This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

July 25, 2023

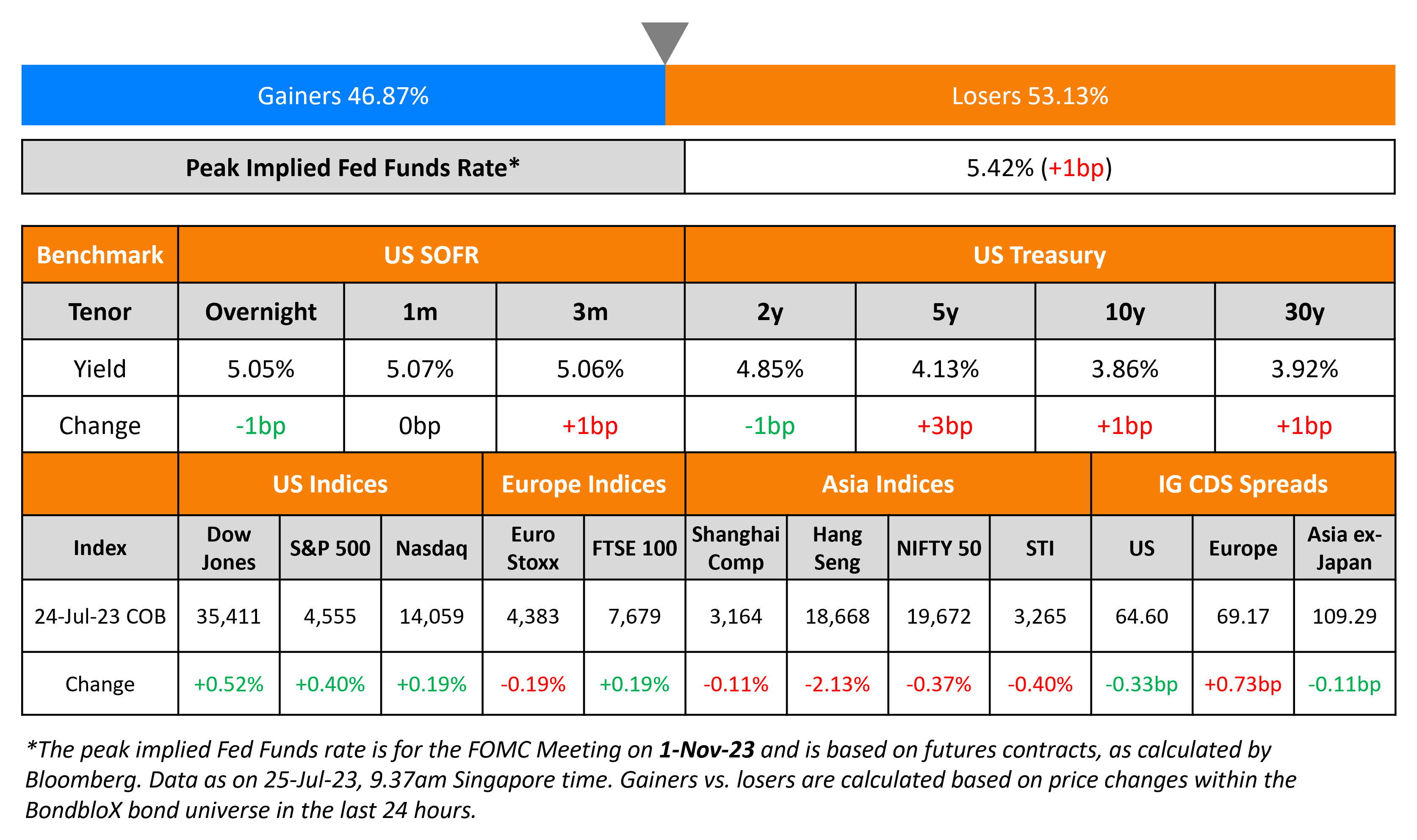

Treasury yields were stable on Monday with another relatively quiet day in markets. The S&P Manufacturing PMI for July continued to indicate a contraction, albeit at a slower rate. The reading came at 49, beating estimates of 46.2 and 2.7 points higher vs. May’s print. The Services PMI however fell 2 points to 54.4, below estimates of 54. The overall composite PMI fell 1.2 points to 52 in June, below estimates of 53. The peak Fed Funds rate moved another 1bp higher to 5.42%. Credit spreads tightened with US IG and HY CDS spreads tighter by 0.3bp and 1.2bp respectively. The S&P rose 0.4% and Nasdaq was higher by 0.2%.

European equity indices were near flat. European main CDS spreads were wider by 0.7bp and Crossover CDS widened 1.9bp. Asia ex-Japan CDS spreads tightened 0.1bp and Asian equity markets have opened higher this morning led by Shanghai and HSI. This comes following China’s Politburo plan to resolve local debt risks to help boost the economy.

.png)

New Bond Issues

- Shangri-La Hotel S$ 5Y at 4.4%

KEPCO raised $1bn via a 3Y sustainability bond at a yield of 5.449%, 35bp inside initial guidance of T+135bp area. The senior unsecured bonds are rated Aa2/AA (Moody’s/S&P), and received orders over $3.15bn, 3.2x issue size. Asset/fund managers/corporates took 49% of the deal, banks 28%, while other financial institutions such as central banks and pension funds took the remaining 23%. APAC took 39%, EMEA 33% and the US 28%. Proceeds will be used to finance/refinance the issuer’s green and social projects.

Rating Actions

- Moody’s downgrades Transcendia’s CFR to Caa3; outlook negative

Term of the Day

Basel III Endgame

Basel III Endgame is considered as the final iteration to the Basel III norms to refines Basel’s approach to setting capital based on the riskiness of banks’ activities. Each bank’s internal models can underestimate credit risk and understate trading risks without factoring in operational risks like failed internal policies, management mistakes, litigation costs etc. The endgame aims to replace existing internal models with a standardized approach, including factoring in operational risks that have not been given large consideration. The reform comes as part of adding armor to ensure stability of big banks.

Banks have said that this reform would lead to additional capital being set aside and thereby higher capital costs. Banks have argued that they are well-capitalized, especially having withstood the pandemic and regularly clearing the Fed’s stress tests.

For more details, click here

Talking Heads

On Urging Investors to Look Beyond US Junk Bonds – BlackRock’s Rick Rieder

“Part of the argument against high yield this year has been the spread’s not interesting at all. You can get yield in a bunch of other places. European high yield if you’re a dollar investor, you swap it back to dollars and you get paid well into the 9s…. European investment grade credit, European high yield swapped back to dollars, you can buy a lot of reasonable companies without going far out the yield curve at an awful lot of yield particularly as a dollar investor.”

On BOJ Set to Stick With Easing as Markets See Clock Ticking on YCC

Mari Iwashita, chief market economist at Daiwa Securities

“I expect Ueda’s cautious stance will persist against calls for early YCC adjustment… still at the stage where it needs to carefully watch for upside inflation risks and downside economic risks.”

Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management

“We feel the time is ripe to undertake a YCC tweak… YCC tweak is not a full-scale pivot to policy tightening. But it sets the stage for reduced policy divergence.”

On Bond Traders Betting on ‘Nirvana’ in New Decoding of Yield Curve

Ed Yardeni, Yardeni Research

“It’s conceivable that the interpretation of what the yield curve is saying here is that the Fed managed to succeed in bringing inflation down… economy has proven to be remarkably resilient and the Fed may not have to raise rates much higher”

Campbell Harvey, Duke University professor

“It’s too early to say that yield curve inversion is a false signal… big question is not whether the downturn is coming. It’s how severe it will be. I do worry that the Fed — with two more rate hikes — will put enough gasoline on the fire “

Top Gainers & Losers – 25-July-23*

Go back to Latest bond Market News

Related Posts: