This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Garanti, Royal Caribbean Price $ Bonds

February 23, 2024

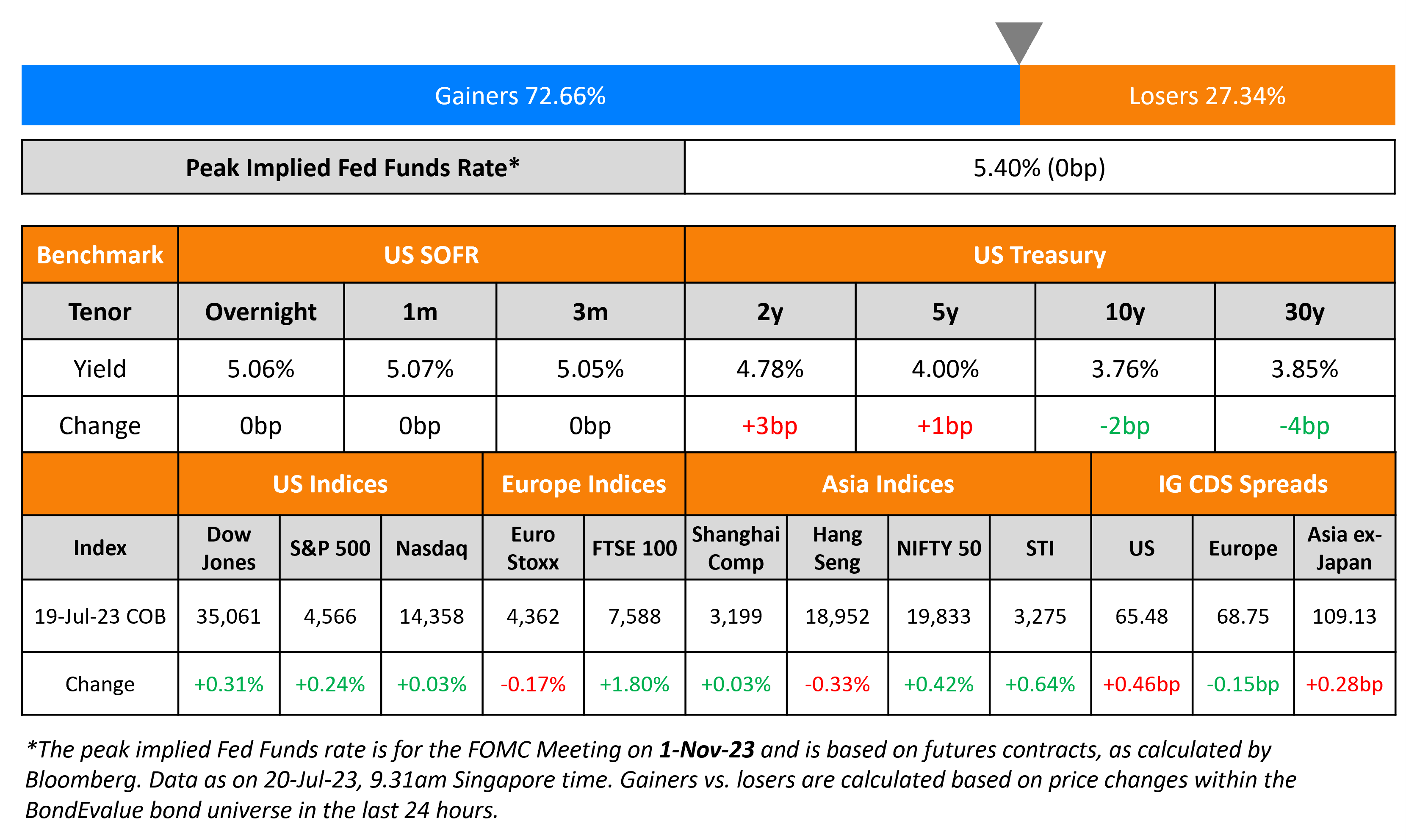

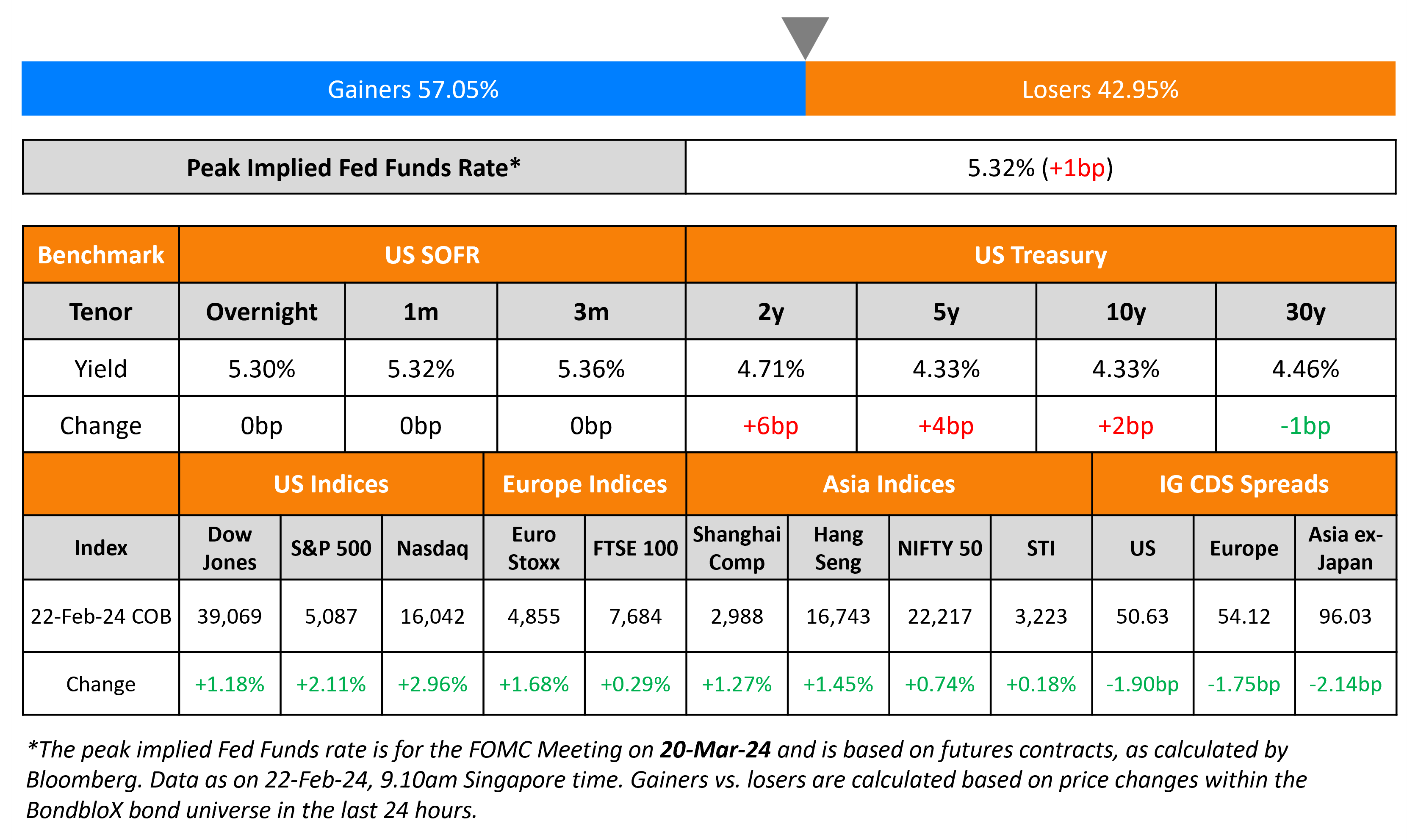

US Treasury yields moved higher with the 2Y yield up 6bp to 4.71% and 10Y up 2bp to 4.33%. Initial jobless claims for the prior week came in better than expected at 201k, decreasing 12k from the previous reading and underscoring continued strength in the labor market. The S&P Flash Manufacturing PMI came at 51.5, from 50.7, helped by stronger growth in orders. The Services PMI cooled to a three-month low of 51.4. Fed Governor Christopher Waller said that January’s jump in consumer prices warrants caution regarding the timing of when they start cutting interest rates, noting that he still expects rate cuts later this year. Philadelphia Fed President Patrick Harker (non-voter) said that it will likely be appropriate to cut interest rates this year, but emphasized the risks of easing policy too soon. Equity markets rallied sharply, with the S&P up 2.1% and Nasdaq jumping almost 3%, thanks to tech stocks soaring including Nvidia’s 16% rally. Looking at credit markets, US IG CDS spreads tightened 1.9bp and HY CDS spreads were 9bp tighter..

European equity markets ended higher too. Credit markets in the region saw the European main CDS spreads tighten by 1.8bp while crossover spreads tightened by 8.3bp. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads were 2.1bp tighter.

-png.png)

New Bond Issues

Royal Caribbean raised $1.25bn via an 8NC3 bond at yield of 6.25%, 12.5bp inside initial guidance of 6.375% area. The senior unsecured bonds are rated Ba2/BB+. The deal size was upsized from $1bn to the current $1.25bn. Proceeds, along with its cash on hand, will be used to redeem 11.625% 2027 notes.

Royal Caribbean raised $1.25bn via an 8NC3 bond at yield of 6.25%, 12.5bp inside initial guidance of 6.375% area. The senior unsecured bonds are rated Ba2/BB+. The deal size was upsized from $1bn to the current $1.25bn. Proceeds, along with its cash on hand, will be used to redeem 11.625% 2027 notes.

Garanti Bankasi raised $500mn via a 10NC5 bond at yield of 8.375%, 50bp inside initial guidance of 8.875% area. The subordinated notes are rated Caa2/CCC+ (Moody’s/Fitch). The issuer of the notes is Turkiye Garanti Bankasi AS and proceeds will be used for general corporate purposes.

Shinhan Card raised $500mn via a 5Y dual-listed Formosa bond at a yield of 5.576%, 35bp inside initial guidance of T+160bp area. The senior unsecured notes are rated Aa3/AA-/AA-. Proceeds will be used for general corporate purposes.

Panama raised $3.1bn via three-part offering. It raised:

- $1.1bn via a 7Y bond at yield of 7.5%, 50bp inside initial guidance of 8% area

- $1.25bn via a 13Y bond at yield of 8%, ~50bp inside initial guidance of mid-8% area

- $750mn via a 33Y bond at yield of 8.25%, inside initial guidance of high-8% area

The bonds are rated Baa3/BBB/BBB-. Proceeds will be used for general budgetary purposes.

BNG Bank raised $2bn via 3Y bond at yield of 4.618%, 4bp inside initial guidance of SOFR MS+36bp area. The senior unsecured notes are rated Aaa/AAA/AAA.

New Bond Pipeline

-

Dubai Islamic Bank hires for $ 5Y Sust. bond

- Del Monte Philippines hires for $ Perp

- Daewoo Engineering & Construction hires for S$ bond

Rating Changes

- Moody’s upgrades Royal Caribbean’s CFR to Ba2, outlook positive

- Iccrea Banca Upgraded To ‘BBB-/A-3’ On Strengthening Capitalization; Outlook Stable

- Domtar Corp. Downgraded To ‘B+’ From ‘BB-‘ On Weaker Credit Measures; Outlook Negative

- Fitch Downgrades First Quantum Minerals to ‘B’; Maintains RWN

- Moody’s changes Staples’ outlook to negative; affirms B3 CFR

Term of the Day

Formosa Bond

A Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange.

Talking Heads

On Traders Reducing Bets on ECB Cuts in 2024 to Less Than One Point

Jane Foley, head of FX strategy at Rabobank

“To avoid a drop in the euro-dollar exchange rate, this also suggests a likely delay in ECB policy changes”

Evelyne Gomez-Liechti, a strategist at Mizuho International

“Three 25bp cuts is our base case for the ECB and we think they will only cut gradually as labor markets continue to be resilient.”

On Dumping Nearly All Treasuries on Growth Optimism – George Efstathopoulos, Fidelity Fund Manager

“We don’t expect sort of a recession anymore. The probability of no landing is still small, but it’s been increasing. If that increases much more, potentially we will not be talking about Fed cuts anymore… more signs of re-acceleration (US economy) than it is of slowing down”

On Foreigners Pursuing Every Avenue to Access Hot India Bond Trade

Johnny Chen, fund manager at William Blair

“Given India’s disinflation trend and improved technical outlook with impending index inclusion, we favor duration in India”

Claudia Calich, head of emerging-market debt at M&G Investment

“Even if the pretax yield on supranational bonds tends to be lower than on India government debt, the yield is higher on an after-tax basis”

Top Gainers & Losers- 23-February-24*

Go back to Latest bond Market News

Related Posts: