This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 2, 2022

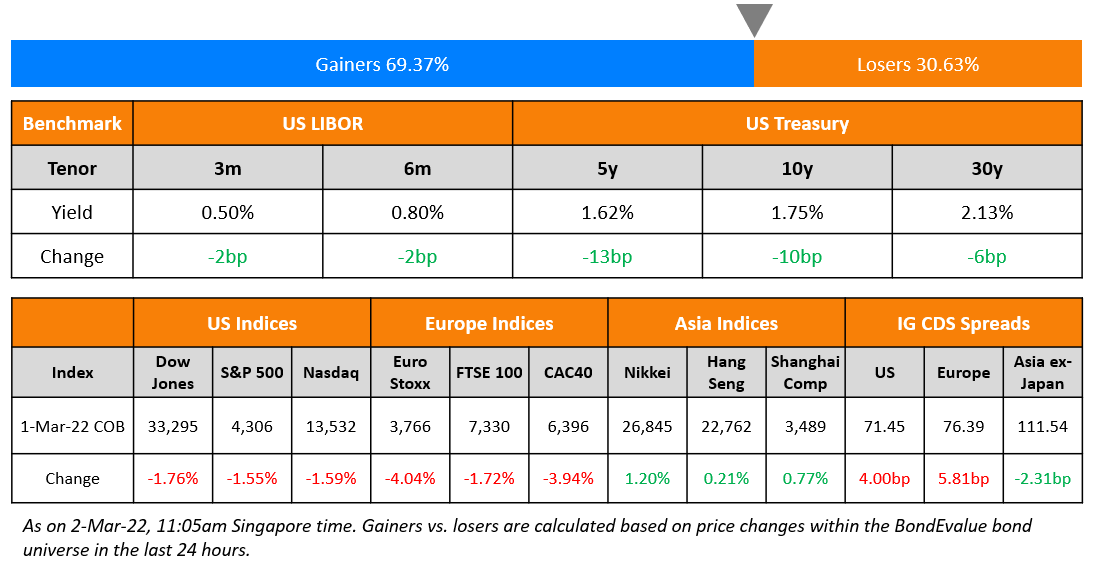

US equity markets ended lower on Tuesday with the S&P and Nasdaq ending 1.6% lower each. Sectoral losses were led by Financials and Materials, down 3.7% and 2.3%. European markets were sharply lower – DAX, CAC and FTSE crashed 3.9%, 3.9% and 1.7%. US 10Y Treasury yields eased 10bp to 1.75%. Brazil’s Bovespa was up 1.4%. In the Middle East, UAE’s ADX was up 2.2% and Saudi TASI was up 0.7%. Asian markets have opened with a positive bias – Shanghai, HSI, STI and Nikkei are down 0.4%, 1.1%, 0.5% and 1.9% respectively. US IG CDS spreads widened 4bp and HY spreads were 34.2bp wider. EU Main CDS spreads were 5.8bp wider and Crossover CDS spreads were a 12.8bp wider. Asia ex-Japan CDS spreads were 2.3bp tighter.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

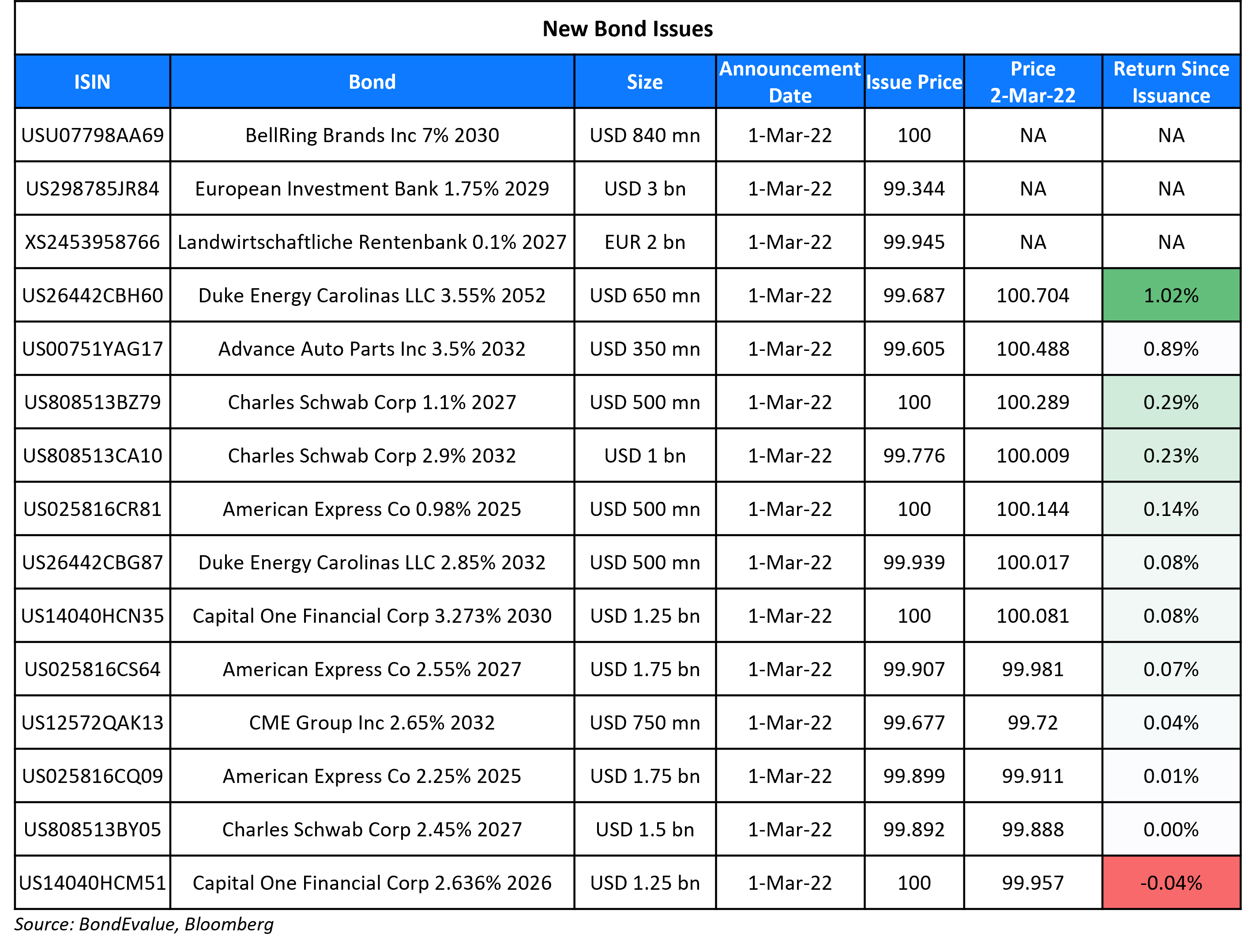

New Bond Issues

American Express raised $4bn via a three-trancher. It raised:

- $1.75bn via a 3Y fixed-rate bond at a yield of 2.285%, 25bp inside initial guidance of T+105bp area

- $500mn via a 3Y FRN at SOFR+93bp as compared to initial guidance of SOFR equivalent area

- $1.75bn via a 5Y bond at a yield of 2.57%, 25bp inside initial guidance of T+125bp area

The bonds are rated A2/BBB+. Proceeds will be used for general corporate purposes. The company dropped its planned 5Y FRN tranche while launching the bond.

Charles Schwab raised $3bn via a three-trancher. It raised:

- $1.5bn via a 5Y bond at a yield of 2.473%, 25bp inside initial guidance of T+115bp area

- $500mn via a 5Y FRN at SOFR+105bp as compared to initial guidance of SOFR equivalent area

- $1bn via a 10Y bond at a yield of 2.926%, 25bp inside initial guidance of T+145bp area

The bonds are rated A2/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Honda Motor hires for $ green bond

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Fitch Downgrades 7 Ukrainian Banks to ‘CCC-‘

- Russian VEB.RF And Sub. Rtgs Cut To ‘BB+’ And Put On CreditWatch Neg After Similar Action On Russia; Rtgs Then Suspended

- Kazakhstan-Based SB Alfa-Bank JSC ‘BB’ Ratings Placed On CreditWatch Negative On Parent’s Deteriorating Creditworthiness

- Siemens Energy Outlook Revised To Negative; ‘BBB/A-2’ Ratings Affirmed

Term of the Day

Short Interest

Short interest refers to the number of open positions of shares/units that have been sold short. Open positions sold short refers to borrowing and selling shares/units but not yet repurchasing them back to close the trade. Short interest is looked at as an indicator of bearishness in the market where an increased number of short interest would indicate a more bearish view on markets.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Growth Angst Shaking Markets Already Obsessed With Inflation Risk

Bloomberg Intelligence’s Mike McGlone

“What the market is doing now is pricing in for that increasing risk of a global recession and spiking energy, spiking commodity prices will aggravate that”

Alicia Levine, head of equities and capital markets advisory for BNY Mellon Wealth Management

“You have that specter of the late 1970s, early 1980s of that stagflationary fear of ever-ratcheting-down growth and ever-ratcheting-up inflation. And what this conflict does is it plays into the inflationary piece”

Michael Shaoul, chief executive of Marketfield Asset Management

“One of the stranger arguments made in recent weeks has been the claim that the U.S. economy is on the verge of rolling over, or that we are entering a period of ‘stagflation”

On Argentina Reaching a Deal With IMF Staff, President Says

“The Argentine government has now reached an agreement with the staff of the International Monetary Fund to put forward a program that lets us refinance the debt. It’s an agreement without austerity policies and with increases in real spending in every year of the program.

On Russia default ‘extremely likely’ if Ukraine crisis worsens -Banking lobby

Elina Ribakova, a global banking industry lobby group’s deputy chief economist

“If we stay here and this (the crisis) escalates, then default and restructuring is likely”

On Investors betting Ukraine crisis will slow pace of ECB and Fed tightening

Antoine Bouvet, a rates strategist at ING

“There’s a big dovish repricing going on. The market has taken the view that the implications from Ukraine are that the ECB and other central banks will move more slowly.”

Rick Rieder, CIO of global fixed income at BlackRock

“This also has a significant impact on growth globally and in the US. This is clearly going to keep inflation high for a longer period of time. But much of these dynamics are not in the Fed’s control.”

Fabio Panetta, an ECB executive board member

“It would be unwise to pre-commit on future policy steps until the fallout from the current crisis becomes clearer”

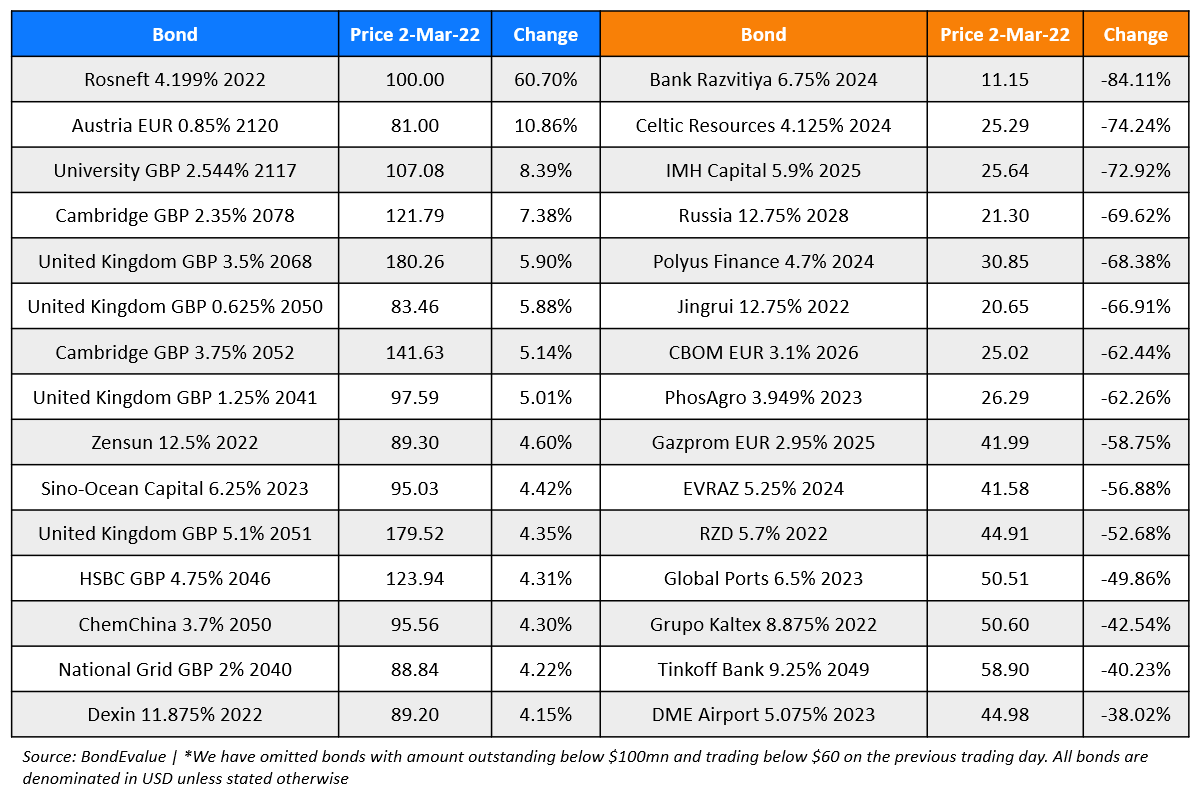

Top Gainers & Losers – 02-Mar-22*

Other Stories

Go back to Latest bond Market News

Related Posts: