This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

October 16, 2023

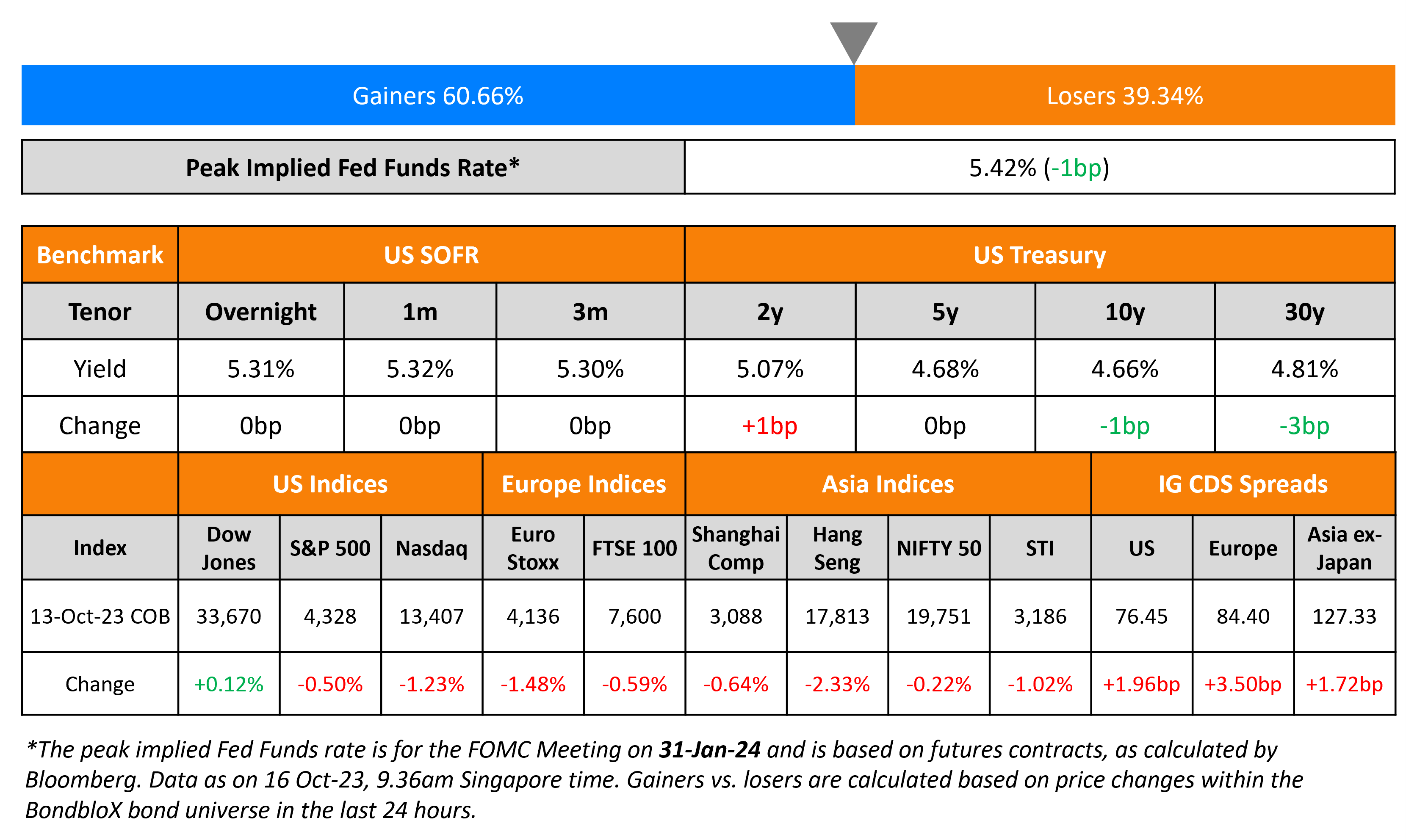

US Treasury yields were flat on Friday after a volatile week, impacted by the Israel-Hamas war. The consumer sentiment index slid more than 5 points in October to 63, the sharpest monthly decline since June 2022 with forecasts at 67. Philadelphia Fed President Patrick Harker, a voting member said that disinflation was underway and reiterated favoring holding interest rates where they are, barring a sharp change in data. US credit markets saw IG CDS spreads widening 2bp and HY spreads wider by 9bp. US equities moved lower with the S&P down 0.5% and the Nasdaq falling 1.2%.

European equity markets were lower too. In credit markets, European main CDS spreads were wider by 3.5bp and crossover spreads widened 19bp. Asian equity markets have opened in the red today morning. Asia ex-Japan IG CDS spreads widened 1.7bp.

New Bond Issues

- KDB $ 3Y FRN/3Y/5Y/10Y at SOFR equiv/T+90/105/120bp

Zhejiang Kunpeng raised $223mn via a 364-day bond at a yield of 6.7%, 60bp inside initial guidance of 7.3% area. The senior unsecured bonds have expected ratings of Baa3 (Moody’s). Hangzhou Shangcheng, rated Baa2 (Moody’s), has provided a keepwell, together with a liquidity support deed and a deed of equity interest purchase undertaking. Proceeds will be used to refinance existing debt and increase working capital. The bonds also have a change of control put at 101.

New Bond Pipeline

- MUFG hires for $ Perp NC5.25 AT1 bond

- Medco Energi hires for $ 5.5NC2 bond

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Fitch Downgrades Banco BMG S.A.’s Long-Term National Rating to ‘A-(bra); Affirms IDR at ‘B+’

- Fitch Affirms Freedom Mortgage Rating at ‘BB-‘; Outlook Revised to Stable from NegativeMoody’s places

- Walgreens’ Baa3 senior unsecured ratings on review for downgrade

Term of the Day

Asset Backed Security (ABS)

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on.

Talking Heads

On Wealth Managers Smiling On Bonds

Benjamin Melman, global CIO at Edmond de Rothschild Asset Management

“Bond markets have been falling since the beginning of September, sending yields on 10-year US Treasuries and the equivalent German Bund up by 60bp and 40bp, respectively”

Jordan Lopez and Nick Burns,high yield strategists at Payden & Rygel

“High yield bonds have outperformed several fixed income sectors year-to-date. The category is up 5.9% through September, ranking it among the best performers in the fixed income space… Yields are once again high in the 9% range”

On US Treasury Market Volatility

Ben Emons, a senior portfolio manager at NewEdge Wealth

“Volatility is off the chart. “People are trading bonds like stocks”

Mohammed El-Erian, Chief Economic Adviser at Allianz

“We have lost the economic anchor. We have lost the technical anchor and we have lost the policy anchor… enormous volatility. So far, we are lucky that when we have overshoots it triggers some sort of reaction”

On rate hikes likely over amid ongoing disinflation – Philadelphia Fed President Patrick Harker

“Absent a stark turn in what I see in the data and hear from contacts … I believe that we are at the point where we can hold rates where they are… It will take some time for the full impact of the higher rates to be felt… holding rates steady will let monetary policy do its work”

On Time Running Out for the ‘Year of the Bond’ as Losses Mount

Lacy Hunt, Hoisington Investment Management

“We thought that inflation would come down and it did. In fact, there has been no decline that large in inflation that has not been involved with a recession in its immediate aftermath in the past”

Bob Michele, CIO fixed income at JP Morgan Asset Management

“We have to respect the market technicals and see where this can wash out”… If yields on longer maturities go above 5.25% and the employment market stays firm, then it’s time to retreat for real.

Top Gainers & Losers- 16-October-23*

Go back to Latest bond Market News

Related Posts: