This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

GFH Financial Launches $ Sukuk

October 24, 2024

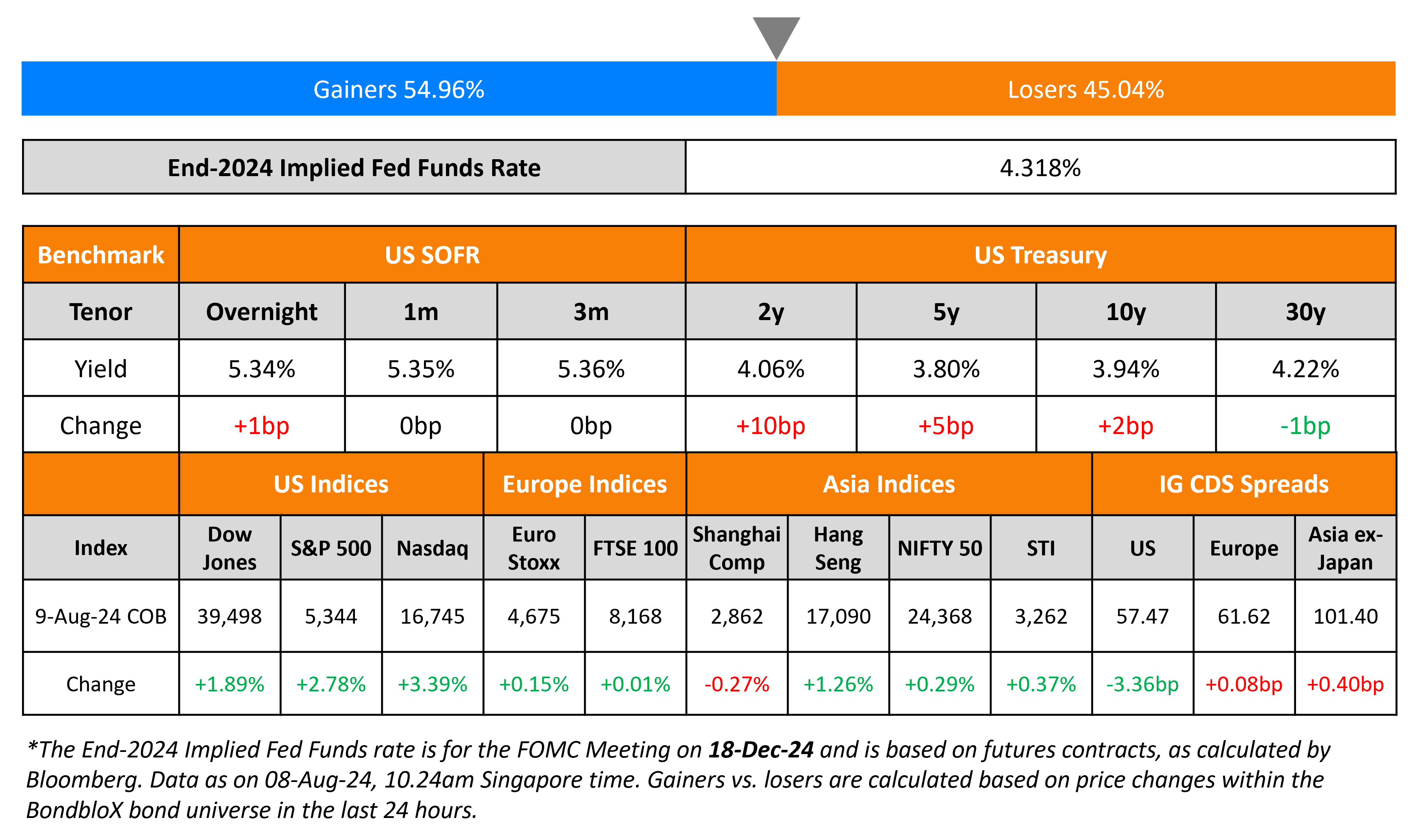

US Treasury yields extended their rise for a third straight day by 2-3bp across the curve. The Fed’s Beige Book was released yesterday and showed flat economic activity for most parts of the US in September. Analysts postulate that the US economy continues to slow despite upside shocks observed in the recently released inflation readings and unemployment rates. US IG and HY CDS saw a widening of 1bp and 5.1bp respectively. Looking at US equity markets, the S&P and Nasdaq closed lower by 0.9% and 1.6% respectively.

In Europe, traders are repricing their bets on an additional rate cut during the ECB’s final policy meeting for 2024. This comes on the back of below-target inflation in key economies such as Germany and Spain, with expectations that the ECB will target a policy rate that is below the neutral rate for the economy. European equities closed lower across the board yesterday. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.6bp and 2bp respectively. Asian equities have opened broadly mixed this morning. Asia ex-Japan IG spreads were wider by 0.5bp yesterday.

New Bond Issues

-

GFH Financial $ 5Y Sukuk at 8% area

Hotel Properties Ltd raised S$160mn via a PerpNC5 bond yesterday at a yield of 5.5%, 25bp inside initial guidance of 5.75% area. If not called by 30 October 2029, the coupon will reset to the 5Y SGD SORA-OIS rate plus the initial spread of 286.3bp and an additional coupon step-up of 100bp. The notes have a dividend stopper and a dividend pusher (12-month lookback) in place. Upon a change of control event, the notes are to be redeemed at par, and if not redeemed, will see a coupon step-up of 300bp. Private banks will receive a 25 cent concession.

Bank of China (Paris branch) raised $300mn via a 3Y green bond at a yield of SOFR+58bp, 47bp inside initial guidance of SOFR+105bp area. The senior unsecured notes are rated A1/A/A. Proceeds will be used to finance and/or refinance eligible projects as defined in its sustainability series bonds management statement.

Rating Changes

-

Moody’s Ratings upgrades Talen Energy Supply’s CFR to Ba3; outlook stable

-

Fitch Upgrades Helix Energy Solutions Group Inc.’s LT IDR to ‘BB-‘; Outlook Stable

-

Fitch Downgrades Longfor to ‘BB’; Outlook Negative

-

Moody’s Ratings downgrades the long-term ratings of The Toronto-Dominion Bank and TD Group US Holdings LLC; outlooks changed to stable

-

Moody’s Ratings changes Deutsche Telekom’s outlook to positive; affirms Baa1 rating

-

NOVA Chemicals Corp. Outlook Revised To Stable From Negative On Improving Credit Measures; ‘BB-‘ Rating Affirmed

Term of the Day

Lookback Distribution Pusher

A lookback distribution pusher is similar to a dividend pusher where the issuer has to automatically make a distribution to the bondholder (as in coupon/principal) if they have made any distributions like dividends during a lookback period say 3, 6 or 12 months before the bond’s payment. These features are particularly observed in perpetual bonds. For example, the Hotel Properties S$160mn PerpNC5 has a 12-month lookback distribution pusher.

Talking Heads

On US Must Act Now to Change Path of Rising Debt – IMF’s Gaspar

“It is growing at about 2% of GDP every year… From that viewpoint, this path of debt cannot continue forever… Growth has been outperforming that of other advanced economies, the labor market in the United States shows indicators that are the envy of many other countries”

On Yield Chasers Paying Up for Frothy HY Debt – Marty Fridson, Wall Street author

“Investors systematically overpay for industries that offer higher-than-median yields… Empirical analysis fingers yield chasing as the culprit… High yield is decidedly rich at present”

On Surge in Treasury ‘Term Premium’ Warning of Rising Bond Risks

George Catrambone, DWS Americas

“It’s a combination of things right now, with the election, fiscal and tariff risks, so term premium is higher”

Elias Haddad, BBH

“he US fiscal outlook is expected to worsen under a Trump presidency raising the compensation investors require for holding long-dated Treasuries, the term premium”

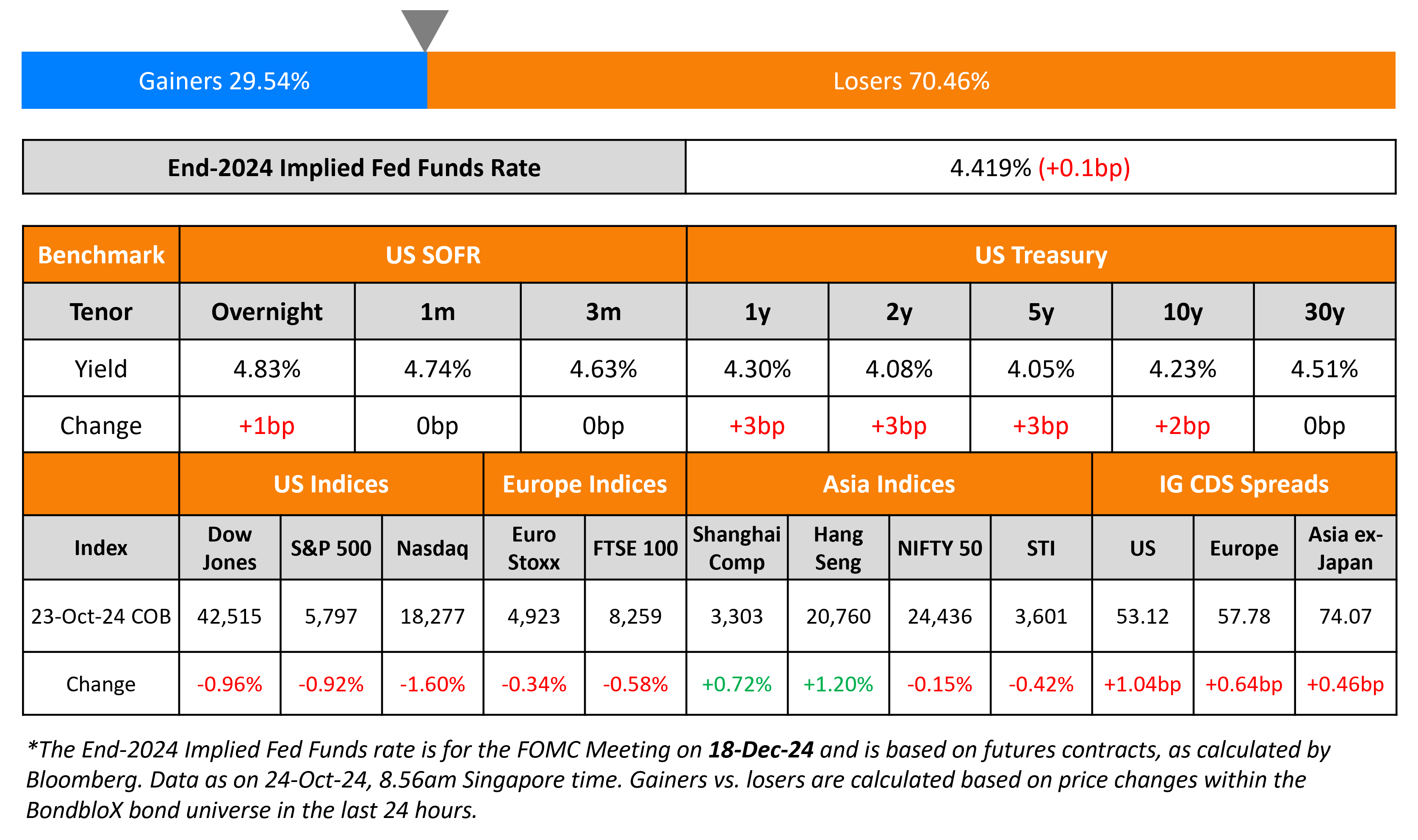

Top Gainers & Losers 24-October-24*

Go back to Latest bond Market News

Related Posts: