This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC, Ping An, Manappuram, UBS and Others Price $ Bonds

May 9, 2024

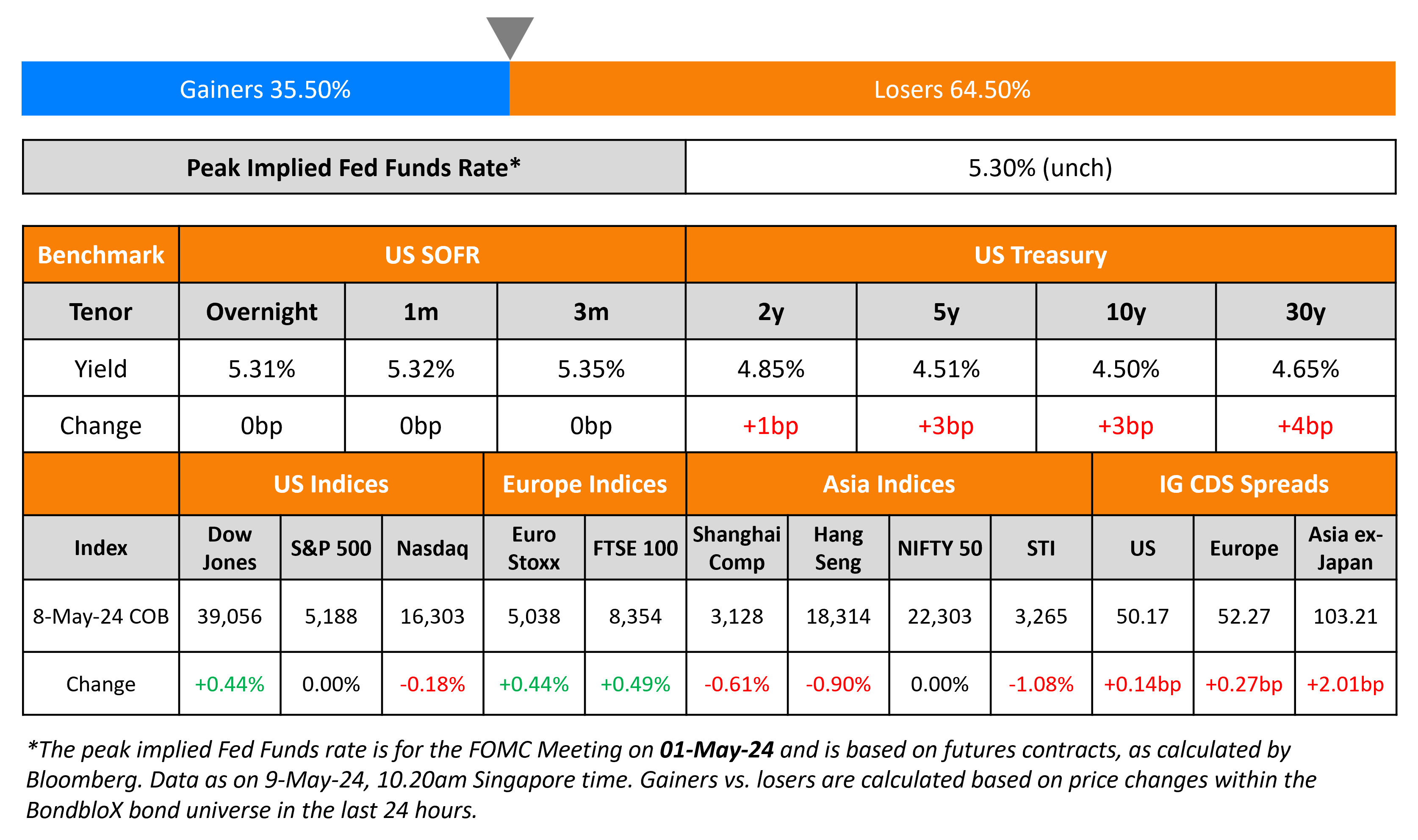

US Treasury yields were marginally higher on Wednesday. US Wholesale Inventories for March fell 0.4%, in-line with expectations. Boston Fed President Susan Collins said that rates may need to remains restrictive with the economy possibly needing to weaken to get sustainably to 2% inflation. Separately, the US Treasury’s auction of 10Y notes was softer, having tailed by 1bp. This was despite a stronger bid-to-cover of 2.49x (vs 2.30x last month) and a higher indirect bid take-up. S&P and Nasdaq were nearly unchanged. US IG CDS spreads widened 0.1bp and HY spreads were 2bp wider.

European equity markets were higher. Europe’s iTraxx main CDS spreads widened 0.3bp and crossover spreads widened 0.2bp. Asian equity indices have opened higher this morning. Asia ex-Japan CDS spreads were 2bp wider.

New Bond Issues

HSBC raised $3.25bn via a two-tranche TLAC issuance. It raised $1.85bn via a 4NC3 bond at a yield of 5.597%, 25bp inside initial guidance of T+120bp area. It also raised $1.4bn via a 8NC7 bond at a yield of 5.733%, 25bp inside initial guidance of T+150bp area. The senior unsecured bonds are rated A3/A-/A+. Proceeds will be used for general corporate purposes. The new 4NC3 notes were priced at a new issue premium of 6.7bp over its existing 4.755% 2028s callable in June 2027, that currently yield 5.53%.

China Ping An Insurance raised $300mn 10Y bond at a yield of 6.224%, 37bp inside initial guidance of T+210bp area. The senior unsecured bonds are rated Baa2. The notes have a change of control put at 101, and would occur when the group does not or ceases to, at any time, own or control, directly/indirectly, 100% of issued share capital of issuer. Proceeds will be used to refinance existing debt.

Manappuram raised $300mn via a 4Y bond at a yield of 7.5%, 25bp inside initial guidance of 7.75% area. The senior secured bonds are rated BB-/BB-. The door-to-door tenor is 4Y with a weighted average life (WAL) of 3.33Y. The bonds amortize 10% in the 24th and 30th month, 20% in the 36th month, 25% in the 42nd month and 35% in the 48th month. Proceeds will be used for onward lending and other activities, in accordance with approvals granted by the RBI. Maintenance covenants include but are not limited to a capital adequacy ratio complying with the RBI requirements (currently at 15%). It also involves having a security coverage ratio >= 1x.

UBS raised $1.75bn via a 6NC5 bond at a yield of 5.617%, ~30.5bp inside initial guidance of T+140/145bp area. The senior unsecured bonds are rated A3/A-/A. The new bonds were priced roughly in-line with its existing 5.428% 2030s callable in February 2029, that yield 5.61%.

Westpac raised $3bn via a four-tranche issuance:

The senior unsecured bonds are rated Aa2/AA-. Proceeds will be used for general corporate purposes. The new 2Y notes were priced at a new issue premium of 6bp over its existing 1.15% 2026s that currently yield 5.14%. The new 5Y notes were priced 26bp tighter to its existing 5.195% 2029s that currently yield 5.35%.

Aldar raised $500mn via a 10Y green sukuk at a yield of 5.584%, 30bp inside initial guidance of T+140bp area. The senior unsecured bonds are rated Baa1, and received orders of over $1.9bn, 3.8x issue size. Proceeds will be used to finance, refinance and/or invest, in whole or in part, in Eligible Green Projects, as set out in Aldar Properties Green Framework.

Security Bank raised $400mn via a 5Y bond at a yield of 5.594%, 30bp inside initial guidance of T+140bp area. The senior unsecured bonds are rated Baa2. Proceeds will be used to extend term liabilities, expand funding base, improve liquidity gaps, to fund investments and other general corporate purposes.

Islamic Development Bank raised $2bn via a 5Y sukuk at a yield of 4.754%, 5bp inside initial guidance of SOFR MS+55bp area. The senior unsecured bonds are rated Aaa/AAA/AAA, and received orders of over $2.4bn, 1.2x issue size. The issuer is Isdb Trust Services NO 2 SARL (ISDB).

Export Import Bank of Thailand raised $400mn via a 5Y bond at a yield of 5.354%, 35bp inside initial guidance of T+120bp area. The senior unsecure bonds are rated Baa1/BBB+ (Moody’s/Fitch). Proceeds will be used for general funding purposes.

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

- Al Rajhi hires for $ PerpNC5.5 Sust. bond

Rating Changes

-

ENN Natural Gas Upgraded To ‘BBB’ On Likely Easing Leverage

-

Moody’s Ratings affirms issuer ratings of CIMB Group and its Malaysian subsidiaries; upgrades CIMB Bank’s BCA to baa1 from baa2

-

Moody’s Ratings downgrades West China Cement’s CFR to B1; outlook remains negative

-

Moody’s Ratings downgrades Truist’s ratings (senior unsecured to Baa1); outlook stable

-

Denmark-Based Saxo Bank Outlook Revised To Negative On Compliance Framework Deficiencies; ‘A-‘ Rating Affirmed

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Private Credit Hasn’t Hurt Financial Resilience – Fed Governor Lisa Cook

“The growth of private credit likely has not materially adversely affected the financial system’s resilience. Private credit funds appear well positioned to hold the riskiest parts of corporate lending”

On Hawkish Singapore Policy, Cooling Inflation a Tailwind for Bonds

Eugene Leow, senior rates strategist at DBS Group

“As the market took away the point that the hurdle for Fed rate hikes is set high, investors are dipping in again. There was a lot of duration fear and this extended into Singapore Government Securities over the past few weeks”

On Asian Junk Bond Sales Are Hottest in Five Years on India Boom

Bhavik Pandya, debt capital markets, BofA

“A number of Indian borrowers are ready to tap the high yield offshore bond market, taking advantage of strong investor appetite seen in recent deals”

Satyajit Singh, head of fixed income strategy at Emirates NBD

“Strong high-yield issuers are taking advantage of the low spreads to refinance”

Top Gainers & Losers- 09-May-24*

Go back to Latest bond Market News

Related Posts: