This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Longfor Downgraded to Ba3 by Moody’s

September 2, 2024

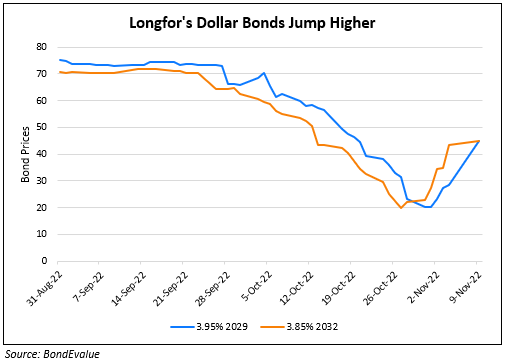

Longfor Properties has been downgraded by a notch to Ba3 from Ba2 by Moody’s. The rating agency also downgraded Longfor’s senior unsecured debt to B1 from Ba3. The downgrade reflects expected weakening of Longfor’s credit metrics over the next 6-12 months due to weak contracted sales and ongoing margin pressure on property development business as a result of ongoing downturn in Chinese real estate sector, according to Moody’s. Moody’s projects gross contracted sales of Longfor to fall by 40% to ~RMB 100bn ($14.1bn) in 2024 from RMB 173bn ($24.3bn) in 2023 and as a result, its adjusted debt-to-EBITDA to rise to ~7.5x over the next 1-2 years from 7.1x for the 12 months ended June 2024.

Its dollar bonds traded stable with its 3.95% 2029 at 71, yielding 11.74%.

Go back to Latest bond Market News

Related Posts: