This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

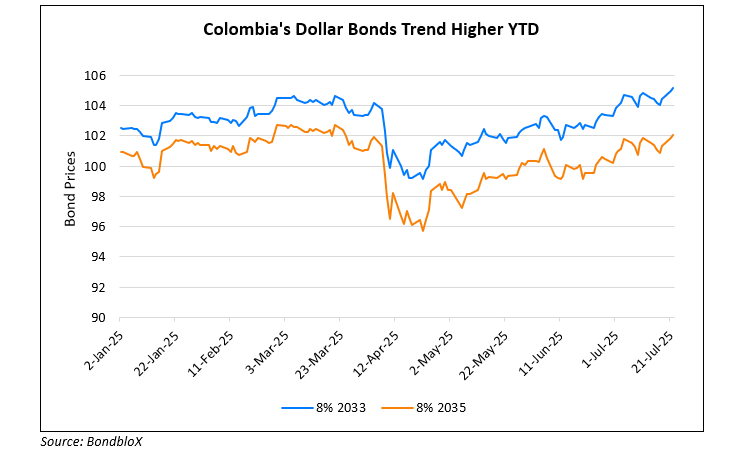

Colombia’s Dollar Bonds Inch Higher on the Progress of its Debt Management Plans

July 22, 2025

Colombia’s Finance Ministry has been working on a debt management plan to reduce the country’s interest burden. The plan involves repurchasing debt issued in both dollars and local currency. However, officials refrained from providing further details to avoid market speculation. The implementation of the plan is expected to help lower the burden of interest payments and its debt-to-GDP ratio. Colombia plans to offer around €5bn in EUR-denominated bonds over the course of 2025 and 2026. Colombia’s dollar bonds were higher across the board and have been trended higher since April as seen in the chart.

Go back to Latest bond Market News

Related Posts:

Pimco calls for Indian Sovereign Bond

May 26, 2017

China to Issue First Sovereign Bond since 2004

June 15, 2017