This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Intel Said to Consider Selling NEX Business, Say Sources

May 21, 2025

Intel is considering selling its networking and edge (NEX) business unit as part of a strategic shift, as per sources. No final decision has been made regarding the sale. The NEX group, which reported $5.8bn in revenue in 2024, was recently integrated into Intel’s data center and PC divisions and is no longer reported separately. This move reflects Intel’s focus on core strengths in PC and data center chips, where the company holds significant market shares – 68% in PC chips and 55% in data center chips. Discussions about divesting the NEX unit are in early stages, with no formal sale process initiated yet. Intel has engaged bankers to explore potential buyers, but no adviser has been hired as of now. The decision to explore a sale is influenced by the limited strategic fit of the NEX unit with Intel’s core outlook and the competitive challenges in the networking chip market. Intel’s recent $4.46bn sale of a majority stake in its Altera unit to Silver Lake further underscores the company’s strategy to streamline operations and concentrate resources on its primary business areas.

Intel’s bonds were trading stable, with its 5.2% 2033s at 98.1, yielding 5.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Intel’s Bonds Rise on Rumors of Potential Tie-Up With TSMC

February 14, 2025

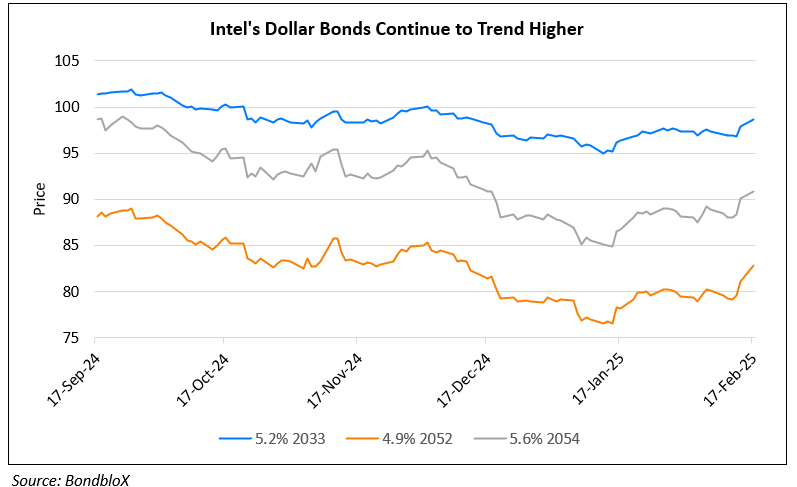

Intel’s Dollar Bonds Continue to Move Higher

February 17, 2025

Intel to Sell 51% Stake in Altera for $4.46bn

April 15, 2025