This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

5 New Deals incl. Greenko, Singapore Post; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 30, 2022

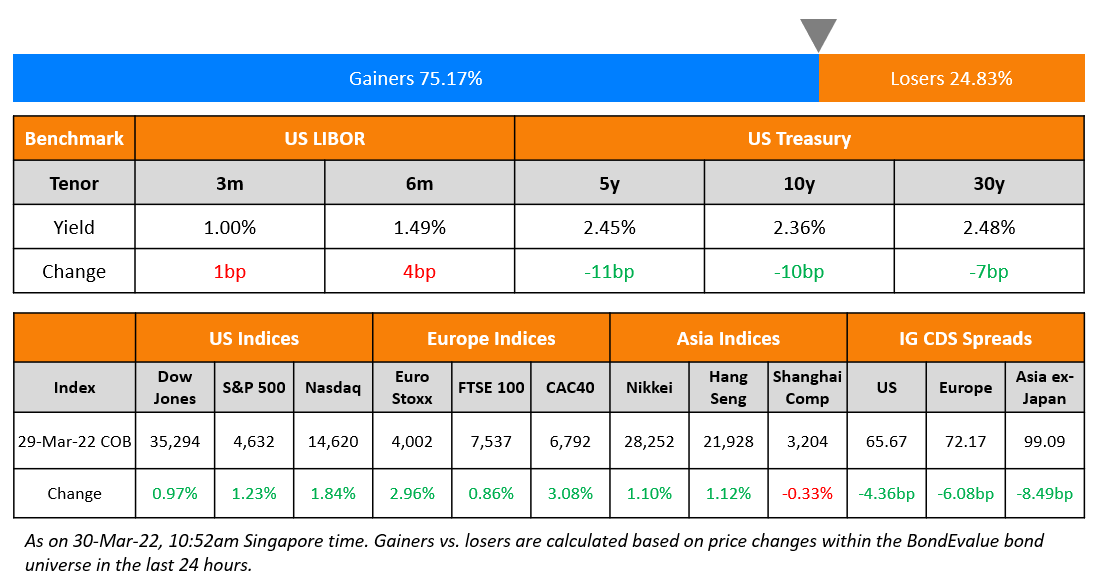

US equity markets moved further higher with the S&P and Nasdaq up 1.2% and 1.8%. Sectoral gains were led by Real Estate and IT, up over 2%. US 10Y Treasury yields eased 10bp to 2.36% as Russia-Ukraine tensions eased (scroll below for details). European markets jumped sharply higher – the DAX, CAC and FTSE were up 2.8%, 3.1% and 0.9% respectively. Brazil’s Bovespa ended 1.1% higher. In the Middle East, UAE’s ADX was up 0.7% and Saudi TASI was up 0.3%. Asian markets have opened with a positive bias – Shanghai, HSI and STI were up 1.3%, 1.2% and 0.1% while Nikkei was down 1.4%. US IG CDS spreads tightened 4.4bp and HY spreads were 18.5bp tighter. EU Main CDS spreads were 1.2bp tighter and Crossover CDS spreads were 6.1bp tighter. Asia ex-Japan CDS spreads tightened 8.5bp.

Happening Today | Masterclass on Bond Valuation & Risk

Today’s session will focus on how to build a diversified bond portfolio, portfolio risk, bond investment strategies and effects of leverage. The session is at 5pm Singapore / 1pm Dubai / 9am London. Sign up by clicking on the banner below:

New Bond Issues

- Greenko $ 3NC2 green at 5.8% area

- Asian Development Bank (ADB) $ 5Y FRN at SOFR+29bp area

- State Grid International $ 3Y/5Y at T+120/135bp area

- MISC $ 3Y/5Y at T+160/180bp area

- Singapore Post S$ Perp NC5.25 at 4.65% area

Chiyu Banking Corp Ltd raised $200mn via a 10NC5 tier 2 bond at a yield of 5.75%, 20bp inside the initial guidance of 5.95% area. The bonds are unrated and received orders over $850mn, 4.25x issue size. Proceeds will be used to supplement the issuer’s Tier 2 capital. The issuer’s parent bank is Xiamen International Bank Co.

Swedbank raised $1.25bn via a two-tranche deal. It raised $850mn via a 3Y bond at a yield of 3.356%, 28bp inside the initial guidance of T+110bp. It also raised $400mn via a 3Y FRN at a yield of 1.1901%, or SOFR+91bp vs. initial guidance of SOFR equivalent. The bonds have expected ratings of Aa3/A+.

HP Inc raised $2bn via a two-tranche deal. It raised $1bn via a 7Y bond at a yield of 4.038%, 25bp inside the initial guidance of T+180bp. It also raised $1bn via a 10Y bond at a yield of 4.204%%, 25bp inside the initial guidance of T+205bp. The bonds have expected ratings of Baa2/BBB. Proceeds will be used for general corporate purposes, which include repayment and refinancing of debt.

New Bonds Pipeline

- State Grid International hires for $ Green bond

- First REIT Management hires for S$ Social bond

-

Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Moody’s upgrades Murphy Oil to Ba2; stable outlook

- Fitch Downgrades Haidilao to ‘BBB-‘; Outlook Stable

- Moody’s changes outlook on Phoenix Natural Gas to negative; affirms Baa2 rating

Term of the Day

Rescission Offer

A rescission offer is an offer made by an issuer to repurchase an investor’s securities and refund the purchase price plus interest. Issuers of securities resort to rescission offers to insulate themselves against legal liability if registration requirements are violated. Barclays mistakenly issued ~$15bn more structured notes and exchange traded notes (ETNs) from the time it did a shelf registration. Now, it will have to repurchase the securities via a rescission offer at the original price.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Fed’s Harker Says He Is Looking For ‘Methodical’ Hikes This Year

“The bottom line is that generous fiscal policies, supply chain disruptions, and accommodative monetary policy have pushed inflation far higher than I — and my colleagues on the FOMC — are comfortable with… I’m also worried that inflation expectations could become unmoored.

On Biggest Junk Bond ETF Sheds Over $3 Billion as Bears Double Down

Peter Chatwell, head of multi-asset strategy at Mizuho International Plc.

“It’s a double whammy — rates repricing higher, equities likely to reprice lower, meaning high-yield companies mechanically have higher leverage and a more expensive refinancing rate. That’s not to mention the general softness in earnings that looks likely from the stagflation.”

On ECB’s Holzmann Eyeing Two Hikes This Year to Boost Policy Room

If at year-end “the deposit rate wasn’t already at 0%, it would be too late. If inflation doesn’t prove to be higher than expected, we could simply stay at 0%”… the spike in energy costs “is going to cause an additional increase in inflationary tensions that we’re already seeing,”

On Soaring shipping costs to drive inflation higher worldwide: IMF

“The inflationary impact of shipping costs will continue to build through the end of 2022. This will create complicated trade-offs for many central bankers facing increasing inflation and still ample slack in economic activity. Moreover, the war in Ukraine is likely to cause further disruptions to supply chains, which could keep global shipping costs – and their inflationary effects – higher for longer”

Top Gainers & Losers – 30-Mar-22*

Go back to Latest bond Market News

Related Posts: