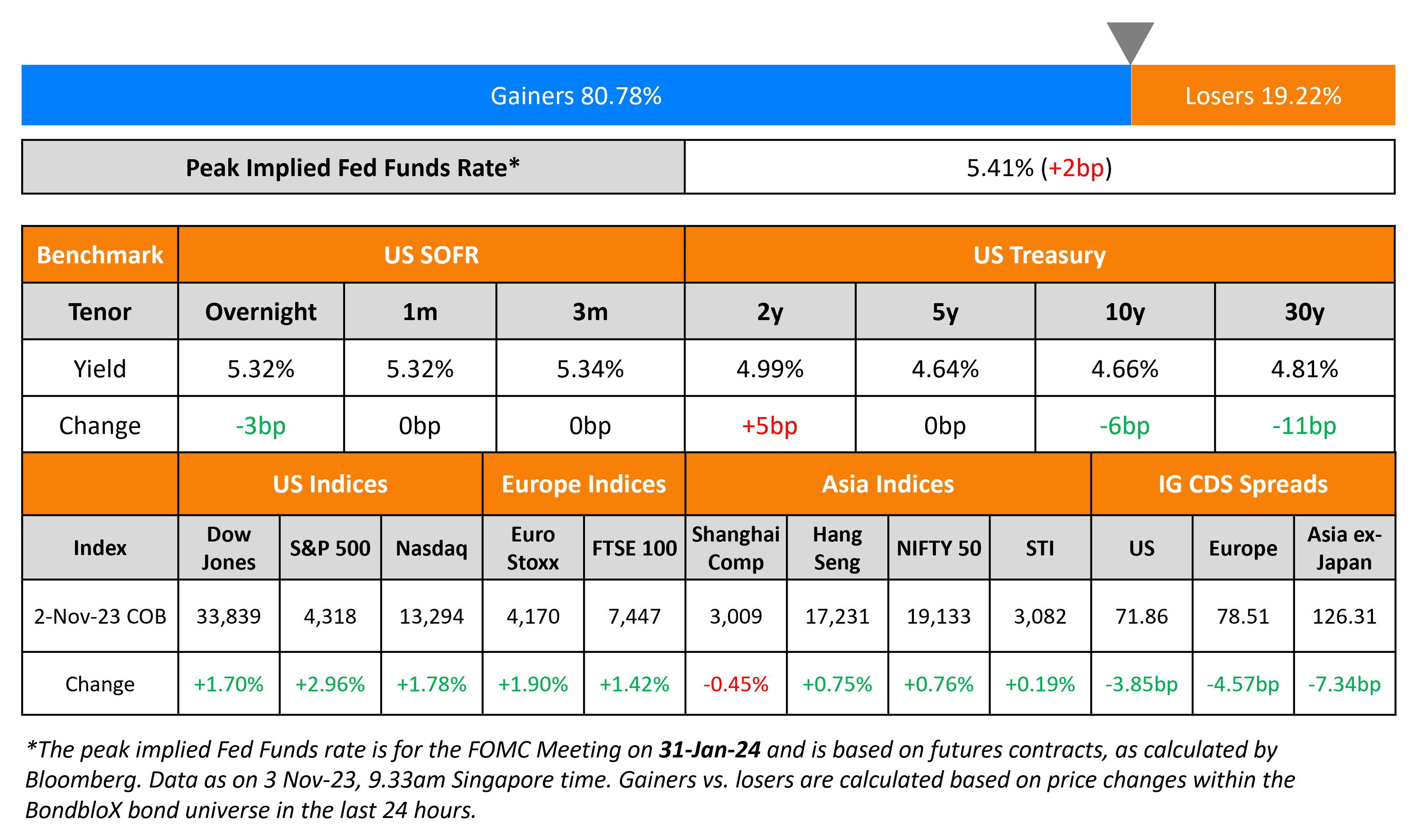

US Treasuries were mixed, with the 2Y yield up 5bp to 4.99% while the 10Y yield fell another 6bp, with the latter continuing its move lower since Wednesday. US initial jobless claims rose for a sixth straight week to 217k, higher than estimates of 210k. Analysts note that the recent trend may indicate trouble finding new jobs for those that have recently lost theirs. Later today, markets await the non farm payrolls (NFP) print with expectations of a 180k print. Average Hourly Earnings (AHE) YoY is expected to rise by 4%. Also, the ISM Non-Manufacturing print is expected to come in at 53. US credit markets continued to tighten – IG CDS spreads tightened 3.9bp and HY spreads tighten by 22.7bp. S&P and Nasdaq rose 1.8-1.9%.

European equity markets closed higher too. In credit markets, European main CDS spreads were tighter by 4.6bp and crossover spreads tightened by 20.6bp. Asian equity markets have opened higher today. Asia ex-Japan IG CDS spreads tightened by 7.3bp.

New Bond Issues

Danske Bank raised €500mn via a 5NC4 Green SNP bond at a yield of 4.522%, 35bp inside initial guidance of MS+170bp area. The bonds have expected ratings of Baa2/BBB+/A+, and received orders over €3.2bn, 6.4x issue size. Proceeds will be used to issue green bond loans.

Ford raised $2.75bn via a two-part deal. It raised $1.5bn via a 5Y bond at a yield of 6.798%, 30bp inside initial guidance of T+245bp area. It also raised $1.25bn via a 10Y bond at a yield of 7.122%, 40bp inside initial guidance of T+285bp area. The new 5Y notes offer a new issue premium of 9.8bp over its existing 6.8% 2028s that yield 6.7%. The senior unsecured bonds have expected ratings of Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

BOC Aviation raised $500mn via a 5Y bond at a yield of 5.934%, 25bp inside initial guidance of T+155bp area. The senior unsecured bonds have expected ratings of A-/A- (S&P/Fitch). Proceeds will be used for capital expenditure, general corporate purposes and refinance existing debt.

New Bond Pipeline

- Oman Telecom hires for $ 7Y sukuk

- KHFC hires for $ 3Y Fixed/FRN bond

- Korea National Oil Corp hires for $ 3Y Fixed or FRN/5Y bond

Rating Changes

- Fitch Downgrades Ethiopia’s Long-Term Foreign-Currency IDR to ‘CC

- Fitch Downgrades Lumen Technologies’ L-T IDR to ‘CCC-‘; Places Rating on Negative Watch

- GLP And GLP China Downgraded To ‘BB’ On Waning Earnings Quality; Outlook Negative; Ratings Withdrawn At Issuer Request

- Unigel Participacoes S.A. Downgraded To ‘D’ From ‘CCC-‘ On Missed Interest Payment After Grace Period

Term of the Day: TBAC

TBAC refers to the Treasury Borrowing Advisory Committee in the US. This committee gathers every quarter to decide on the refunding estimates by the US Treasury for the following quarters. Before the quarterly refunding announcements, the TBAC also sends surveys and has discussions with primary dealers to see the ability to absorb the expected supply of Treasuries, for example.

Talking Heads

On Bond Selloff Close to Over as Fed Nears End of Hiking Cycle

Spencer Hakimian, the founder of Tolou Capital Management

“Risk-reward in Treasuries is decent going into 2024 — especially if economic activity slows down and rate cuts materialize”

Greg Peters, co-CIO of PGIM Fixed Income

“There’s a tremendous amount of value in the bond market today”… no “need to rush in” to buy longer-dated bonds.

On Wall Street on High Alert for Cracks in Treasury-Bill Demand

Joseph Abate, Barclays strategist

“The Treasury’s bill supply increase acknowledges robust structural demand from money market funds and other investors… how much will this demand grow and, more significantly, how much will bill yields need to cheapen to absorb the additional supply?”

On Pimco Sounds Alarm on Under-Regulated Private Credit Markets

Jamie Weinstein, head of PIMCO’s alternative-investments

“Defaults so far are low for now but if we keep rates where they are there will be real stress across the higher risk parts of the market”

Christian Stracke, PIMCO, global head of the credit research

Private credit has become a new high-yield bond and leveraged loan market

Top Gainers & Losers- 03-November-23*

Go back to Latest bond Market News

Related Posts: