This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ISM Manufacturing Touches 49.1, New Orders, Prices Paid Rise

February 2, 2024

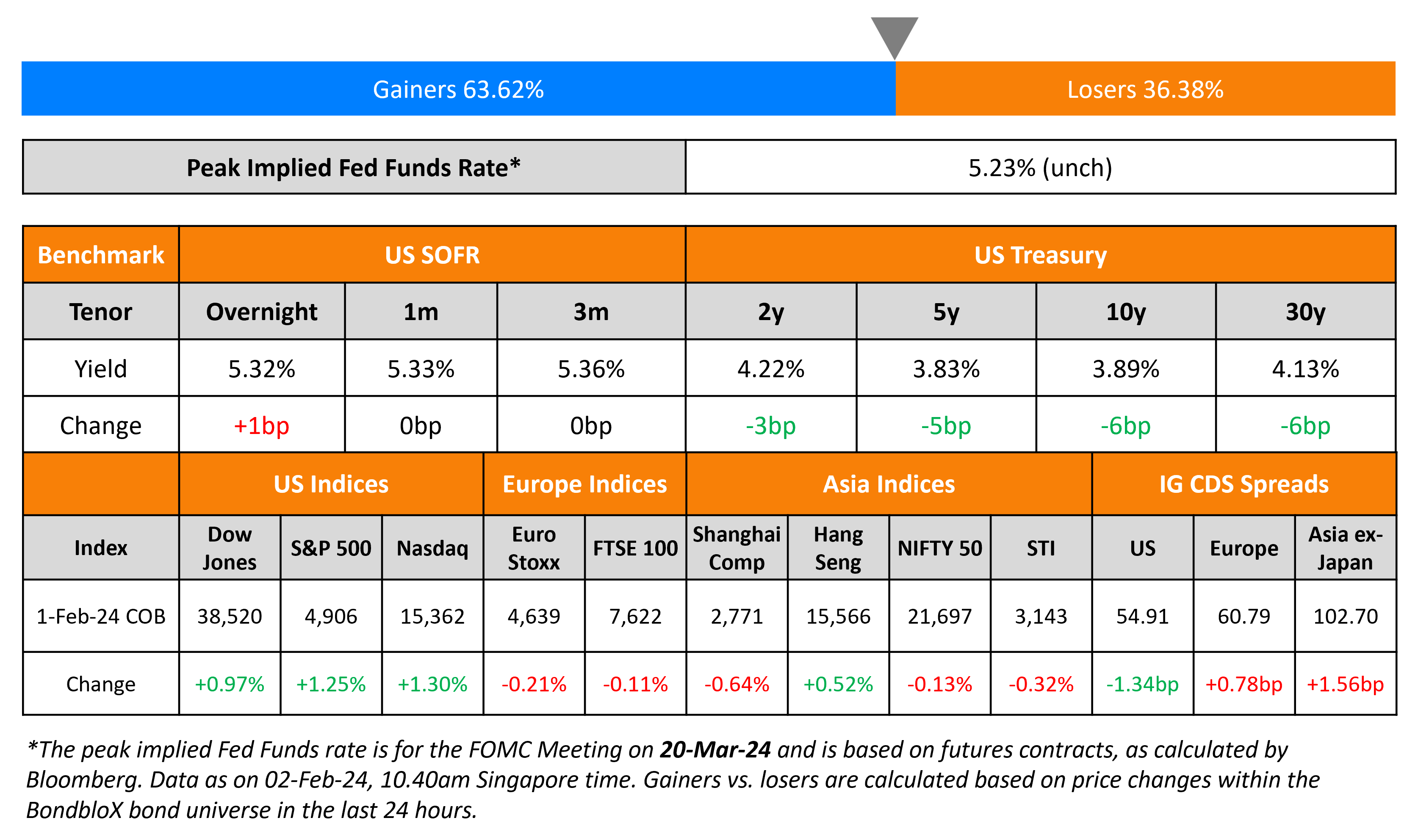

US Treasury yields dropped again yesterday, by 3-6bp across the curve. The ISM Manufacturing print for January rose 2 points to 49.1 last month. While still below the 50-mark indicating contraction, this is higher than the previous downwardly revised data of 47.1 and estimates of 47.2. The ISM New Orders component rose from 47 in December to 52.5 last month. The 5.5-point increase in new orders marked the largest monthly advance in over three years, indicating robust demand. Also the ISM Prices Paid component came at 52.5, above estimates of 46.9 and the prior 45.2 print. Separately, initial jobless claims increased by 9k to 224k for the week ending January 27, above estimates of 212k. Looking at credit markets, US IG and HY CDS spreads tightened 1.3bp and 7bp respectively. Equity markets saw the S&P and Nasdaq rise 1.3% each.

European equity markets ended slightly lower. Credit markets in the region saw the European main CDS spreads widen by 0.8bp and crossover spreads widened by 2.6bp. Asian equity markets have opened higher today. Asia ex-Japan IG CDS spreads widened by 1.6bp.

.png)

New Bond Issues

New Bond Pipeline

- Greenko Mauritius hires for $ bond

- Korea Development Bank hires for $ 3Y/5Y bond

Rating Changes

- Fitch Upgrades Las Vegas Sands IDR to ‘BBB-‘; Outlook Stable

- Paraguay Long-Term Ratings Raised To ‘BB+’ On Greater Economic Resiliency; Outlook Stable

- La Financiere Atalian SAS Downgraded To ‘CC’ From ‘CCC’ On Proposed Debt Restructuring; Outlook Negative

Term of the Day

TBAC

TBAC refers to the Treasury Borrowing Advisory Committee in the US. This committee gathers every quarter to decide on the refunding estimates by the US Treasury for the following quarters. Before the quarterly refunding announcements, the TBAC also sends surveys and has discussions with primary dealers to see the ability to absorb the expected supply of Treasuries, for example.

Talking Heads

On Treasuries Surging after Bank Stock Drop Renewing Fed Rate-Cut Hopes

Jack McIntyre, portfolio manager at Brandywine Global

“Investors are buying Treasuries first, ask questions later”

Tim Duy, chief US economist at SGH Macro Advisors

“If the ultimate outcome is that the Fed is resisting a rate cut the economy needs, we will see stress on market conditions and long yields fall”

On America’s ‘Debt Spiral’ Nearing Critical Threshold

Phillip Swagel, director of the CBO

“It’s a slow spiral, but it’s still a spiral—of rising debt and rising payments on the debt… We are in a spiral now. It’s a slow spiral, but it’s still a spiral of rising debt and rising payments”

On Milei Move to Delay Argentina Spending Cuts Is ‘Pragmatic’ – IMF MD, Kristalina Georgieva

“We have been backing up the Argentine people; we will continue to do so… impressed how open the president and government are to advice, good policy discussions”

Top Gainers & Losers- 02-February-24*

Go back to Latest bond Market News

Related Posts: