This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

July 2025: 71% of Dollar Bonds End Higher Despite Uptick in Treasury Yields

August 1, 2025

July 2025 was a stable month for bond investors, with 71% of dollar bonds ending higher (price returns ex-coupons). About 71% Investment Grade (IG) and 73% of High Yield (HY) bonds ended in the green, although the magnitude of the move was not significant. Corporate bonds saw a slight tightening in credit spreads during the month despite the move higher in US Treasury yields. The month of July saw the tax and spending cut bill being passed into law, the implementation of tariffs by the US President, and consistently solid economic data. From pricing-in about 65bp in rate cuts for 2025 as of end-June, markets are now pricing-in only about 36bp in cuts.

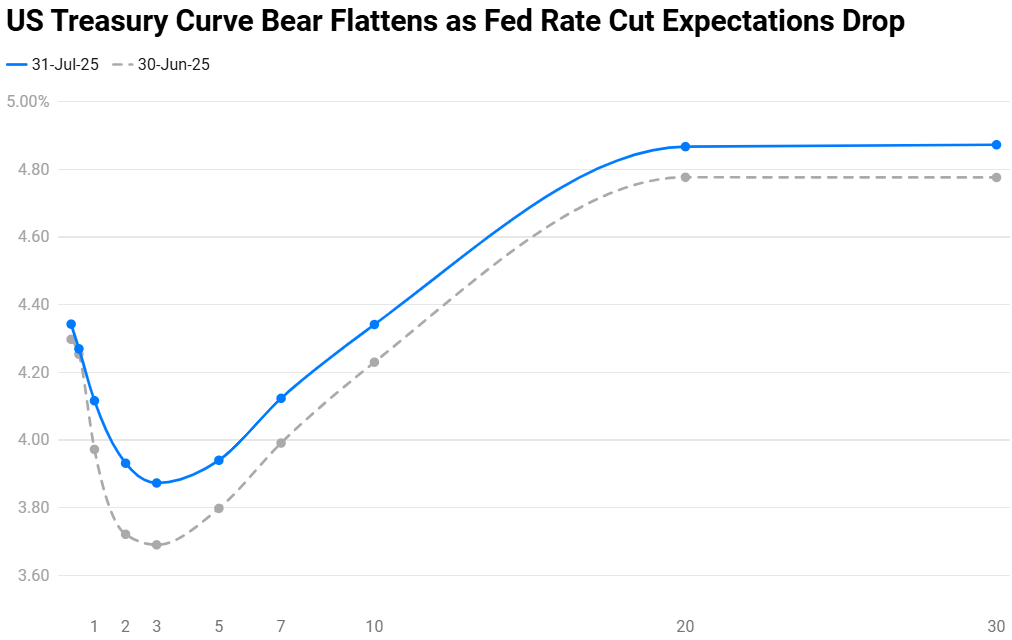

The month of July saw the Treasury yield curve shift higher from June. However the curve bear flattened with the 2Y yield moving higher by 21bp while the 10Y and 30Y yields ended 10bp higher. Economic data was solid, beginning with the labor market – US NFP came-in at 147k, better than expectations of 106k, with the prior month’s reading being revised higher. The unemployment rate improved to 4.1% from 4.2%, better than expectations of 4.3%. The ISM Services PMI came-in at 50.8, marginally better than expectations of 50.5. Looking at inflation, US CPI YoY came-in at 2.7%, stronger than expectations of 2.6% and the prior month’s reading of 2.4%. Core CPI came-in at 2.9%, in-line with expectations, but higher than the prior month’s reading of 2.8%. However, although the ISM Manufacturing PMI came-in slightly better at 49.0 vs. expectations of 48.8, it continued to stay in contractionary territory, underscoring the weakness in the sector. After looking at the economic data and the political state of events, the FOMC decided to keep rates on hold in their July meeting, whilst not offering any clarity on the timing of future rate cuts.

In the top-rated AAA to A- bucket, ultra-long dated dollar bonds (maturing after 2050) of Alibaba, Tencent, Allianz, Estee Lauder and their likes were higher by ~3% owing to their high duration as the 30Y UST yield held steady. in the BBB+ to BBB- space, Oman’s dollar bonds rose by over 3% with the sovereign being upgraded to Baa3 by Moody’s. Among the losers, long dated bonds of insurance company Brighthouse were lower by ~3% with investment firm Aquarian Holdings said to be in talks to acquire the company.

In the high yield space, Colombia’s dollar bonds rallied by over 5% – in early July, the nation was in talks with banks to secure up to ~$10bn in Swiss francs to buyback relatively expensive peso and USD-denominated bonds. Also, progress on its debt management plan to reduce interest burden helped with the rally in its bonds. Pemex’s dollar bonds also rallied by over 5% after the Mexican government was raised up to $10bn via a debt sale to support the company. Besides, Pemex also reported its first quarterly profit in over a year. Among the top gainers within the HY segment, Bally’s bonds rallied by over 10% with expectations that its $4bn Bronx casino bid may revive. Among the losers, bonds of Discovery Communications and Warnermedia fell by over 25-30%, continuing the move lower since June on the back of the company’s split in two, followed by Warner Bros’ downgrade to Ba1. Braskem’s dollar bonds fell by over 12% following two negative updates. This began with Brazilian victims of the Maceió land subsidence disaster filing an appeal in the Netherlands to hold the company’s European subsidiaries liable. This was followed by the surprise BRL 4bn ($717mn) lawsuit filed by the Brazilian state of Alagoas against them.

Issuance Volumes

Global corporate dollar bond issuances stood at $212bn in July, 25% lower MoM. As compared to July 2024, issuance volumes were down 18%. 74% of the issuance volumes came from IG issuers with HY comprising 22% and unrated issuers taking the remaining 4%.

Asia ex-Japan & Middle East G3 issuance stood at $23bn, down 24% MoM and 37% YoY. 76% of the volumes came from IG issuers with HY issuing 18% and unrated issuers taking the rest.

Largest Deals

The largest deal globally was led by Mexico’s $12bn issuance via a 5Y P-Cap bond to support Pemex. This was followed by Morgan Stanley’s and Broadcom’s $6bn three-trancher and further by JPMorgan’s $4bn issuance and Amex’s $4bn three-part deal.

In the APAC and Middle East region, deal volumes were led by Indonesia’s $2.2bn two-part sukuk issuance, Guatemala’s $1.5bn, Riyad Bank’s $1.25bn issuance and Alinma’s $1bn two-part sukuk issuance.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024