This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

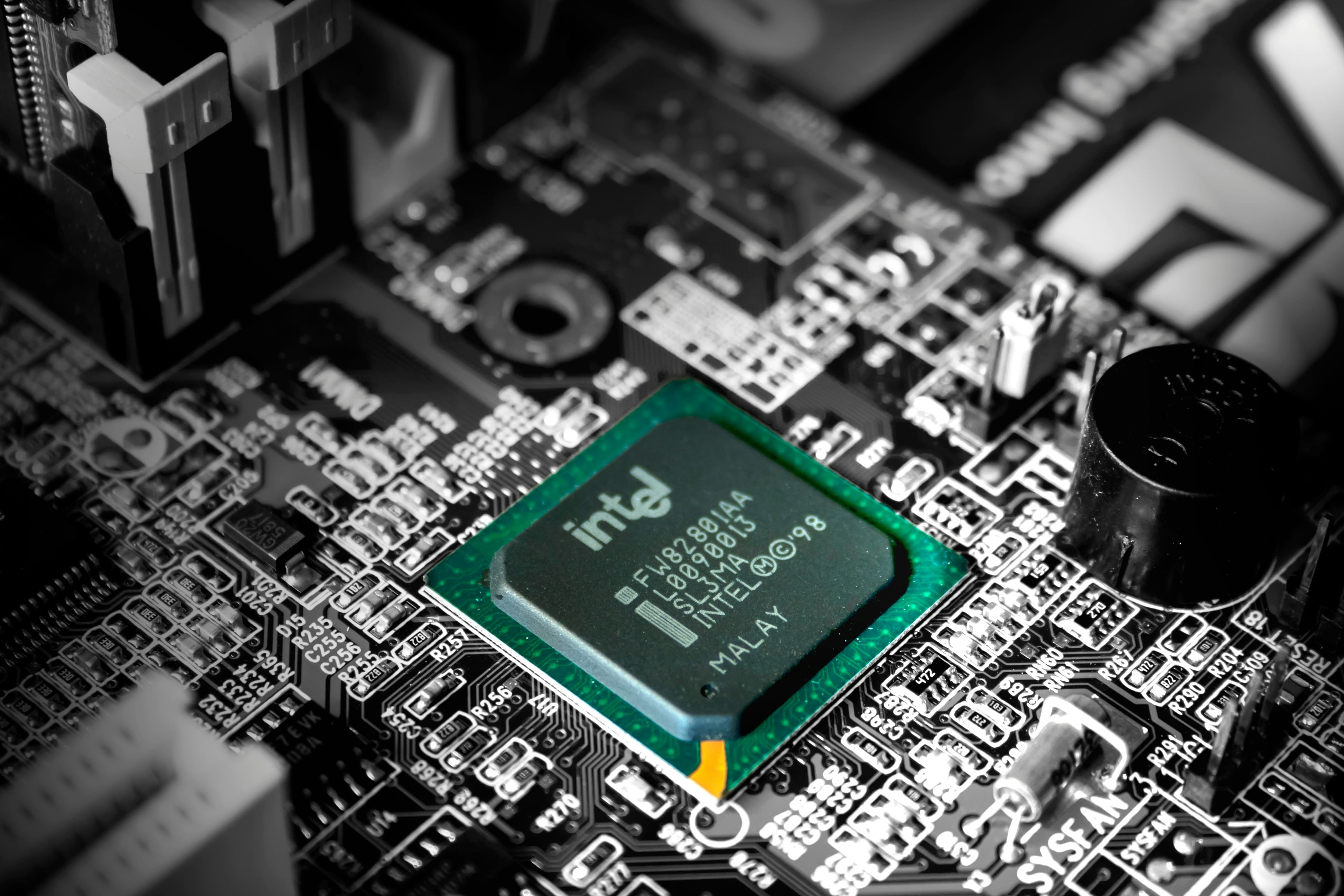

Intel’s Bonds Rise on Rumors of Potential Tie-Up With TSMC

February 14, 2025

Intel’s bonds rose by 1-2 points after there were speculations about a potential partnership with Taiwan Semiconductor Manufacturing Company (TSMC). R.W. Baird’s Analyst Tristan Gerra suggested that Intel could spin off its semiconductor fabrication unit into a joint venture with TSMC. This would involve TSMC supplying semiconductor engineers and expertise to manufacture advanced 3nm and 2nm chips in the US, aided by federal subsidies from the CHIPS Act. While the proposal has benefits, challenges are also being weighed. Intel faced an $18.8bn loss over the past year and expects to return to profitability in 2026. The company was downgraded by S&P and Fitch last year as its key segments struggled, mainly due to tight IT budgets and slow adoption of AI-related products.

Intel’s bonds were up across the curve with its z-spread easing by over 10bp. Its 5.6% 2054s rose by 1.9 points to 90.23, yielding 6.34%.

For more details, click here

Go back to Latest bond Market News

Related Posts: