This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Keppel Infrastructure, Capitaland Ascott REIT Launch S$ Perps

July 29, 2024

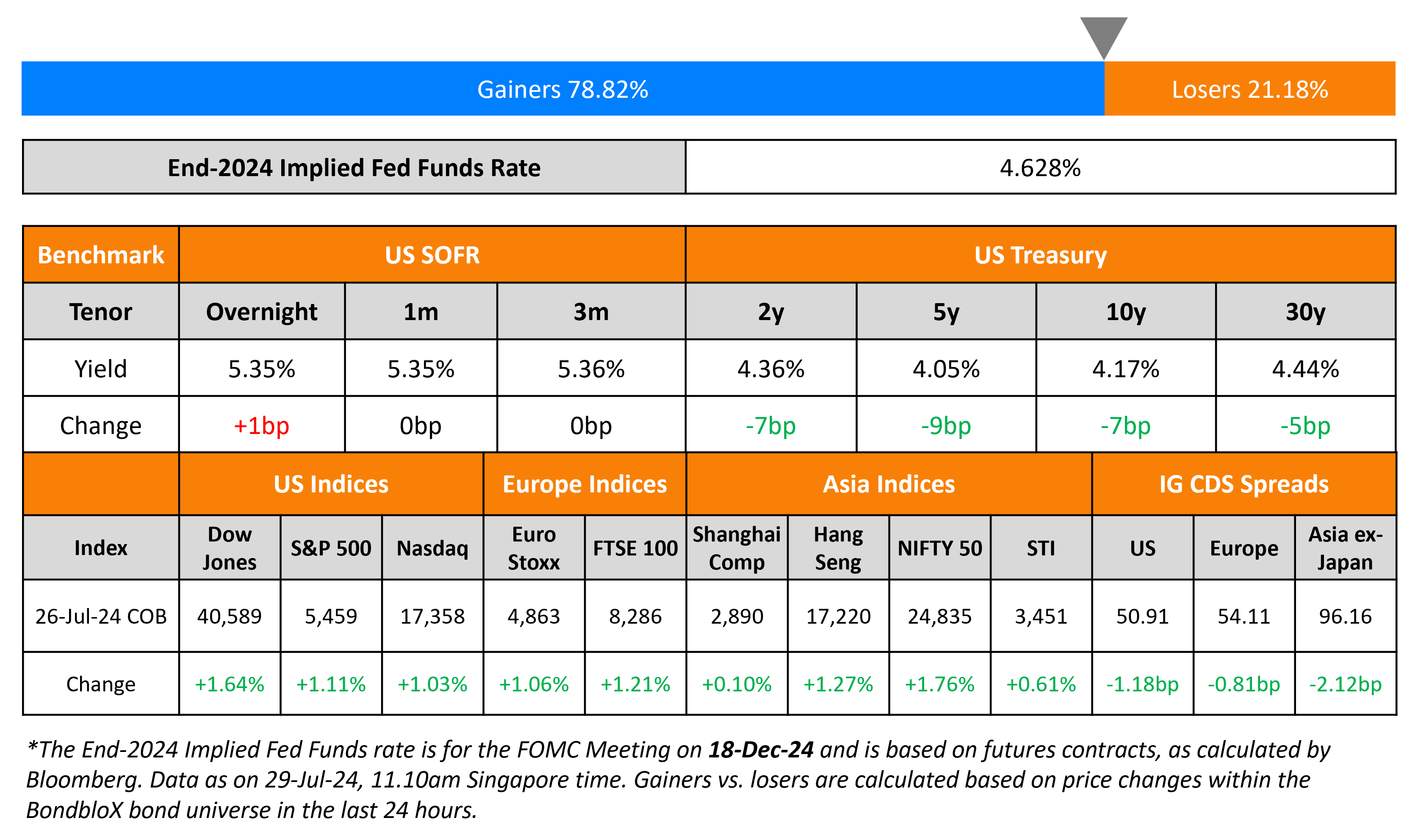

The US Treasury curve moved lower by 7-9bp. US economic data saw the Core PCE YoY come at 2.6% vs. expectations of 2.5%. Separately, the Michigan Consumer Sentiment Index came at 66.4 for July, almost inline with the surveyed 66.5. US equities bounced back on Friday, with the the S&P and Nasdaq up 1-1.1%. US IG and HY CDS spreads tightened by 1.2bp and 4.8bp respectively.

European equity markets closed higher too. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.8bp and 4.8bp respectively. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by over 2.1bp.

New Bond Issues

-

Keppel Infrastructure S$ Perp at 5.15% area

-

Capitaland Ascott REIT S$ PerpNC5.5 at 4.9% area

Rating Changes

- AstraZeneca PLC Upgraded To ‘A+’ On Lower Leverage And Strong Cash Flow Generation; Outlook Stable

- Fitch Upgrades Azerbaijan to ‘BBB-‘; Outlook Stable

- Moody’s Ratings upgrades Paraguay’s ratings to Baa3, changes outlook to stable from positive

- Moody’s Ratings downgrades CPI to Ba1, outlook remains negative

- Fitch Downgrades Gabon to ‘CCC+’

Term of the Day

Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels.

Talking Heads

On Latin American Bond Market Has New Contender for King of Chaos

Jim Craige, head of EM at Stone Harbor Investment Partners

“It’s hard to find a beacon of light… it’s difficult to say there’s a big upside relative to the downside trade here”

Thomas Jackson at Oppenheimer & Co.

“The gas discovery does not address the reason for bonds trading at these distressed levels”

Barclays analyst Sebastian Vargas

“The government “hasn’t given any indication that they’re planning to do anything to reduce that deficit”

On Treasuries Rally as Data Backs the Case for a September Rate Cut

Lindsay Rosner, GSAM

A rate cut in September “seems on track” and there’s “nothing to upset the apple cart… super-tame and in-line economic print (Core PCE)”

Subadra Rajappa, head of US rates strategy at SocGen

“The market seems to be in a rush to price in too many cuts”

Top Gainers & Losers- 29-July-24*

Go back to Latest bond Market News

Related Posts: