This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FWD, BEA, Bocom Launch $ Bonds

June 20, 2024

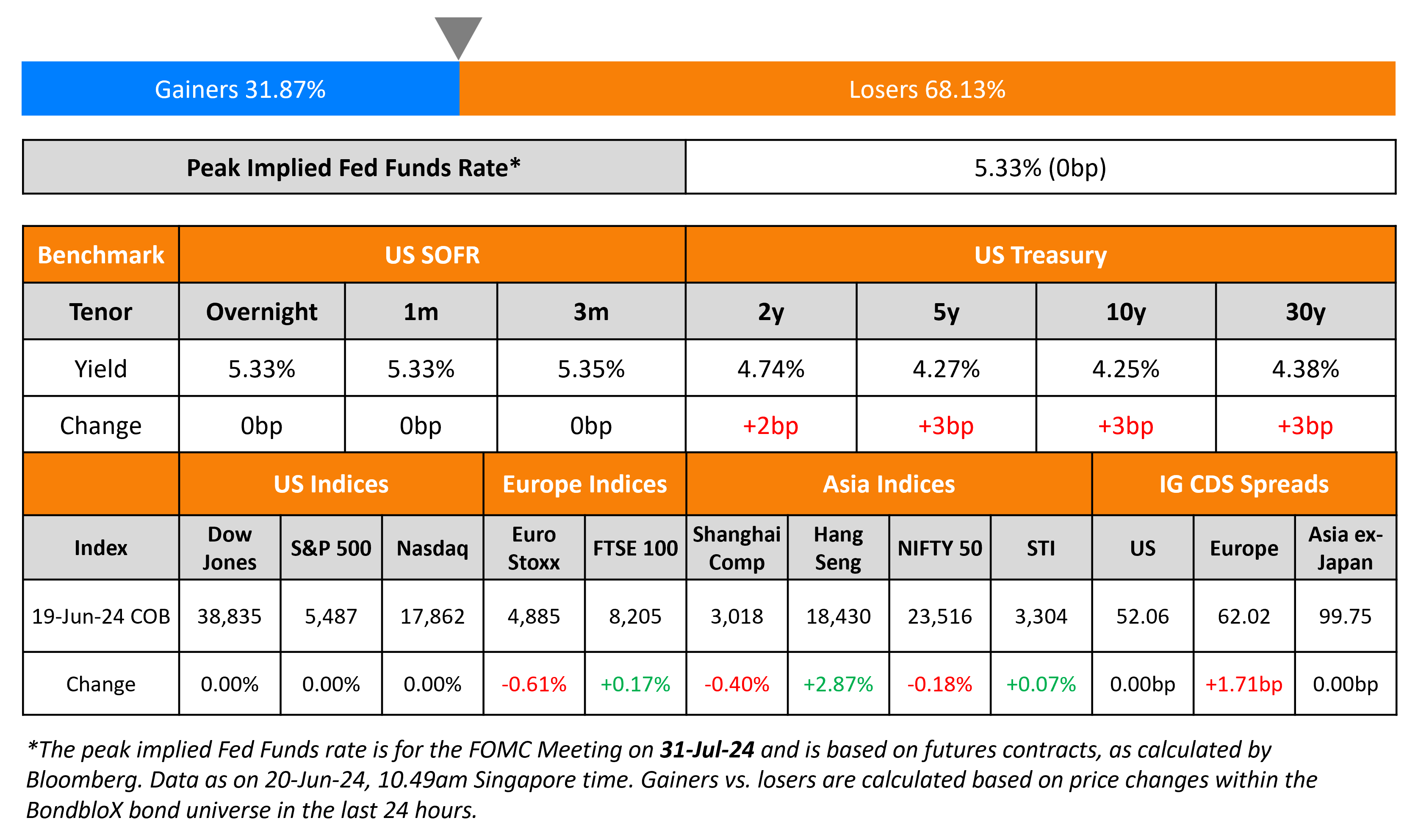

Treasuries traded stable across the curve, after US equity and credit markets were closed on Wednesday, due to the Juneteenth holiday. Looking at European markets, equity indices closed in the red while FTSE ended 0.2% higher. After witnessing a tightening for two days as sentiment on France’s political risks eased, Europe’s CDS spreads widened yesterday – the iTraxx Main and Crossover spreads were wider by 1.7bp and 7.3bp respectively. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were flat. Three new deals have been launched in the primary markets this morning by Asian issuers.

New Bond Issues

- FWD Group $ 7Y at T+380bp area

- Bank of East Asia $ 10NC5 Tier 2 at T+290bp area

- Bocom Leasing $ 3Y Green FRN/3Y at SOFR+115bp/T+105bp areas

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Korea Gas hires for $ 3Y or 5Y bond

Rating Changes

-

Fitch Downgrades Petrofac to ‘RD’ on Uncured Missed Coupon Payment

-

OQ Chemicals Downgraded To ‘D’ From ‘CCC-‘ On Missed Interest Payment

Term of the Day

Stagflation

Stagflation refers to a period of (stag)nant economic growth and high in(flation). It is an economic phenomenon when economic growth is stagnant and the unemployment rate and inflation are high. Stagflation is most commonly caused by supply shocks leading to higher commodity prices or monetary policies that increase money supply in the economy too quickly. An example of stagflation was in the US during the 1970s, when high inflation and high unemployment was at its peak on the back of a surge in commodity prices. Generally. monetary and fiscal policies are not effective at solving economic problems related to a supply side shock, hence it is considered to be tougher to get through a period of stagflation.

Talking Heads

On Opportunity in French Bonds if Spreads Widen More – Vanguard

“Politics is important but other things can matter. There are opportunities in the fixed income market if those spreads continue to widen

On More ECB Rate Cuts Possible If Inflation Slows – GC Member Mario Centeno

“Rates will fall if inflation helps us, which it’s doing… Rates won’t return to zero, ideally… would be a very bad sign if that were to happen. What would be ideal would be for interest rates to also approach 2%”

On Foreign Holding of Indian Bonds to Almost Double – JPMorgan

“We see ample scope for non-resident participation in the local bond market to increase, given it currently sits at one of the lowest levels in EM”

Top Gainers & Losers- 20-June-24*

Go back to Latest bond Market News

Related Posts: