This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Guocoland Prices S$ 3Y at 4.05%

May 28, 2024

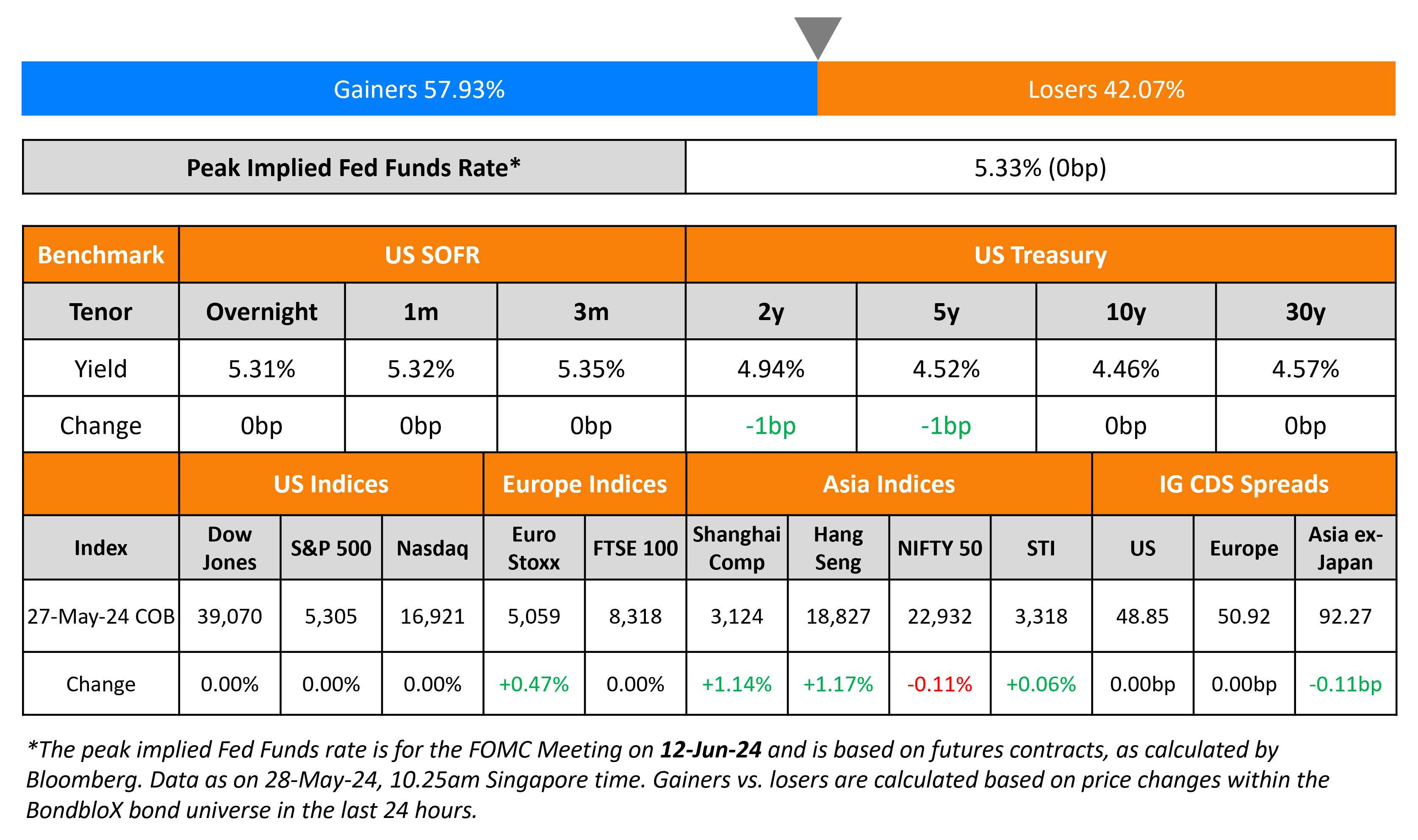

US Treasury yields were almost unchanged as US markets were closed on account of Memorial Day. Similarly, London was also closed due to the spring bank holiday, with European CDS markets also staying shut.

However, European equity markets were open and ended the day in the green. Asian equity indices have opened broadly flat this morning. Asia ex-Japan CDS spreads tightened 0.1bp.

New Bond Issues

Guocoland raised S$180mn via a 3Y bond at a yield of 4.05%, 20bp inside initial guidance of 4.25% area. Proceeds will be used to finance general working capital and corporate requirements. GLL IHT Pte Ltd is the issuer.

New Bonds Pipeline

- Amcor hires for $ 5Y bond

Rating Changes

- Fitch Upgrades Macquarie Bank Limited to ‘A+’; Outlook Stable

- Fitch Upgrades Australia and New Zealand Banking Group to ‘AA-‘; Stable Outlook

- Fitch Upgrades Westpac Banking Corporation to ‘AA-‘; Outlook Stable

- Fitch Upgrades National Australia Bank to ‘AA-‘; Outlook Stable

- Fitch Upgrades Commonwealth Bank of Australia’s Long-Term IDR to ‘AA-‘; Outlook Stable

- Moody’s Ratings upgrades CBA’s senior unsecured ratings to Aa2; outlook stable

- Empresa Nacional del Petroleo Upgraded To ‘BBB-‘ On Improving Operating Performance And Credit Metrics; Outlook Stable

- Fitch Upgrades Oravel Stays to ‘B’; Outlook Stable

- Fitch Downgrades Lippo Karawaci to ‘CCC’; Places on Rating Watch Negative

Term of the Day

Qualified Institutional Placement (QIP)

A qualified institutional placement (QIP) refers to an fund raising mechanism wherein listed companies can issue equity shares to qualified institutional buyers without elaborate regulatory paperwork. In essence, it is a private placement to institutional buyers with lower legal fees, funding costs and is faster than a follow-on public offer (FPO). QIPs are more commonly observed in India and in some parts of arts of southern Asia.

Talking Heads

On China’s property stimulus raises risks for banks in smaller cities – S&P Analyst, Ryan Tsang

“The removal of the floor on mortgage rates will also give lenders less buffer to absorb potential losses when defaults do happen. Banks would have to incur additional costs to pursue defaulters’ other assets to mitigate the losses in such cases”

On Trump is ‘bearish’ choice for bond markets – Bill Gross, former Co-Founder of PIMCO

“Trump is the more bearish of the candidates simply because his programs advocate continued tax cuts and more expensive things. Trump’s election would be more disruptive”

On Record Inflows Will Target Long-Term Turkish Debt – Turkiye Finance Minister, Mehmet Simsek

“We’ve been overwhelmed with the inflows… combination of sound policies and structural transformation is a good narrative… helps portfolio preferences in favor of Turkish assets, which translates into inflows… I would be very surprised if investors don’t take duration risk”

Top Gainers & Losers- 28-May-24*

Go back to Latest bond Market News

Related Posts: