This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hawkish Fed Holds Rates as Expected

June 15, 2023

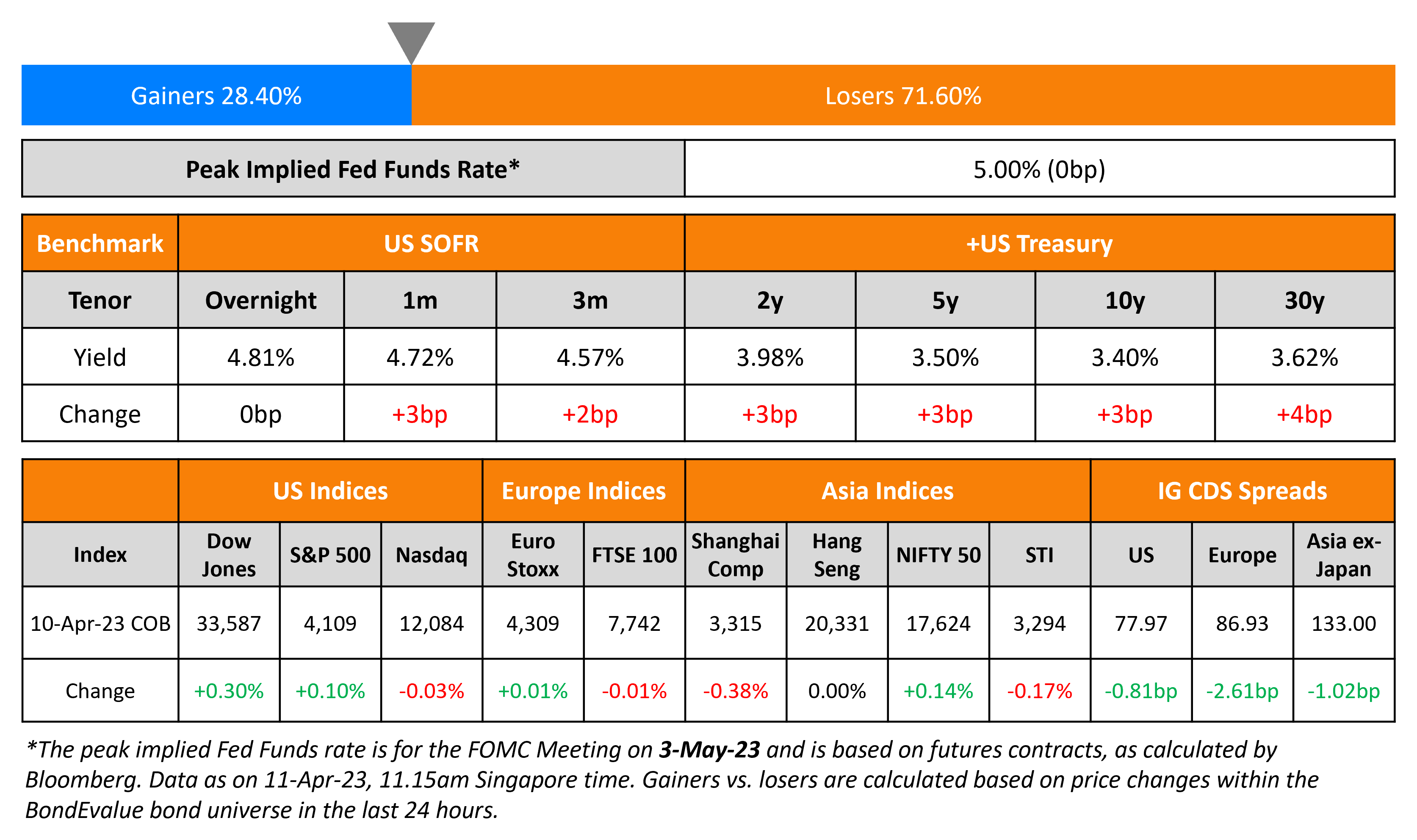

US 2Y Treasury yields inched 6bp higher after the hawkish FOMC meeting where they kept the policy fed funds range on hold as expected, at 500-525bp. The median dots in the FOMC’s dot plot (Term of the Day, explained below) indicate another 50bp in rate hikes by the Fed in the remainder of the year. This compares to the March meeting’s dot plots which showed that policy rates were expected to stay at current levels. With Jerome Powell noting that July would be a “live meeting” and the upward shift in the dot plot for 2023, market participants are now expecting the Fed to hike rates by 25bp in July with a 72% probability. However, market participants are expecting the fed funds range to stay unchanged after a 25bp hike in July vs. the Fed’s dots indicating the rate to be another 25bp higher. The peak Fed Funds Rate moved 2bp higher to 5.29% for September. Regarding inflation, Powell said that the conditions for seeing inflation come down were conditions “coming into place. But the process of that actually working on inflation is going to take some time”.

Equity indices ended higher with the S&P and Nasdaq up by 0.1-0.4%. US IG and HY CDS spreads widened 1bp and 4.6bp respectively.

European equity indices closed higher too. European main CDS spreads were 0.1bp wider and Crossover spreads widened 1.6bp. Asia ex-Japan CDS spreads tightened slightly by 0.2bp with Asian equity markets have opened broadly higher this morning.

.png)

New Bond Issues

- BOC New York $ 3Y Green at T+80bp

Jinjiang Road & Bridge Construction Development raised $125mn via a 364-day bond at a yield of 6.08%, 22bp inside initial guidance of 6.3% area. The bonds are unrated but are guaranteed by its parent company, Fujian Jinjiang Urban. Proceeds will be used to refinance existing debt. The bonds also have a change of control put at 101.

Danske Bank raised €1bn via a 7NC6 green bond at a yield of 4.791%, 25bp inside initial guidance of MS+195bp area. The senior bonds have expected ratings of Baa2/BBB+/A, and received orders over €2bn, 2x issue size. If not called on the first call date, the bonds will reset at the EURIBOR ICE 1Y swap rate plus a spread of 170bp.

New Bonds Pipeline

- Nonghyup Bank hires for $ 5Y Agriculture Supportive Social bond

- Hyundai America hires for $ ESG bond

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

Rating Changes

- Fitch Downgrades Azul’s IDRs to ‘C’ on Announcement of Exchange Offer

- Brazil Outlook Revised To Positive On Expectations For Policy Pragmatism; ‘BB-/B’ Ratings Affirmed

- NagaCorp Ltd. ‘B’ Ratings Placed On CreditWatch Negative Over Mounting Refinancing Risk

Term of the Day

Fed Dot Plot

The Fed dot plot is a visual representation of interest rate projections of members of the Federal Open Market Committee (FOMC), which is the rate-setting body within the Fed. Each dot represents the Fed funds rate for each year that an anonymous Fed official forecasts. The dot plot was introduced in January 2012 in a bid to improve transparency about the range of views within the FOMC. There are typically 19 dots for each year, representing the median rate of each voting member on the committee.

Talking Heads

On a Forecast in Fed Rate Cuts – JPMorgan CIO Bob Michele

“Unemployment at 4.5% is recession, I don’t think there’s ever been a jump of 1.1% in unemployment and the NBER (National Bureau of Economic Research) hasn’t come in and said we’re in recession…So the Fed is predicting recession there…We have never gone from the last rate hike to recession without the Fed cutting rates before then…If everything we are seeing is telling us a recession by year-end, I am still sticking with September as the first rate cut.”

On the ECB’s Future Interest Rate Path

Economists at Deutsche Bank

“We expect the ECB to leave the possibility of a terminal rate above 3.75% on the table and to encourage the market to price out some of the 2024 rate cuts.”

Economists at Berenberg

“The ECB will probably emphasise even more strongly than before that its future policy path is data-dependent amid heightened uncertainty.”

On Further Fed Interest Rate Hikes – DoubleLine Capital CEO and CIO Jeffrey Gundlach

“(Jerome Powell’s signaling of the resumption of monetary tightening) was definitely hawkish in the rhetoric, but not hawkish in the action…I see a trend here, and I don’t think the Fed’s going to be raising interest rates again.”

He sounded a warning about the impact of rising prices stemming from currency devaluations, saying the nation of 105 million won’t be able to tolerate too many more hikes. He also mentioned that when the impact of the foreign-exchange rate is taking a toll on Egyptians’ lives, the government can’t ignore it.

Top Gainers & Losers – 15-June-23*

Go back to Latest bond Market News

Related Posts: