This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 10, 2022

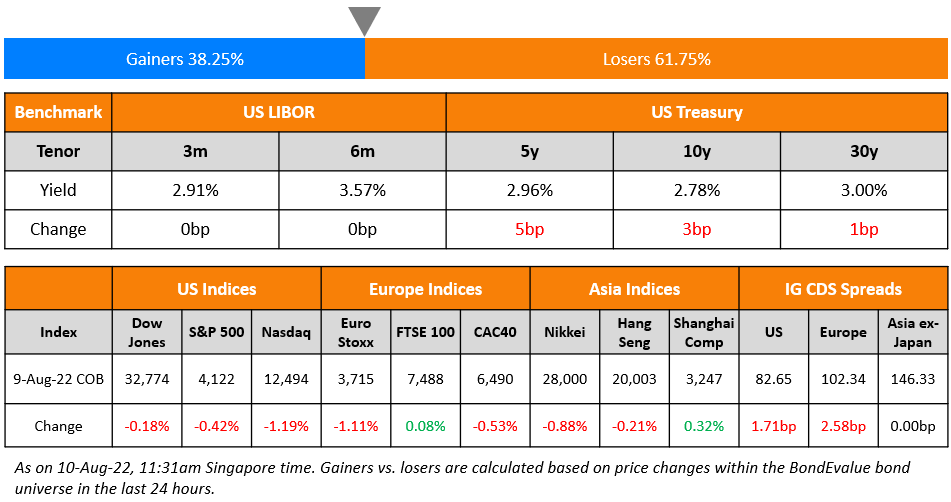

US equity markets ended lower on Tuesday with the S&P and Nasdaq down 0.4% and 1.2% respectively. Sectoral losses were led by Consumer Discretionary down by 1.5% and Information Technology down 1% while Energy was up 1.8%. US 10Y Treasury yields rose 3bp to 2.78%. European markets were mixed – DAX and CAC were down 1.1% and 0.5% respectively while FTSE was flat. Brazil’s Bovespa was up 0.2%. In the Middle East, UAE’s ADX and Saudi TASI rose 0.2% and 0.3% on respectively. Asian markets have opened mixed – Shanghai, Nikkei and HSI were down 0.4%, 0.7% and 2% respectively while STI was up 0.6% each. US IG CDS spreads widened 1.7bp and US HY spreads were wider by 15.1bp. EU Main CDS spreads were 2.6bp wider and Crossover spreads were widened by 13.8bp. Asia ex-Japan IG CDS spreads were unchanged.

Consumer prices in Mexico rose 8.15% for July, in-line with estimates of 8.14%. Rising food, energy prices and supply shocks led to higher inflation. The Mexican central bank is expected to hike interest rate by 75bp this week.

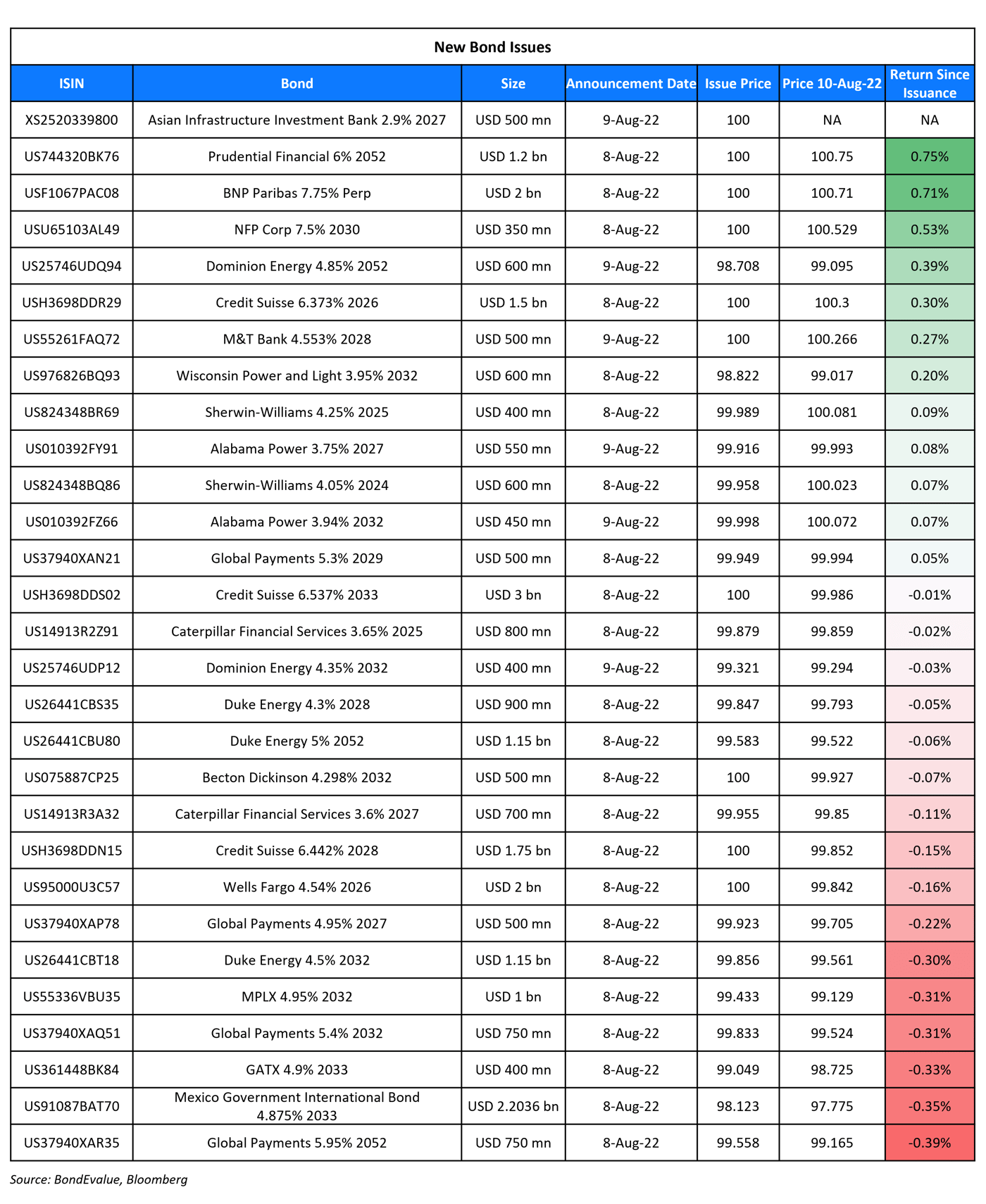

New Bond Issues

Wells Fargo raised $2bn via a 4NC3 Sustainability fixed-to-floating bond at a yield of 4.54%, 25bp inside the initial guidance of T+165bp area. The senior unsecured bonds have expected ratings of A1/BBB+. Proceeds will be used for general corporate purposes. The new bonds are priced at a new issue premium of 31bp vs. its existing 4.1% 2026s that currently yield 4.23%.

BNP Paribas raised $2bn via a PerpNC7 AT1 at a yield of 7.75%, 25bp inside initial guidance of 8% area. The AT1 bonds have expected ratings of Ba1/BBB-/BBB. The call date for the AT1s is on 16 August 2029. If the bond is not called by the call date, the coupon rate will reset then and every five years thereafter to the 5Y Treasury plus a margin of 489.9bp. Aside from the call option, the bank also has the power to call back its AT1s in the event of tax changes or regulatory/capital disqualification. Additionally, the bonds have a mechanical trigger which will activate when BNP’s CET1 ratio drops below 5.125%. The new bonds are priced at a new issue premium of 59bp vs. its existing 7% Perp that yield 7.16%.

Prudential Financial raised $1.2bn via a 30NC10 bond at a yield of 6%, 37.5bp inside the initial guidance of 6.375% area. The bonds have expected ratings of Baa1/BBB+/BBB. Proceeds will be used for general corporate purposes. The new bonds are priced at a new issue premium of 19bp vs. its existing 5.125% 2052s that yield 5.81%.

Credit Suisse raised $6.25bn via a three-tranche deal. It raised

- $1.5bn via a 4NC3 fixed-to-floating bond at a yield of 6.373%, 20bp inside the initial guidance of T+345bp area. The new bonds are priced at a new issue premium of 11.3bp vs. its older 5.929% 2026s that yield 6.26%.

- $1.75bn via a 6NC5 fixed-to-floating bond at a yield of 6.442%, 20bp inside the initial guidance of T+375bp area. The new bonds are priced at a new issue premium of 30.2bp vs. its older 4.282% 2028s that yield 6.14%.

- $3bn via a 11NC10 fixed-to-floating bond at a yield of 6.537%, 20bp inside the initial guidance of T+400bp area.

The bonds have expected ratings of Baa2/BBB. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Energy Development Oman hires for $ sukuk

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

- Moody’s downgrades Royal Caribbean’s CFR to B2; outlook is stable

- Moody’s downgrades Carnival’s CFR to B2; outlook is negative

- Moody’s changes outlooks to negative and affirms the ratings of 14 Italian financial institutions

- China Cinda Asset Management, Subsidiary Outlooks Revised To Negative; Ratings Affirmed

Term of the Day

Make Whole Call (MWC) Provision

A Make Whole Call (MWC) is a type of call option on a bond that gives the issuer the right to redeem a bond before its maturity date by compensating (making whole) bondholders for future coupon payments. MWC provisions were introduced in the 1990s and are rarely exercised by issuers. If exercised, the issuer has to pay a lump sum amount to the bondholders that represent the net present value of future foregone coupon payments, typically stated as a formula in the bond prospectus.

MWCs are different from traditional call options in that investors are compensated for foregoing future coupon payments. With traditional call options, the issuer can exercise the call option at the predefined call price without having to pay bondholders for foregoing future coupons. This makes MWCs beneficial to bondholders as compared to traditional call options and are typically expensive for the issuer to exercise. In Moody’s recent $500mn bond offering, the bonds have MWC provisions.

Talking Heads

Bank of England would sell gilts even if it cuts rates in future

Deputy Governor Dave Ramsden

The Bank of England would press on with plans to gradually sell its vast stock of British government bonds even if an economic slowdown eventually forces it to cut interest rates. Ramsden, in charge of the BoE’s roughly 1 trillion-pound balance sheet, told Reuters it was “more likely than not” that borrowing costs would need to rise again after the BoE raised Bank Rate by 50 basis points to 1.75% last week.

Fed Rate-Hike Forecasts Raised at JPMorgan, Evercore on Blowout Jobs Report

Michael Feroli of JPMorgan and Derek Tang of LH Meyer

Friday’s blowout jobs report spurred economists at JPMorgan Chase & Co., Evercore ISI and LH Meyer to say bigger US interest-rate increases are now in store this year, with Citigroup Inc. seeing a risk of a 1 percentage-point hike in September.

Michael Feroli of JPMorgan and Derek Tang of LH Meyer now expect a 75 basis-point increase at the Federal Reserve’s Sept. 20-21 meeting, compared with 50 basis-point calls before. And Evercore analysts led by Krishna Guha see an extra quarter percentage point this year, taking the upper bound of the target rate to 3.75% by December.

Singapore PM Warns Inflation, Interest Rates Could Remain High

Prime Minister Lee Hsien Loong

With inflation and interest rates set to stay high, Singapore is prepared to increase support measures to help deal with the increased cost of living, Prime Minister Lee Hsien Loong said.

“The world is not likely to return anytime soon to the low inflation levels and interest rates that we have enjoyed in recent decades,” Lee said in a televised message Monday on the eve of the country’s National Day. “I know the cost of living is at the top of everyone’s minds. The government has carried out multiple support packages, targeting assistance to those who need it most. More such measures will be “rolled out in the coming months”

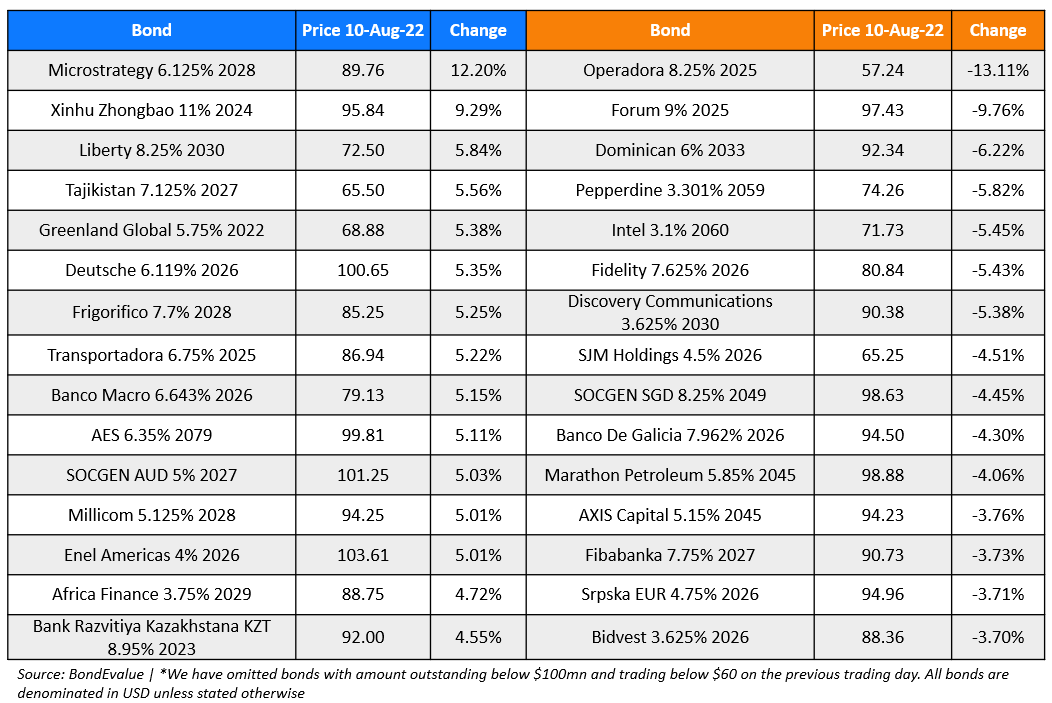

Top Gainers & Losers – 10-August-22*

Other News

Go back to Latest bond Market News

Related Posts: