This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

India Cleantech Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 29, 2021

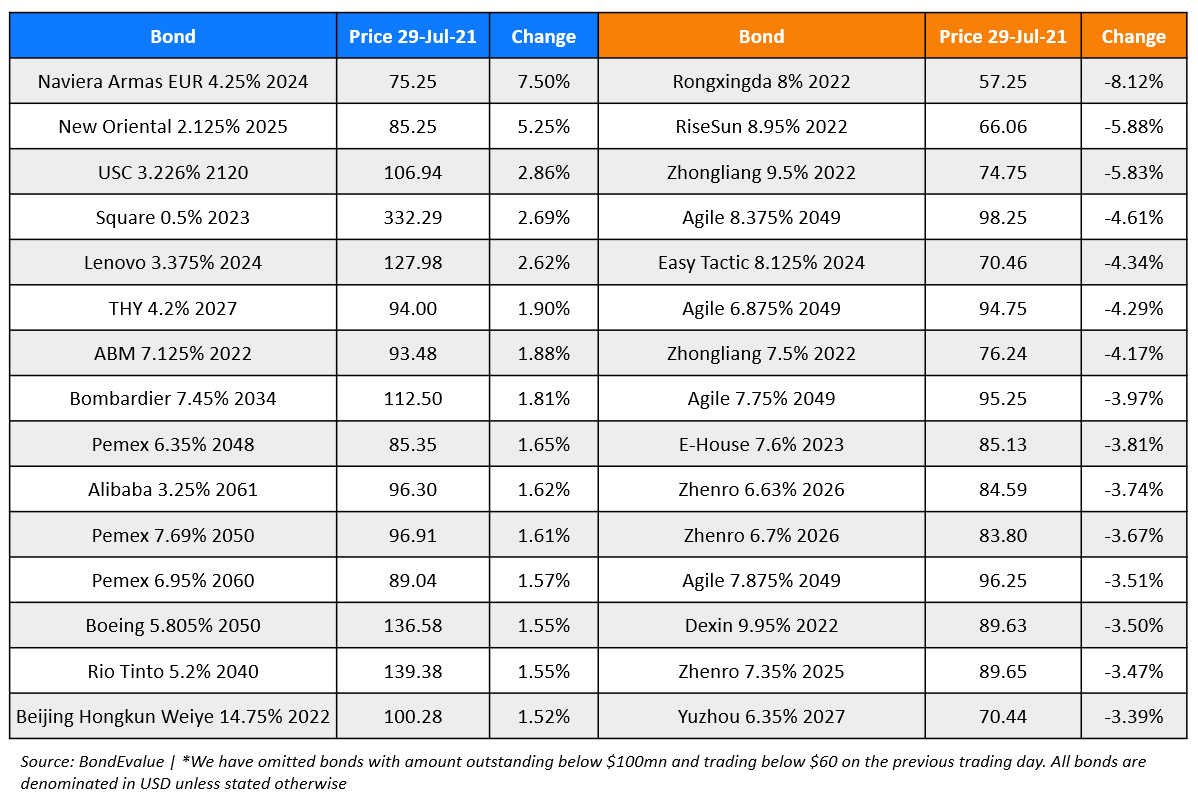

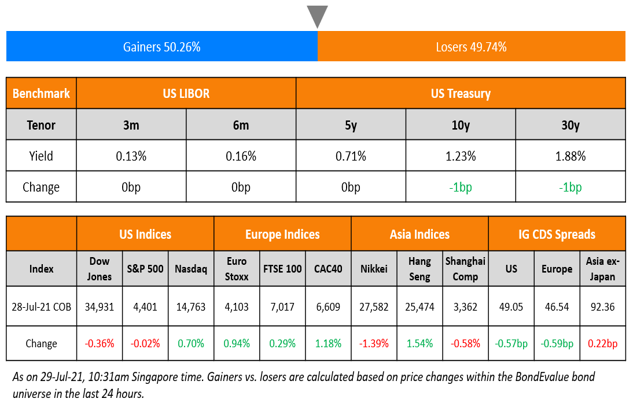

US markets shed the risk-off sentiment with the S&P broadly flat while the tech heavy Nasdaq gained 0.7%. The upside was supported by Energy and Healthcare up 1% and 0.4% respectively while the indices were dragged down by Consumer Staples and Real Estate, down 0.9% and 0.6% respectively. Facebook and Boeing (detailed below) beat expectations while Paypal reported a drop in profits. Amazon is set to report earnings later today. European stocks reversed some of the losses – the CAC was up 1.2% and DAX and FTSE were up 0.3% each. Saudi TASI and UAE’s ADX were up 0.2% and 1% respectively. Asia Pacific stocks were up – the HSI led, up 2%, followed by Shanghai, Singapore’s STI and Nikkei up 0.9%, 0.5% and 0.4% respectively.

The Federal Reserve decided to keep an accommodative stance by maintaining status quo on interest rates with Powell saying that the Fed will give an advance notice before making any changes to its asset purchases. He added that he wants to see “substantial further progress” in the economy before adjusting asset purchases. US 10Y Treasury yields ended almost unchanged but yields fell from 1.27% to 1.23% intra-day post the FOMC meeting. The 2s10s curve flattened 3bp led by the 10Y. Analysts say that the lack of any timeline or commitment to any future plans beyond continuing to assess the situation was a soft stance with markets expecting a slight hawkish (Term of the day, explained below) tilt.

US IG CDS and HY spreads tightened 0.6bp and 1.3bp respectively. EU Main and Crossover spreads tightened 0.6bp and 3bp respectively. Brazil’s Bovespa was up 1.3%. Asia ex-Japan CDS spreads were 0.2bp wider.

%20(1).jpg?upscale=true&width=1520&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

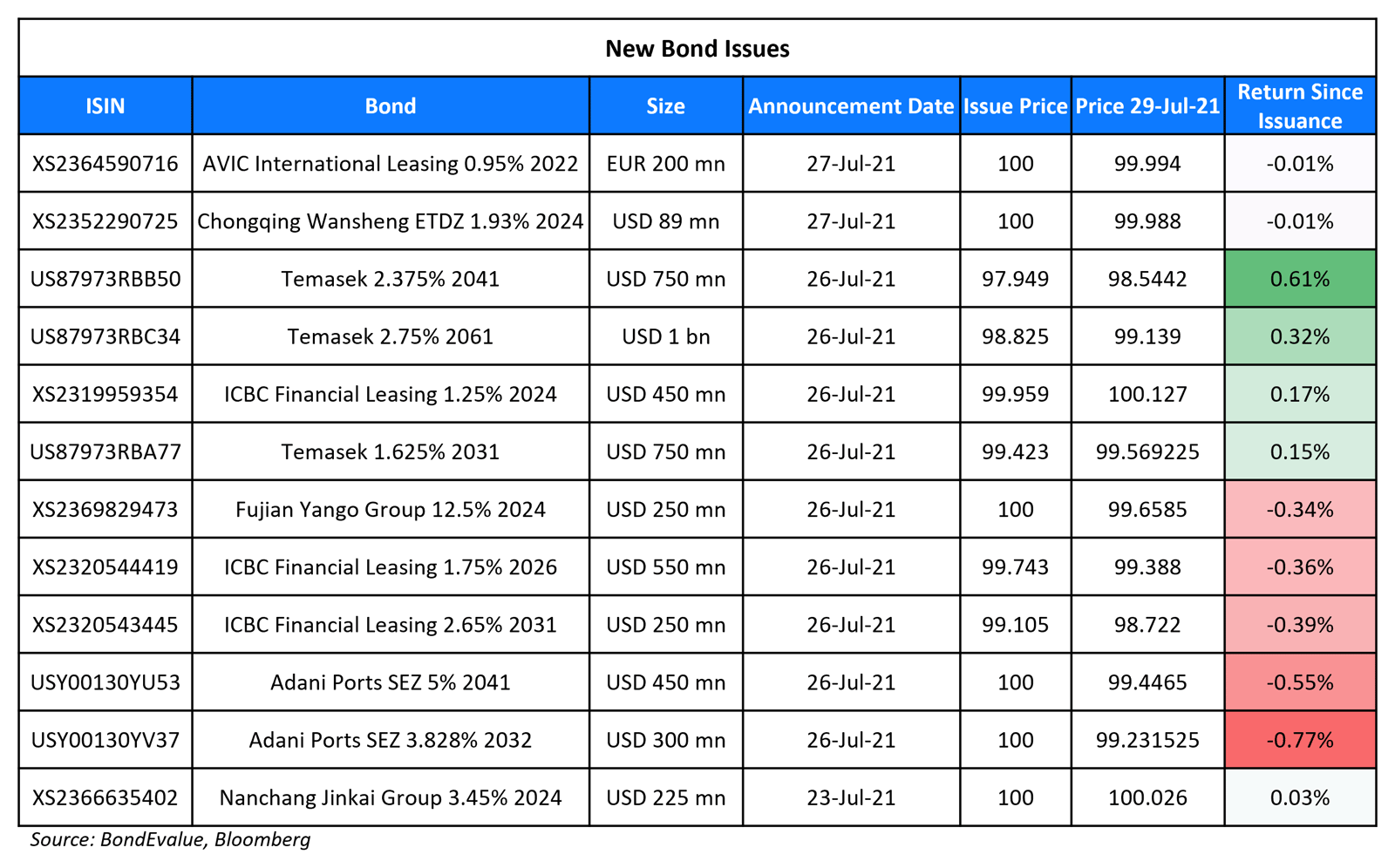

New Bond Issues

-

India Cleantech Energy/Acme Solar $ amortising 5NC3 green bond at 5% area

-

Chengdu Xingjin Construction Development and Investment Group $ 3Y final at 3.7%

- Yantai Penglai District Construction Investment capped $50mn 364-day note final at 4.95%

- ABM Investama $ 5NC3 at 9.875% area, alongside concurrent tender offer

ESR REIT raised S$125mn via a 5Y bond at a yield of 2.6%, 15bp inside initial guidance of 2.75%. The bonds are unrated. The issuer is RBC Investor Services Trust Singapore, in its capacity as the REIT’s trustee. Proceeds will be used for debt refinancing, financing or refinancing of acquisitions and investments, funding development and asset enhancement works, as well as supporting working capital needs and capital expenditure. This is the REIT’s first issuance since it priced an S$150mn 4.6% PerpNC5 in 2017.

New Bonds Pipeline

-

Gemdale Corp hires for $ green bonds

-

Chindata Group hires for $ green bonds; calls today

-

Chongqing International Logistics Hub Park Construction hires for $ bonds; calls today

Rating Changes

- Brazilian Rental Co. Movida Upgraded To ‘BB-‘ And ‘brAA+’ On Incorporation Of CS Participacoes, Outlook Stable

- Fitch Downgrades Evergrande and Subsidiaries, Hengda and Tianji, to ‘CCC+’

- Fitch Revises IGH’s Outlook to Stable; Affirms IDR at ‘BB+’

- Fitch Revises Arauco’s Rating Outlook to Stable; Affirms IDR at ‘BBB’

- Petrobras’ Stand-Alone Credit Profile Revised Up To ‘bb+’ By S&P; ‘BB-‘ Rating Affirmed On Sovereign Cap; Outlook Stable

- Advanced Micro Devices Inc. Ratings Remain On CreditWatch Positive by S&P; Upgrade To ‘BBB+’ Likely On Xilinx Acquisition

- EuroChem Upgraded To ‘BB’ By S&P On Improved Free Operating Cash Flows Amid A Stronger Market; Outlook Stable

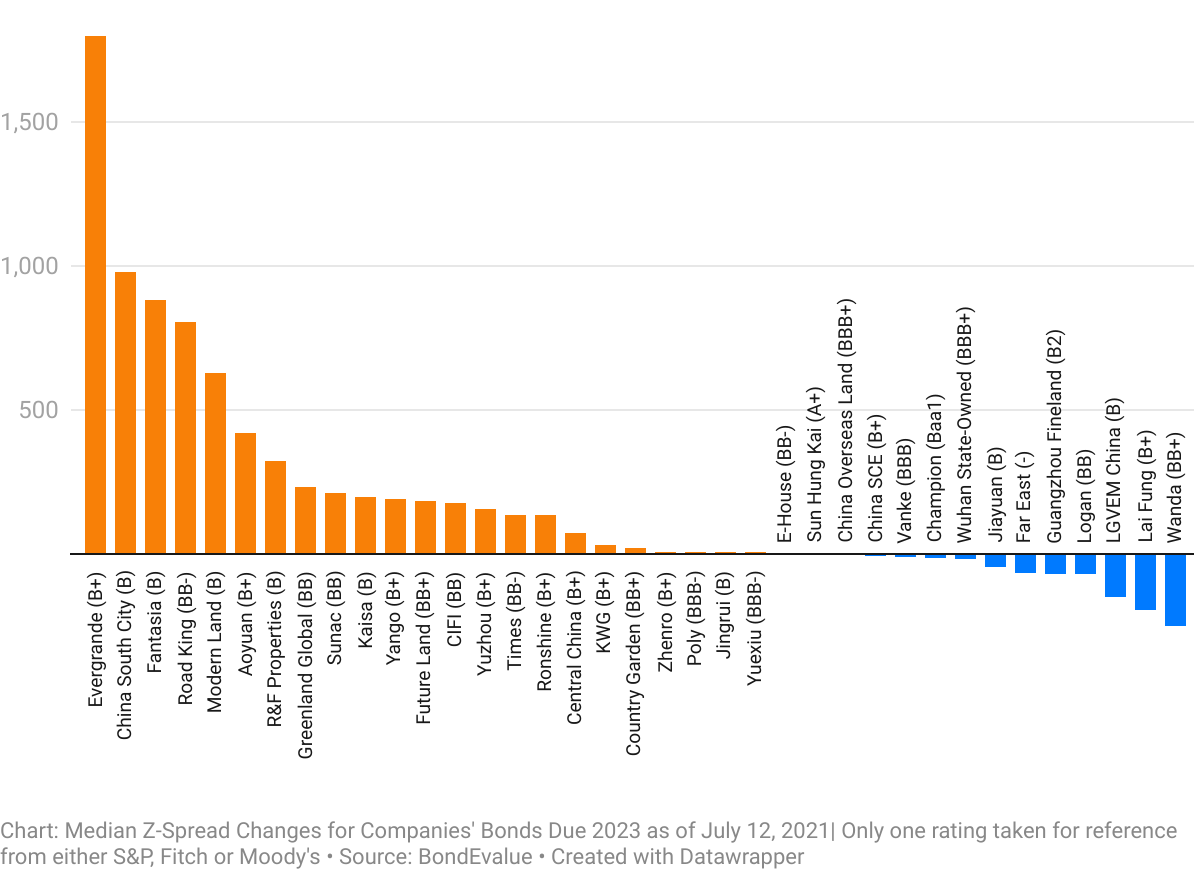

ICYMI: Chinese Developers’ Bond Spreads Widen as Focus on Three Red Lines Increases

In case you missed it – China’s real estate developers’ high yield Index underperformed its peers witnessing a sharp drop of 6% in June and down 3.7% YTD. Investor concerns were apparent since the start of Q2 with Z-Spreads widening across certain Chinese real estate developers. China Evergrande’s Z-Spread widened by a massive 1,800bp since April, the highest in the sector as investor concerns grow over its liquidity position. The ‘three red-lines’ (Term of the Day, explained below), a key regulatory threshold for property developers set by Beijing has become an important factor that separates the winners and the losers.

In this editorial piece, we detail the widening Z-Spreads across companies in the Chinese property sector, the sector’s underperformance, and the three red-lines calculations of the key players.

Term of the Day

Hawkish

Hawkish is a term used to describe a monetary policy stance where policymakers are concerned about inflation or overheating risks and therefore adopt a tightening stance. A hawkish stance could be either in the form of rate increases, asset purchases decreases or even indications on the same relative to market expectations. This is the opposite of a dovish stance, where the monetary policy stance is more accommodative in nature. In yesterday’s FOMC meeting, analysts expected a slight hawkish tilt to the central bank decision regarding a timeline or greater details on planned asset purchase decreases. But, Chairman Powell did not signal any of that and rather indicated that there was still time to decide on that.

Talking Heads

Jerome Powell, Federal Reserve Chairman

“We’re not there. And we see ourselves as having some ground to cover to get there.” “We’re making progress. We expect further progress and if things go well we will reach that goal,” he said.

Stephen Stanley, chief economist at Amherst Pierpont Securities LLC

“The chairman tried to walk that back a little bit in the press conference, making it seem like it’s more of a continuous process rather than just a big discrete move.”

Neil Dutta, head of U.S. economics at Renaissance Macro Research

“The Fed is starting the clock on tapering. It is not happening now or even in September, but expect the pace of asset buying to slowdown late this year or early next.”

Diane Swonk, chief economist at Grant Thornton LLP

“Powell is unfazed by the delta variant and upbeat on the labor market.” “I was expecting a more cautious tone. We have become more resilient and learned to live with Covid. But that has been accompanied by unprecedented fiscal support and that support will end by the end of the year.”

“What this shows is that there isn’t an intention to unilaterally destroy business models and businesses which are fundamentally aligned to the party’s priorities for China’s development.”

Matt Maley, chief market strategist at Miller Tabak

“The invest-in-China mantra has always been based on the idea that China was going to be the next big global power, so that’s where I need to be.” “That’s being rethought. How can you discount risk when it’s not clear what China will do?”

Brendan Ahern, chief investment officer at KraneShares ETFs

“A lot of investors have given up on international investing.” “If you are an international advisor, and you have had 10 years of underperformance, you are constantly defending why you are invested overseas.”

John Davi, founder of Astoria Advisors

“International markets can outperform for a year or two, but then the U.S. always comes back,” he said. “The U.S. is a higher quality market, and much of the rest of the world is lower quality,” he said. “Low quality can outperform for short periods, but not in the long run. In the 25 years I have been doing this, growth and quality have always outperformed in the long run, and for the most part that means the U.S. markets.” “Emerging markets are not for the faint of heart. Volatility is in the DNA of these funds,” he said. “You have to be very long term; you have to believe in the secular theme that the Chinese consumer is going to keep growing faster than the rest of the world, and China stocks will capture some of that. But along the way, it can be very painful.”

Dave Nadig, director of research at ETF Trends

“China is a unique and special case in the global economy,” he said. “From a U.S. investor’s perspective, we should look at international investing as the U.S., China, and everyone else. China can change the rules of the game so quickly we have to think about it differently. If nothing else, the regulatory risk is much higher than we thought.”

“It seems to us that it’s an action taken by the credit rating agency that lacks professionalism, ethics — in short, it’s something shameful,” Romero said.

Go back to Latest bond Market News

Related Posts: