This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 12, 2021

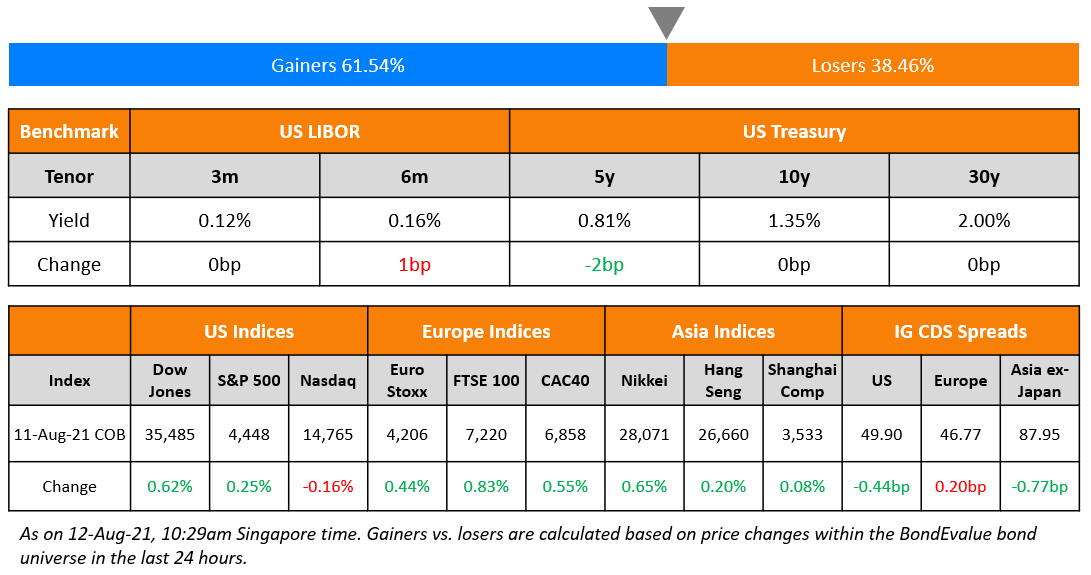

US markets had another mixed day as tech stocks remained subdued after the US core CPI number came in softer than expected – S&P added 0.3% to end at another record while the tech heavy Nasdaq fell 0.2% following Tuesday’s losses of 0.5%. Materials, Industrials and Financials rose more than 1% and Energy and Utilities added between 0.5-1%. Healthcare, down 1% was the only laggard. European markets had another good day – the FTSE, CAC and DAX were up 0.8%, 0.6% and 0.4% respectively. Saudi’s TASI and UAE’s ADX added 0.2% and 0.5% respectively. Brazil’s Bovespa closed 0.1% lower. APAC stocks had another mixed start – Singapore’s STI and Nikkei were up ~0.4%, Shanghai was flat and HSI was down ~0.1%. US 10Y Treasury yields were flat at 1.35%. US IG and HY CDS spreads tightened 0.4bp and 3.6bp. EU Main and Crossover CDS spreads widened 0.2bp and 1bp respectively. Asia ex-Japan CDS spreads were 0.8bp tighter.

US Consumer Price Index (CPI) rose 0.5% vs. 0.9% MoM in July and in-line with expectations. The core CPI came in lower at 0.3% vs. 0.9% MoM and against expectations of 0.4%. German CPI came at 3.8% inline with expectations and higher than previous month’s 2.3%. Italian CPI also improved to 0.5% in July vs. 0.1% in Jun and vs. expectation of 0.3%. Brazil’s retail sales for June came in at negative -1.7%, lower than the expectations of 0.7% and vs. 2.7% last month.

BondEvalue has been named under the ‘Forbes Asia 100 to Watch’ list for making bonds more widely accessible to individual investors with the BondbloX Bond Exchange, the world’s first fractional bond exchange that allows trading in minimum denominations of $1,000. BondbloX is regulated by the Monetary Authority of Singapore and has secured $6 million in its series A funding round led by MassMutual Ventures and Citigroup.

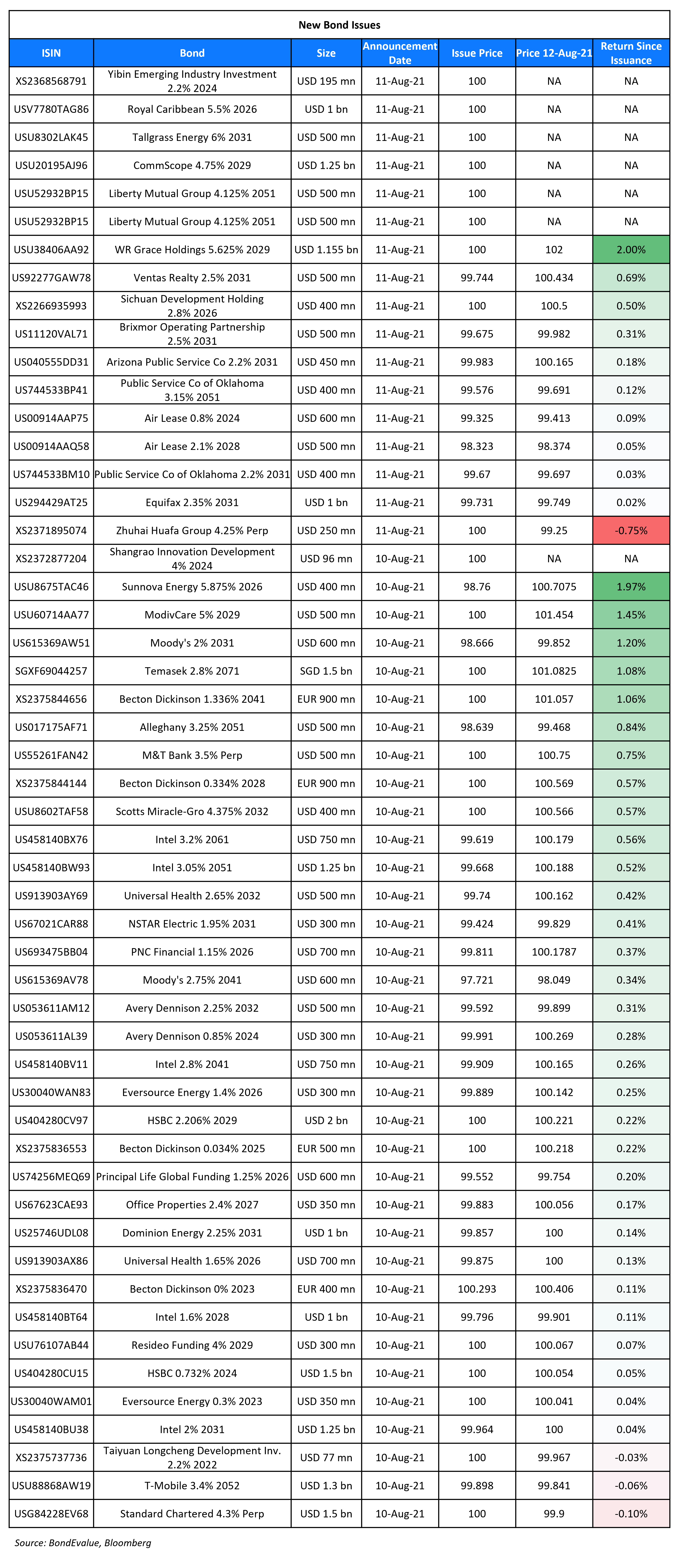

New Bond Issues

-

Shinsun Holdings $ 2Y sustainable notes at 12.75% area

-

Shaoxing City Investment Group $ 5Y bonds at 3.1% area

Royal Caribbean raised $1bn via a 5Y bond at a yield of 5.5%, unchanged from initial guidance. The bonds are rated B. Proceeds will be used for general corporate purposes, including the replenishment of capital as a result of the up to 40% redemption of its 11.5% 2025s and the refinancing of future debt maturities. The new bonds offer a new issue premium of 40bp over its older 5.25% bonds due July 2026 that are currently yielding 5.1%.

Zhuhai Huafa Group raised $250mn via a Perpetual non-call 3Y (PerpNC3) at a yield of 4.25%, 25bp inside initial guidance of 4.5% area. The bonds have expected ratings of BBB- and received orders over $1.7bn, 6.8x issue size. The bonds are issued by Huafa 2021 I Co and guaranteed by Zhuhai Huafa Group. There is a 300bp coupon step-up if the bonds are not called on the first call date of August 18, 2024. There is also a dividend stopper. Proceeds will be used for offshore debt refinancing.

Sichuan Development Holding raised $400mn via a 5Y bond at a yield of 2.8%, 50bp inside initial guidance of 3.3% area. The bonds have expected ratings of A- and received orders over $3.5bn, 8.8x issue size. The bonds will be issued by Yieldking Investment and guaranteed by Sichuan Development International Holding, both wholly owned subsidiaries of the parent. The bonds will also have the benefit of a keepwell deed and a deed of equity interest purchase undertaking provided by the parent.

Azure Power Energy raised $414mn via a 5NC2 amortizing green bond at a yield of 3.575%, 42.5bp inside initial guidance of 4% area. The bonds have expected ratings of Ba2/BB+ and received orders over $1.7bn, 4x issue size. There is a put option at 101 if there is a change of control event and a ratings downgrade. The bonds have a weighted average life (WAL) of 4.33Y. Azure Power Energy is a special purpose vehicle (Term of the Day, explained below) incorporated in Mauritius and wholly owned by Azure Power Global, a leading solar power company in India. Proceeds will be used to refinance existing $500mn 5.5% 2022s and to subscribe to new INR debt to be issued by 16 restricted subsidiaries of Azure Power India. They will also be used for equity capitalization. Nomura says that Azure is closely comparable to Greenko Energy, with the sponsor profile of the latter possibly better due to the stake of GIC of Singapore, and its past equity support. They add that Azure should trade about 25-30 bps wider than Greenko’s 3.85% 2026 note, which are currently yielding 3.36%.

Yibin Emerging Industry Investment raised $195mn via a 35-month SBLC note at a yield of 2.2%, 20bp inside initial guidance of 2.4% area. The bonds are unrated and have the benefit of an irrevocable standby letter of credit provided by Bank of Shanghai Chengdu branch. Proceeds will be used for domestic debt refinancing and supplementing working capital.

New Bonds Pipeline

- Perusahaan Pengelola Asset hires for $ bond

-

PCGI Holdings hires for $ 5NC3 bond; calls today

- HDFC Bank hires for $ AT1 Bond

Rating Changes

- Fitch Downgrades Peru LNG to ‘B+’; Outlook Remains Negative

- Fitch Downgrades Huarong Industrial to ‘CCC’ from ‘BB’; Removes RWN

- Fitch Revises Tenet Healthcare’s Rating Outlook to Positive; Affirms ‘B’ IDR

- NortonLifeLock Inc. Senior Secured Ratings On CreditWatch Negative By S&P On Increasing Mix Of Secured Debt For Avast

Term of the Day

Special Purpose Vehicle (SPV)

An SPV is a separate legal entity with its own assets and liabilities created by an organization (parent). SPVs are typically setup for a specific purpose such as issuing debt. SPVs can be in the form of limited partnerships, trusts, corporations or limited liability companies.

Some benefits of setting up SPVs include:

- Isolating financial risk for the organization that is setting up the SPV

- Securitization of assets

- Tax savings if the SPV is domiciled in a tax haven such as the Cayman Islands

Some SPVs can also be referred to as ‘bankruptcy-remote entities’ in that its operations are limited to the acquisition and financing of specific assets in order to isolate financial risk.

Azure Power Energy raised $414mn via a 5NC2 green bond with the issuer being an SPV, wholly-owned by Azure Power Global.

Talking Heads

“It would be my view that if the economy unfolds between now and our September meeting … if it unfolds the way I expect, I would be in favor of announcing a plan at the September meeting and beginning tapering in October.” “The reason I’m saying we ought to begin the tapering soon is I think these purchases are very well equipped to stimulate demand. But we don’t have a demand problem in the economy.” “My thought is I’d rather take the foot off the accelerator soon and reduce the RPMs.” “What I don’t want to do is keeping running at this speed for too long and then we’re going to have to take more aggressive action down the road,” Kaplan said.

Travis King, head of investment-grade corporates at Voya Investment Management

“It’s been a crazy new issue week so far for mid-August.”

Matt Freund, co-chief investment officer at Calamos Investments

“There are so many pitches coming at you that if you miss one you are going to have something else to swing at momentarily.”

Ivan Hrazdira, head of debt capital markets for the Americas at Credit Agricole

“The slight increase that we’ve seen in longer term rates suggests to a lot of market participants that we may be bottomed out and that now is a good time to hit the markets.”

Matt Brill, head of U.S. investment grade credit at Invesco

“It’s also a function of people being able to work from anywhere now.” “People are putting in orders from places they probably wouldn’t have in the past.”

Anastasia Amoroso, iCapital Network’s chief investment strategist

“The Fed should find comfort in this report, but the Fed’s taper announcement in September is not a done deal.” “Policy makers should be focused on how the delta variant is impacting leisure and hospitality sectors. Possibly we’ll see lower activity in August due Covid-19.”

Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management

“Today’s softer-than-expected readings in the CPI core seem to validate the views of Powell, Williams and some of the other more moderate Fed members who are focusing on a slower path to normalization.”

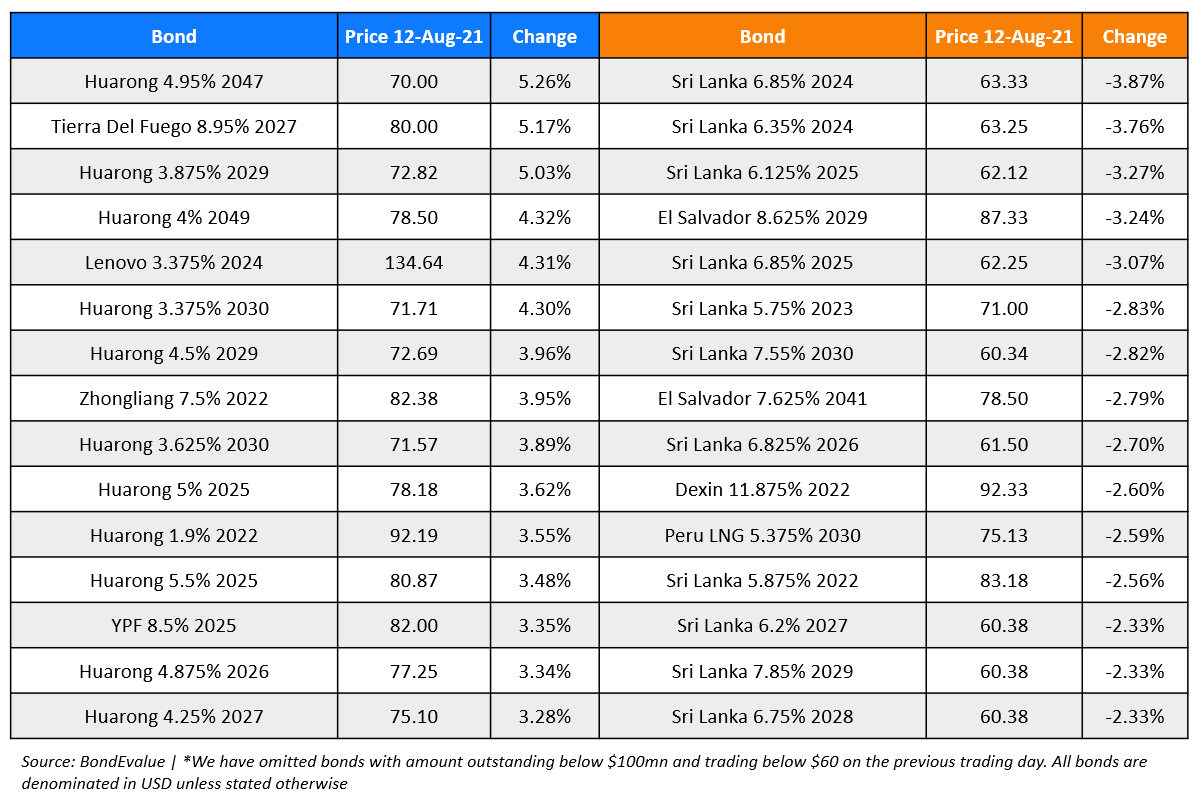

Top Gainers & Losers – 12-Aug-21*

Go back to Latest bond Market News

Related Posts: