This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Await CPI

February 12, 2025

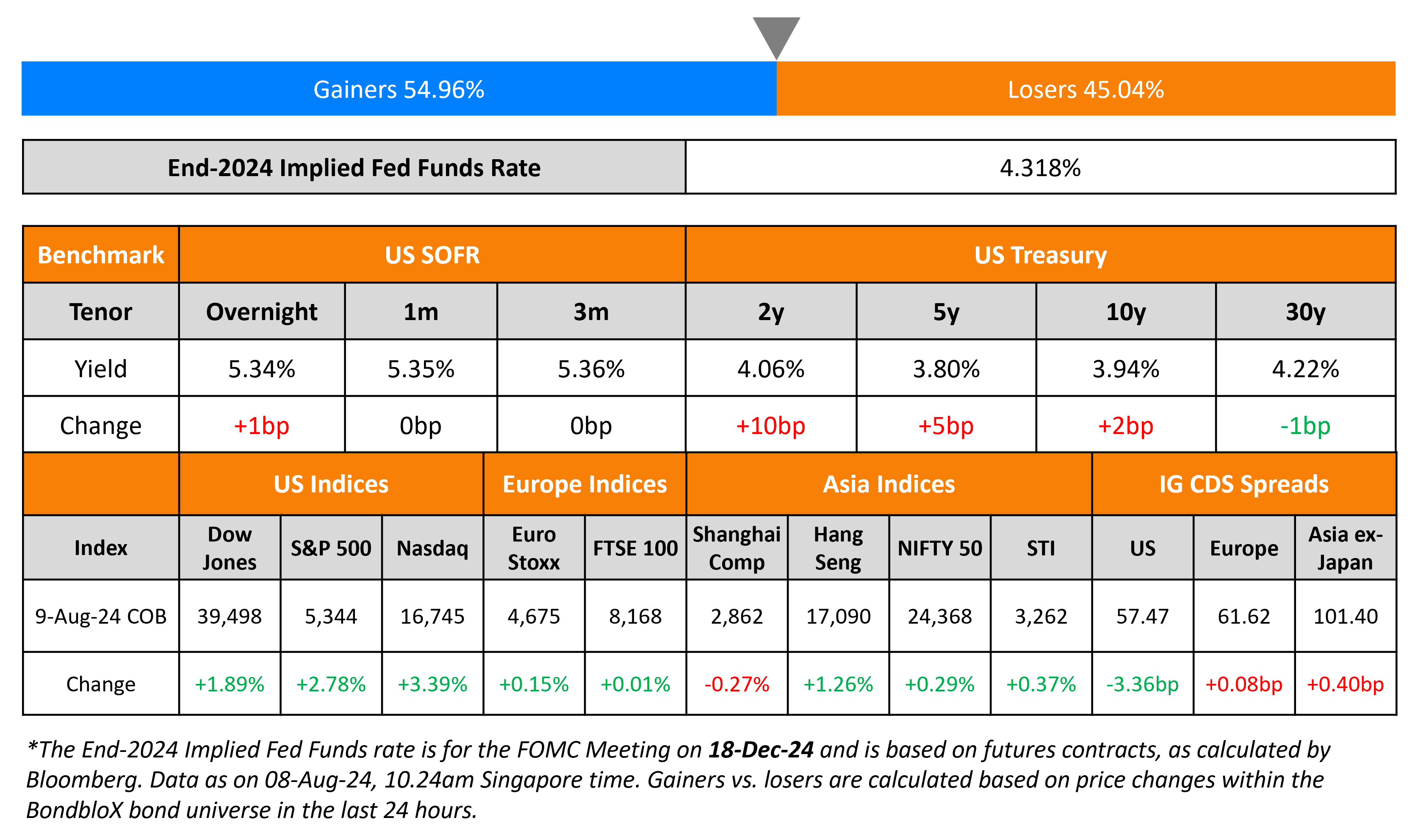

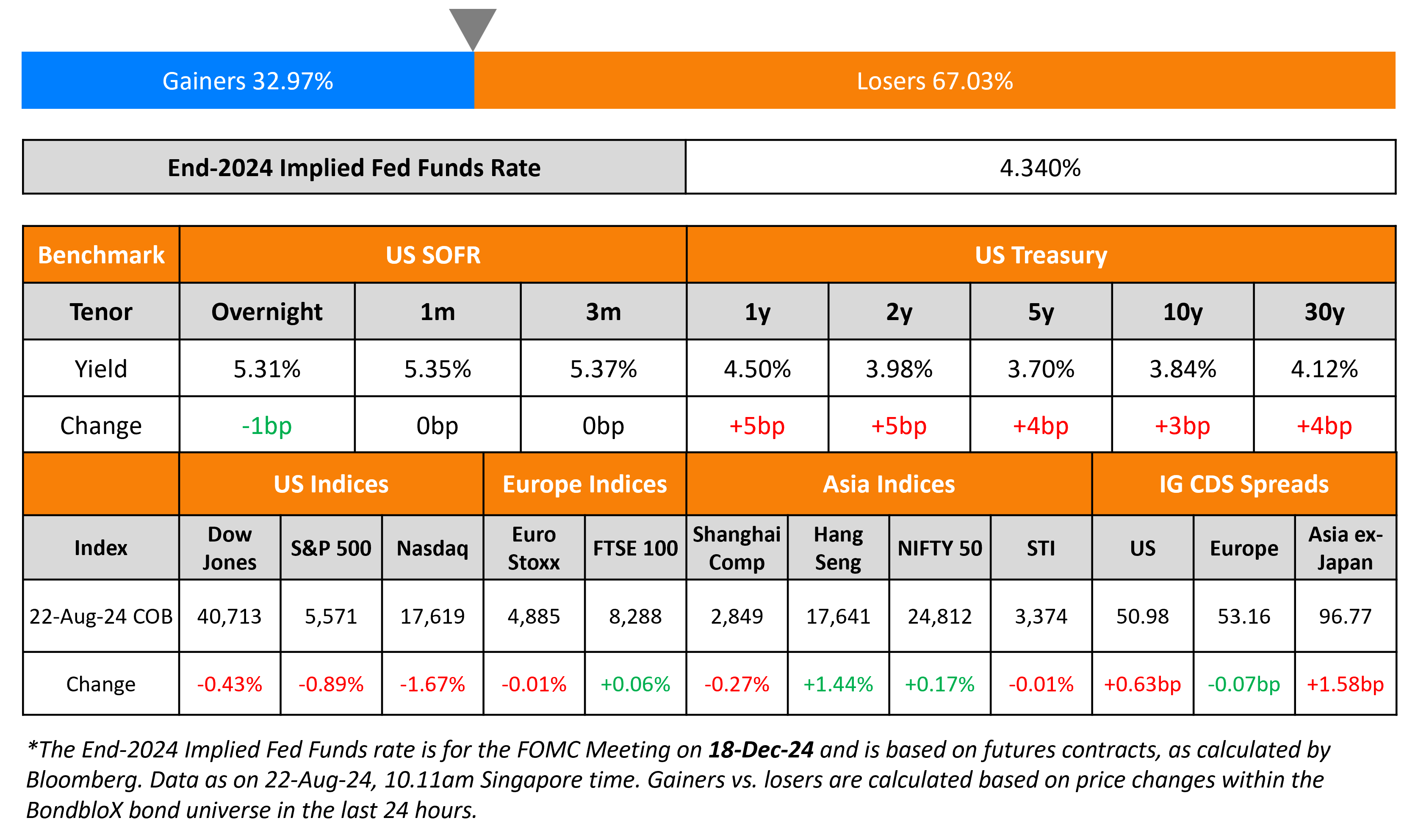

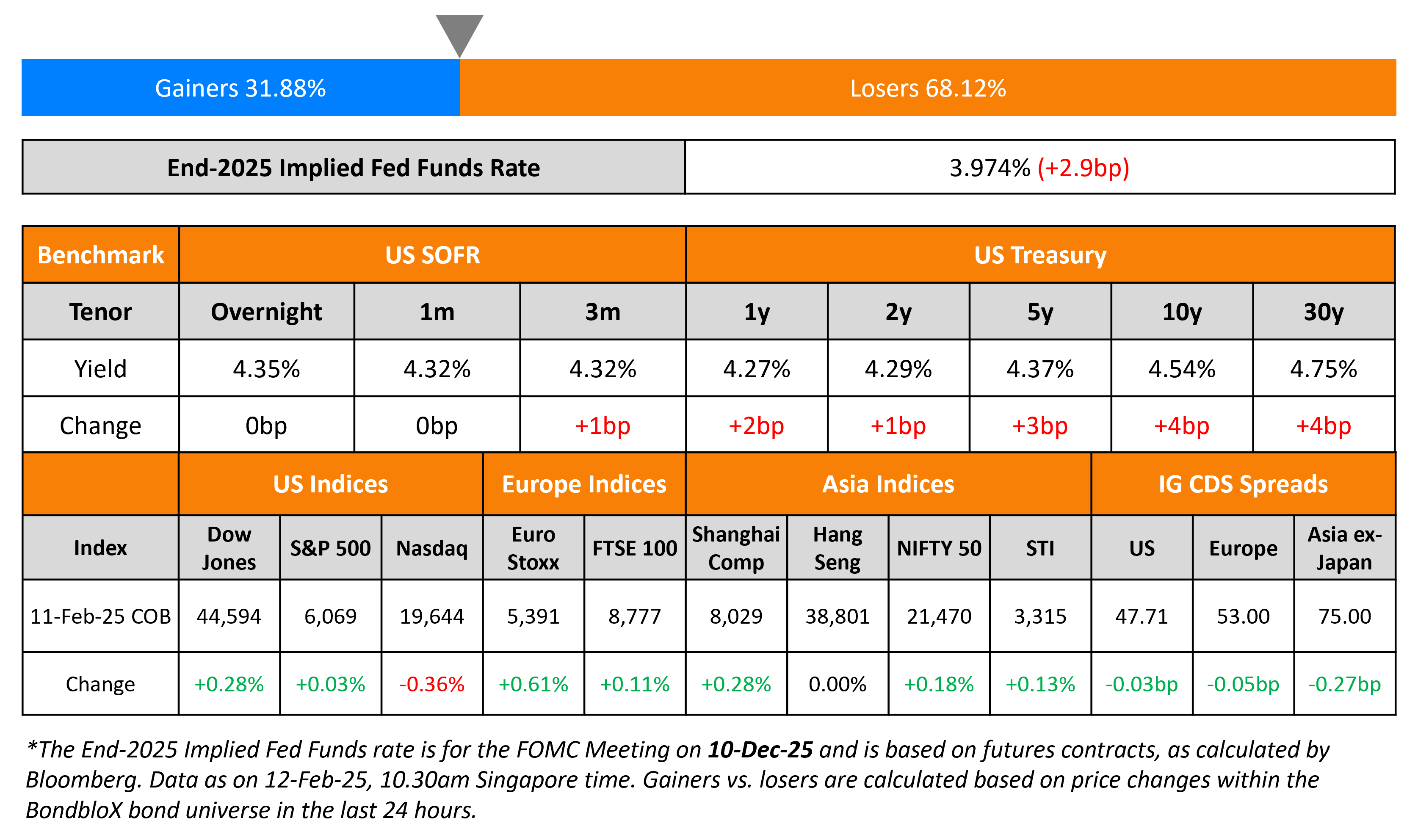

US Treasury yields were marginally higher across the curve. Fed Chairman Jerome Powell said that there was no need to rush to cut interest rates as it could hinder progress on inflation, in his testimony to Congress. Separately, Cleveland Fed President Hammack said that rates should be on hold until inflation eases further. Markets await the inflation report later today, where economists expect the headline and core prints at 29% and 3.1% YoY.

US equity markets saw the S&P end flat while Nasdaq fell by 0.4%. Looking at credit markets, US IG CDS spreads were stable while HY CDS spreads widened by 0.4bp respectively. European equity markets moved higher. The iTraxx Main and and Crossover CDS spreads tightened by 0.1bp and 0.2bp respectively. Asian equity markets have opened broadly mixed. Asia ex-Japan CDS spreads were tighter by 0.3bp.

New Bond Issues

-

Saudi Electricity $ Green Sukuk 5Y/10Y at T+120/130bp area

Julius Baer raised $400mn via a PerpNC5.5 AT1 bond at a yield of 7.5%, 50bp inside initial guidance of 8% area. The subordinated notes are rated Ba1, and received orders of over above $2.75bn, ~6.9x issue size. If not called by 19 August 2030, the coupon will reset to the 5Y UST plus 309.2bp. A trigger event would occur if the CET1 Ratio of the group is less than 5.125%, wherein the notes will be converted into equity. Net proceeds will be used for general corporate purposes.

BNP Paribas raised €1.5bn via a 12NC7 Tier 2 bond at a yield of 3.945%, 25bp inside initial guidance of MS+190bp area. The subordinated bonds are rated Baa2/BBB+/A-.

Israel raised $5bn via a two-part deal. It raised $2.5bn via a 5Y bond at a yield of 5.573%, 30bp inside initial guidance of T+150bp area. It also raised $2.5bn via a 10Y bond at a yield of 5.891%, 30bp inside initial guidance of T+165bp area. The bonds are rated Baa1/A/A. Proceeds will be used for general budgetary purposes. The new 5Y bond was priced at a new issue premium of 12bp over its existing 2.75% 2030s that currently yield 5.45%.

New Bonds Pipeline

- Mongolia hires for $ bond

Rating Changes

-

Fitch Upgrades Santander to ‘A’; Outlook Stable

-

Moody’s Ratings upgrades Coty’s CFR to Ba1; outlook stable

-

BCPE North Star Holdings L.P. Upgraded To ‘B-‘ From ‘CCC+’ On Proposed Liquidity Improvement; Outlook Stable

-

Legal & General Group’s U.S. Subsidiaries Downgraded To ‘A+’; Ratings On CreditWatch Negative; Group Ratings Affirmed

-

Fitch Revises BBVA’s Outlook to Positive; Affirms IDR at ‘BBB+’

Term of the Day: Common Equity Tier 1 (CET1) Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III. Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On The Timing of Exiting The UK Bond Bet After Recent Rally – BlackRock

“We cut our gilt allocation to neutral. Markets have moved closer to our view on Bank of England policy rates… concerns about the UK fiscal outlook will linger.”

On the Gaining Popularity of Basis Trades in China amid Low Bond Yields

Li Kunkun, Guoyuan Securities

“The wide basis could shrink in the next few months, especially ahead of maturities of futures contracts… good opportunity to build an arbitrage position”

Zhang Guobin, Pengyang Asset

“Such trades were not too attractive to clients previously, when bond yields were higher… now, we believe a decent proportion of portfolio position could be used (to boost returns)”

On it being too early to see impact of US tariffs on world economy – IMF MD, Kristalina Georgieva

“It is an evolving story… there are many, many unknowns… when I think of the impact on the world economy, my answer to you would be today, it’s too early to say”

Top Gainers and Losers- 12-February-25*

Go back to Latest bond Market News

Related Posts: