This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 16, 2022

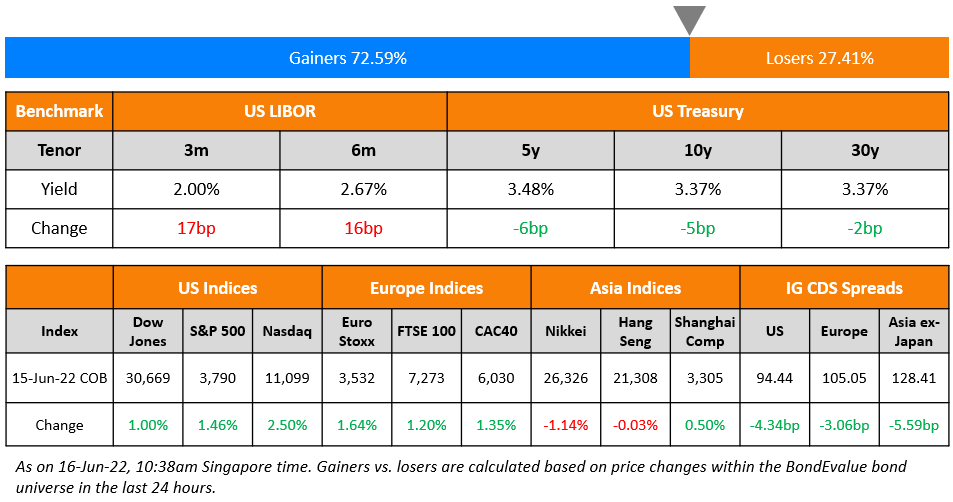

US equity markets jumped higher on Wednesday with the S&P and Nasdaq up 1.5% and 2.5% respectively. Sectoral gains were led by Consumer Discretionary, up 3% and Communication Services, up 2.4%. US 10Y Treasury yields fell 5bp to 3.37%. While the US Fed hiked by 75bp, the meet was considered a little less hawkish (scroll below for details on the FOMC meeting). European markets ended higher with the DAX and CAC up 1.4% each and the FTSE up 1.2%.. Brazil’s Bovespa was up 0.7%. In the Middle East, UAE’s ADX was up 0.4% while Saudi TASI closed 0.4% lower. Asian markets have opened broadly higher – Shanghai, STI and Nikkei were up 0.2%, 1.1% and 1% respectively while HSI was down 0.4%. US IG CDS spreads tightened 4.3bp and HY spreads were 22bp tighter. EU Main CDS spreads were 3.1bp tighter and Crossover spreads were 17bp tighter. Asia ex-Japan IG CDS spreads tightened 5.6bp.

Besides the US Fed, the Brazilian central bank hiked its Selic policy rate by 50bp to 13.25%, the highest level since the beginning of 2017. It also signaled another hike in its following meeting. Also, Hong Kong raised its base rate by 75bp to 2% for the third time this year following the Fed’s hike. The ECB called for a surprise ad hoc meeting on Wednesday to discuss the the current market situation. The next ECB policy meeting is due on June 22 with a rate hike of 25bp expected in July.

This masterclass will be conducted by Asian bond and liability management expert Florian Schmidt and will cover sovereign debt crises and solutions, key elements of a debt restructuring, restructuring mind map, creditor types, restructuring frameworks, case studies and discussion on Sri Lanka. The masterclass is ideal for bond investors, advisors, wealth managers and relationship managers.

New Bond Issues

New Bonds Pipeline

- Korea Western Power hires for $ Green bond

- Kookmin Bank hires for € 3.5Y Sustainability bond

- Hanwha Energy mandates for $ green bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Rite Aid Corp. Downgraded To ‘CC’ From ‘CCC+’ On Announced Below-Par Exchange Offer, Outlook Negative

- SM Energy Co. Outlook Revised To Positive On Debt Paydown And Austin Chalk Development

- Moody’s affirms Guatemala’s Ba1 ratings; changes outlook to stable from negative

Term of the Day

Fed Dot Plot

The Fed dot plot is a visual representation of interest rate projections of members of the Federal Open Market Committee (FOMC), which is the rate-setting body within the Fed. Each dot represents the Fed funds rate for each year that an anonymous Fed official forecasts. The dot plot was introduced in January 2012 in a bid to improve transparency about the range of views within the FOMC. There are usually 19 dots for each year, but 1 positions is currently vacant, which is why the latest dot plot has 18 dots.

Talking Heads

On the Federal Reserve’s Rate Hike

Jerome Powell, Federal Reserve Chairman

“We want to see progress. Inflation can’t go down until it flattens out… If we don’t see progress … that could cause us to react. Soon enough, we will be seeing some progress.” Decisions will be made “meeting by meeting” and the Fed will “continue to communicate our intentions as clearly as we can.”

Larry Meyer, a former Fed governor and chief executive of LHMeyer

“As soon as (inflation) expectations move, you have to hit like a hammer. Do more and do it quick. That is where we are.”

On Wall Street Sounding a Louder Recession Call After Fed Rate Hike

Ryan Sweet, Moody’s Analytics

“The Federal Reserve is going to hike interest rates until policymakers break inflation, but the risk is that they also break the economy. Growth is slowing and the effect of the tightening in financial market conditions and removal of monetary policy have yet to hit the economy.”

Wells Fargo’s Jay Bryson

Base scenario is for a “mild recession”.

On T. Rowe Saying Buy Bonds Now at ‘Most Attractive Point’ in Years

“We think that over the next several quarters investors may want to consider adding duration”… Some BB-rated bonds, the safest part of the junk-bond market, are priced at 80 cents on the dollar, levels that “historically have proven to be good buying points…I don’t think we’re quite at the peak for yields… The threat of recession is real”

On Italian Bonds Surge on Bets ECB Will Move to Cap Rising Yields

Christoph Rieger, head of fixed-rate strategy at Commerzbank AG

“It seems possible that the ECB is working on a PEPP-like tool to counter general market fragmentation. Defining the contingencies, however, will be a challenge, and there is a large risk that markets will be disappointed by the lack of specifics that the ECB will reveal today!”

Piet Christiansen, chief strategist at Danske Bank

“If the ECB is only deploying the frontloading of reinvestments, it should be considered the bare minimum. Recall that ECB can already implement PEPP reinvestments very flexibly.”

Rabobank strategists including Richard McGuire

“Given the difficult situation, we would think that today’s announcement is more likely to see the tweak of an existing instrument which will disappoint the market”

Top Gainers & Losers – 16-June-22*

Go back to Latest bond Market News

Related Posts: