This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 25, 2023

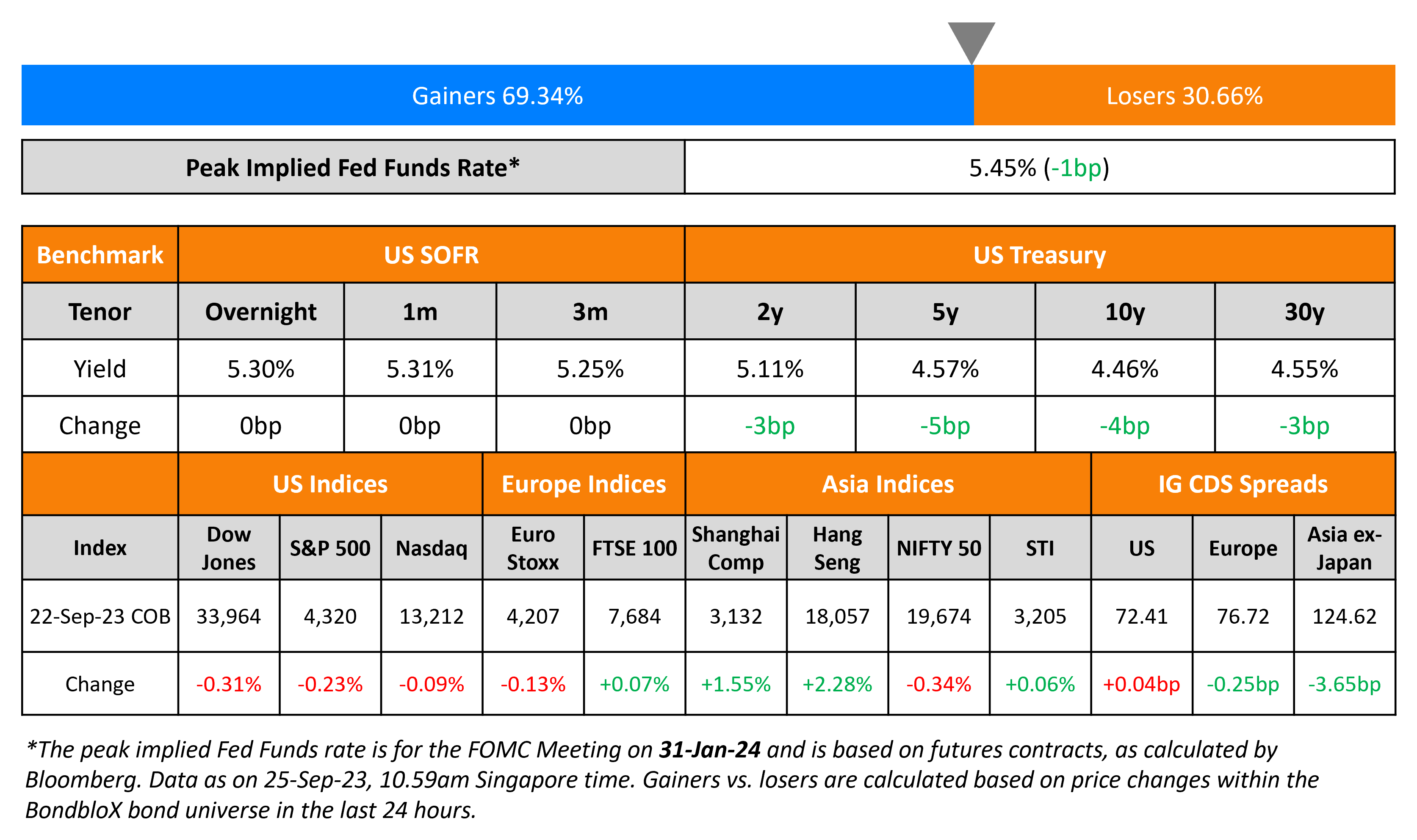

US Treasury yields retreated slightly on Friday by 3-5bp after jumping higher by over 12bp post the hawkish FOMC meeting last week. US business activity showed little change in September. The S&P Global US Composite PMI dipped from 50.2 in August to 50.1 in September as compared to expectations of 50.4. S&P’s Manufacturing PMI was higher at 48.9 from 47.9 in August but was still the fifth straight month of contraction. The Services PMI came at an eight month low of 50.2, below August’s 50.5, and estimates of 50.7. In credit markets, US IG CDS spreads were flat while HY spreads widened by 0.5bp. The S&P and Nasdaq fell 0.1-0.2% on Friday.

European equity markets ended slightly lower. In credit markets, European main CDS spreads were tighter by 0.3bp and crossover spreads tightened 2.4bp. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads tightened 3.7bp.

New Bond Issues

- Korea Land & Housing Corp $ 2Y Social at T+105bp area

New Bond Pipeline

- Philippines hires for $1bn Retail bond

- NBN hires for $ 5Y/10Y bond

- Emirates NBD hires for Sustainable bond

Rating Changes

- Uber Technologies Inc. Upgraded To ‘BB-‘ On Maturing Business Profile, Progress Toward 2024 Targets; Outlook Positive

- Moody’s downgrades Redsun to Ca/C; outlook negative

- Fitch Revises Burgan Bank’s Outlook to Stable; Affirms at ‘B-‘

- Fitch Revises Outlook on 16 Turkish Banks to Stable on Sovereign Change

Term of the Day

Springing Covenant

A springing covenant is a covenant that becomes effective upon the occurrence of a certain event. While these are more common in revolving and leveraged loan facilities, they can also be seen in bonds. Springing covenants are generally a feature of some covenant-lite agreements, Reuters notes. These covenants are based on leverage ratios but differ wherein, they do not apply unless a revolving facility is drawn above a specific threshold at the relevant date. With regarding to discussions regarding Vedanta’s possible exchange offer there is a springing covenant which allows an extended January 2027 note to be prioritized over the 2026s for payment if there are no concrete refinancing plan for the 2026s six month ahead of maturity.

Talking Heads

On Fed Done Raising Rates for Now – Morgan Stanley, Chief US Economist Ellen Zentner

“I have a strong view that they’re done here — but they have left the door open… For them to hike in November and December, two things have to happen. One, they’re pleased with what they’ve seen with increased slack in the labor market and the slowdown in job gains. They noted that… pair that with, say, core services… In 2024, the cuts that we have there, we’re expecting them to start in March. We have a quarterly pace, 25bp a quarter”

On Favoring More Than One Further Rate Hike – Fed Governor Michelle Bowman

“I continue to expect that further rate hikes will likely be needed to return inflation to 2% in a timely way…along with my own expectation that progress on inflation is likely to be slow given the current level of monetary policy restraint, suggests that further policy tightening will be needed to bring inflation down in a sustainable and timely manner”

On Wall Street Selloff Across Assets Rattling Risk-Parity Quants

George Cipolloni, PM at Penn Mutual Asset Management

“During the 2021 boom, everything rallied together — some called it the ‘Everything Bubble,’ with lower rates (and higher bond prices) contributing to higher stock and asset price values. What we are seeing on the downside, in my opinion, is simply the unwinding of that.

Top Gainers & Losers- 25-September-23*

Go back to Latest bond Market News

Related Posts: