This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

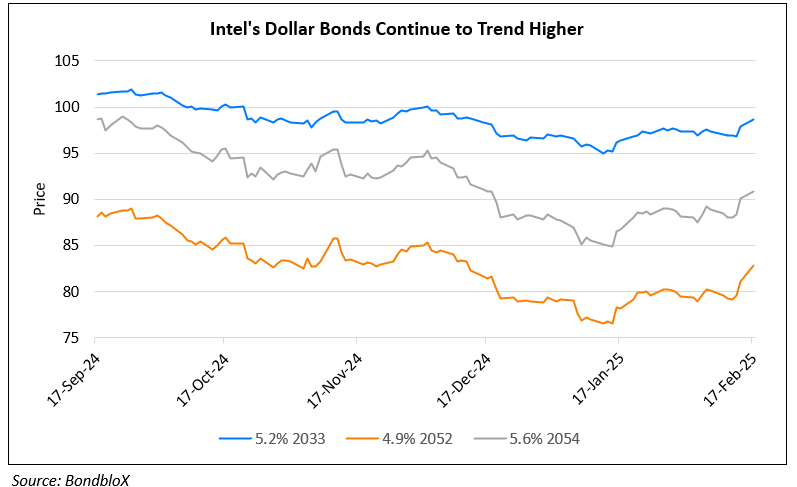

Intel’s Dollar Bonds Continue to Move Higher

February 17, 2025

Intel’s bonds continued their move higher on Friday after it was reported that the company could face potential bids from Broadcom and Taiwan Semiconductor Manufacturing Co. (TSMC) which could split the company in two, according to the Wall Street Journal. Broadcom is interested in Intel’s chip design and marketing business but would likely move forward only if it partners with a company for Intel’s manufacturing operations. TSMC has considered taking control of Intel’s chip plants, possibly through an investor consortium. Both companies are not collaborating, and discussions are still informal. Intel’s interim executive chairman, Frank Yeary, is leading the talks, focusing on maximizing shareholder value. The Trump administration has expressed concerns about foreign control over Intel’s US factories, with a White House official indicating opposition to foreign entities operating them. Intel has faced significant challenges recently, with a $16.6bn loss in 3Q last year mainly due to tight IT budgets and slow adoption of AI-related products. Despite these struggles, Intel continues to be a key player in the US chip industry, benefiting from government support, including a $7.86bn subsidy. The company was downgraded by S&P to BBB and by Fitch to BBB+ last year.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Intel’s Bonds Rise on Rumors of Potential Tie-Up With TSMC

February 14, 2025

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017