This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Intel Revises CHIPS Act Agreement, Receives $5.7bn

September 2, 2025

Intel revised its CHIPS Act agreement with the US Department of Commerce, eliminating earlier project milestone requirements. This has enabled Intel receive ~$5.7bn in cash ahead of schedule, granting Intel greater flexibility over the funds. The move is believed to provide Intel more flexibility over the funds, although some restrictions on usage remains — the funds can not be used for dividends and buybacks, certain control-changing deals and from expanding in certain countries. As part of this agreement, Intel issued 274.6mn shares to the US government and granted the option to buy up to an additional 240.5mn shares under certain conditions. Also, 158.7mn shares were placed in escrow, set to be released when further CHIPS funding is available for the Secure Enclave program. Intel confirmed that it has already spent at least $7.87bn on projects eligible for CHIPS Act funding. The update comes just weeks after the US government’s move to take a 9.9% equity stake in Intel.

Intel’s 5.2% 2033s were trading stable at 100.5, yielding 5.1%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Intel’s Bonds Rise on Rumors of Potential Tie-Up With TSMC

February 14, 2025

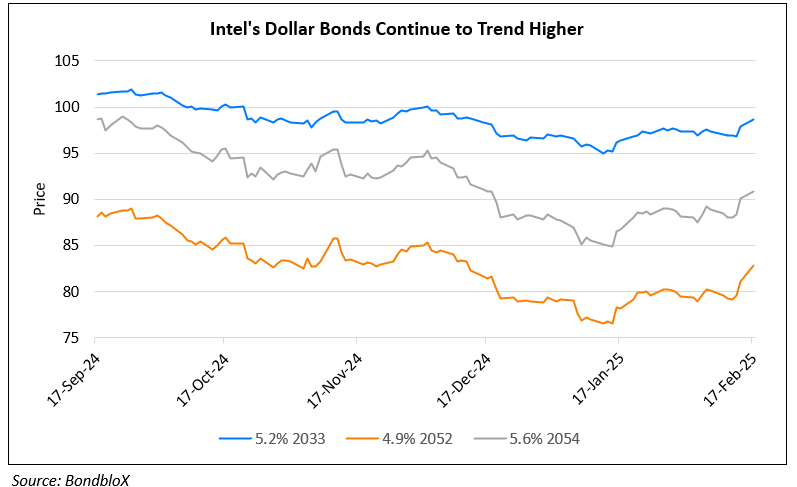

Intel’s Dollar Bonds Continue to Move Higher

February 17, 2025

Intel to Sell 51% Stake in Altera for $4.46bn

April 15, 2025