This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hyundai Capital Prices $ Bond; Pemex Reports $8.2bn Loss in 3Q

October 30, 2024

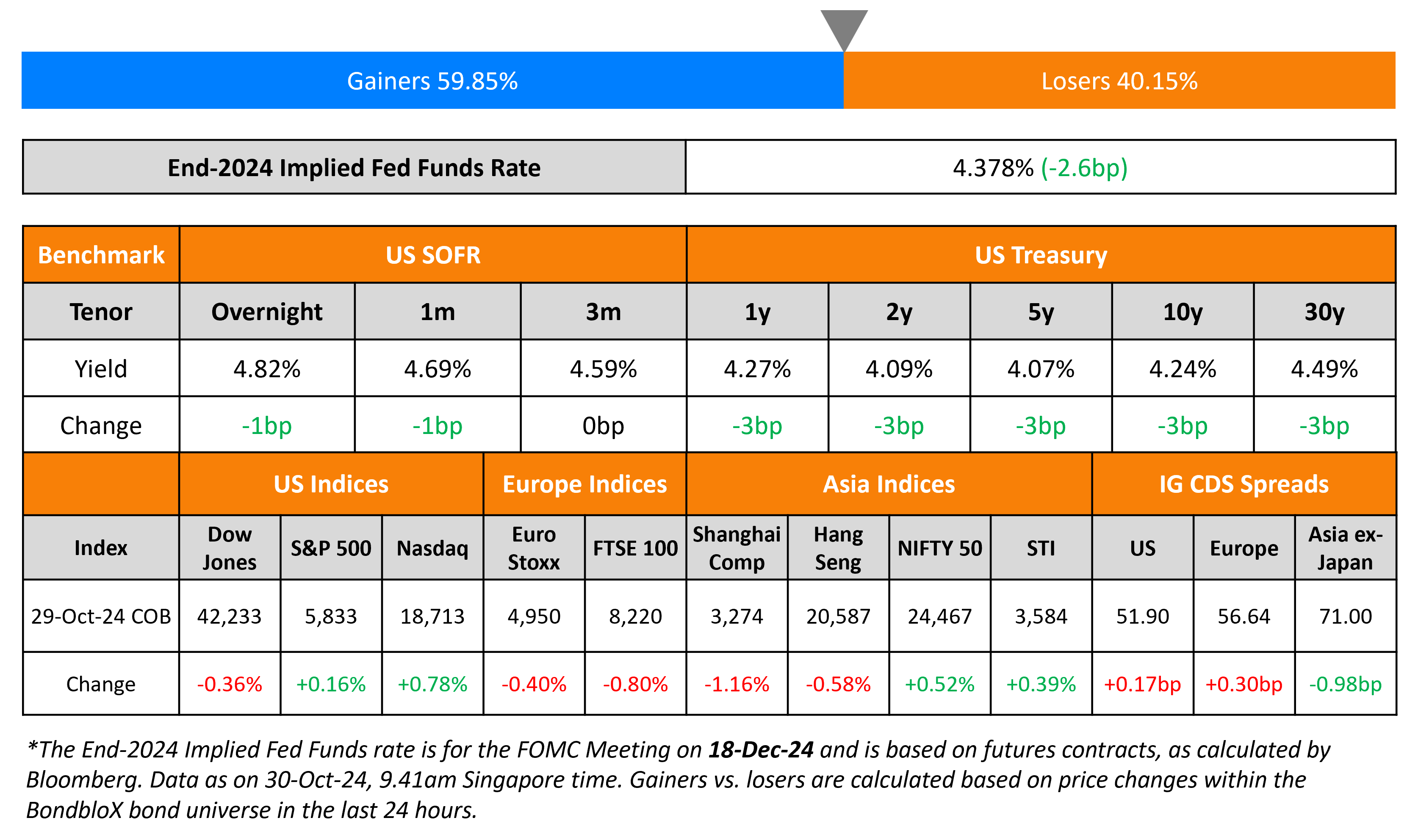

US Treasury yields fell by about 3bp across the curve. The 7Y US Treasury auction saw strong demand, with a bid-to-cover of 2.74x (vs. 2.63x last month) and an indirect acceptance rate of 72.0%. The final yield for the 7Y note stood at 4.22% (vs. 3.67% last month). On top of this, the JOLTS job openings number for the month of September came in at 7.44mn, softer than estimates of 7.99mn and the prior revised figure of 7.86mn. However, analysts have remarked to treat this data release with caution due to the very low response rate for the survey. Additionally, the September figure was also expected to have been disproportionately affected by the ongoing labour strikes and the hurricanes that had occurred. US IG and HY CDS spreads widened by 0.2bp and 0.5bp respectively. Looking at US equity markets, both S&P and Nasdaq closed higher by 0.2% and 0.8% respectively.

However, European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.3bp and 0.8bp respectively. Asian equity indices have opened broadly mixed as of today morning. Asia ex-Japan IG CDS spreads saw a 1bp tightening.

New Bond Issues

Hyundai Capital America raised $850mn via a 3Y bond at a yield of 4.887%, 20bp inside initial guidance of T+100bp area. The senior unsecured bonds are expected to be rated A3/A-/A-. The new bonds are priced in-line with the existing 2.375% bonds yielding 4.88% and maturing on 15 October 2027. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Tata Capital hires for $ bond

-

Islamic Development Bank hires for € 5Y Sukuk bond

-

New Development Bank hires for $ 3Y Green bond

Rating Changes

- Moody’s Ratings upgrades Broadcom’s senior unsecured rating to Baa1 and commercial paper rating to P-2; outlook changed to stable

- Moody’s Ratings upgrades Molson Coors’ unsecured ratings to Baa1; affirms Prime-2; outlook stable

- Vertiv Group Corp. Upgraded To ‘BB+’ On Strong Performance And Improved Competitive Position, Outlook Positive

- Fitch Revises Vale’s Outlook to Positive; Affirms at ‘BBB’

- Fitch Revises General Motors’ Outlook to Positive; Affirms IDR at ‘BBB’

- Royal Caribbean Cruises Ltd. Outlook Revised To Positive On Expected Improvements In 2025

Term of the Day

Grandfathered Bond

Grandfathered bonds refer to a European class of bonds issued prior to March 1, 2001 that were exempted from retention tax payment. A retention tax is a tax that is automatically withheld or paid directly to the government and became effective on July 1, 2005. Since these bonds were issued much earlier, the old rules of not paying retention taxes continued to apply onto the bonds, thus making it “grandfathered”.

Talking Heads

On Fed Cutting Rates by 25bp in Next Two Meetings

Thomas Simons, senior economist at Jefferies

“I expect we will get a 25-basis-point cut at each of the next two meetings. The information we gather suggests the economy overall is not in desperate need of easing.”

Stephen Gallagher, chief U.S. economist at Societe Generale

“Since the start of this year, the median view of Fed officials on the neutral rate has risen from 2.5% to 2.9%, and it is likely that this view can edge up slightly more.”

“We actually view China as a decent place to hide, since the market has a lot of domestic drivers and lower correlation with global asset moves.”

“Today the U.S. economy is strong. We’ve seen robust economic growth, bolstered by solid consumer spending and business investment, even while inflation has come down significantly from its peak.”

Top Gainers & Losers 30-October-24*

Other News

Go back to Latest bond Market News

Related Posts: