This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Longfor Downgraded to BB- by Fitch

June 27, 2025

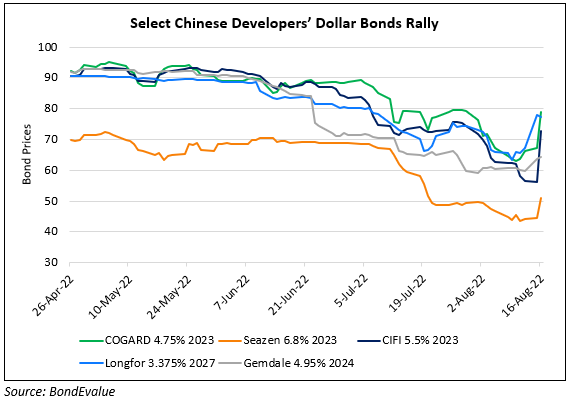

Chinese property developer Longfor Group Holdings was downgraded by a notch to BB- from BB by Fitch. The downgrade reflects continued declining sales with contracted sales projected to decline by 30% in 2025 and a further 20% in 2026, following weaker-than-expected performance so far in 2025. This downturn is partly due to the company’s focus on deleveraging, which has led to significantly reduced land acquisitions over the past three years. Landbank replenishment is expected to remain limited in 2025, with a gradual recovery in investment beginning in 2026 as debt pressures ease. The ongoing sales decline is straining cash flow, leaving Longfor dependent on its liquidity buffer and secured borrowings to meet debt maturities. According to Fitch, the company is forecasted to generate RMB 10bn ($1.4bn) in operating cash flow and raise another RMB 10bn ($1.4bn) in IP-backed loans in 2025, against RMB 19bn ($2.65bn) in unsecured debt due. While Longfor has no near-term plans to issue bonds due to high costs, market sentiment is improving, as evidenced by a recent offshore issuance by a peer. Meanwhile, Longfor’s non-development income remains resilient, with rental income rising 2.5% and service-related income up 2.4% in the first five months of 2025, providing steady cash flow and bolstering access to secured financing.

Longfor’s 3.95% 2029s traded slightly lower at 80.7, yielding 9.64%.

For more details, click here

Go back to Latest bond Market News

Related Posts: