This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fund Managers Warm to Short-Term Asian IG Dollar Bonds

November 20, 2024

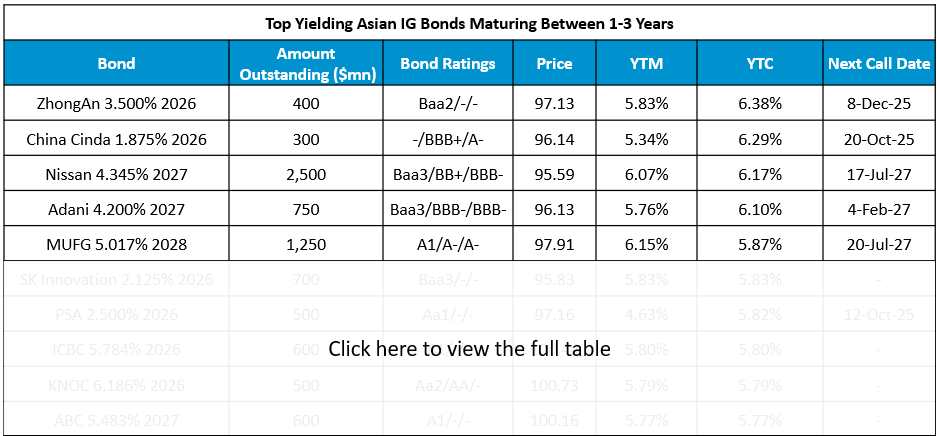

Asian IG dollar bonds maturing between one to three years offer an average yield premium of 64bp vs. 46bp for comparable US IG bonds, as per Bloomberg, noting that asset managers including Muzinich & Co. and PineBridge have warmed to these notes. This comes following the increase in yields following Donald Trump’s election victory. Mel Siew, a portfolio manager at Muzinich said, “At the front end there’s still value, which makes us feel a bit more optimistic about Asian credit”. Omar Slim of PineBridge said, “Given the fiscal backdrop and where we are valuation wise, we now think the short end and belly of the curve are a sweet spot as term premia should build up on the longer end”. Given this backdrop, below is a list of the top yielding Asian IG dollar bonds maturing between 2026-28 that are callable at least after six months.

Go back to Latest bond Market News

Related Posts: