This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

August 2022: High Yield Bonds Outperform Investment Grade Peers as Benchmark Rates Soar

September 2, 2022

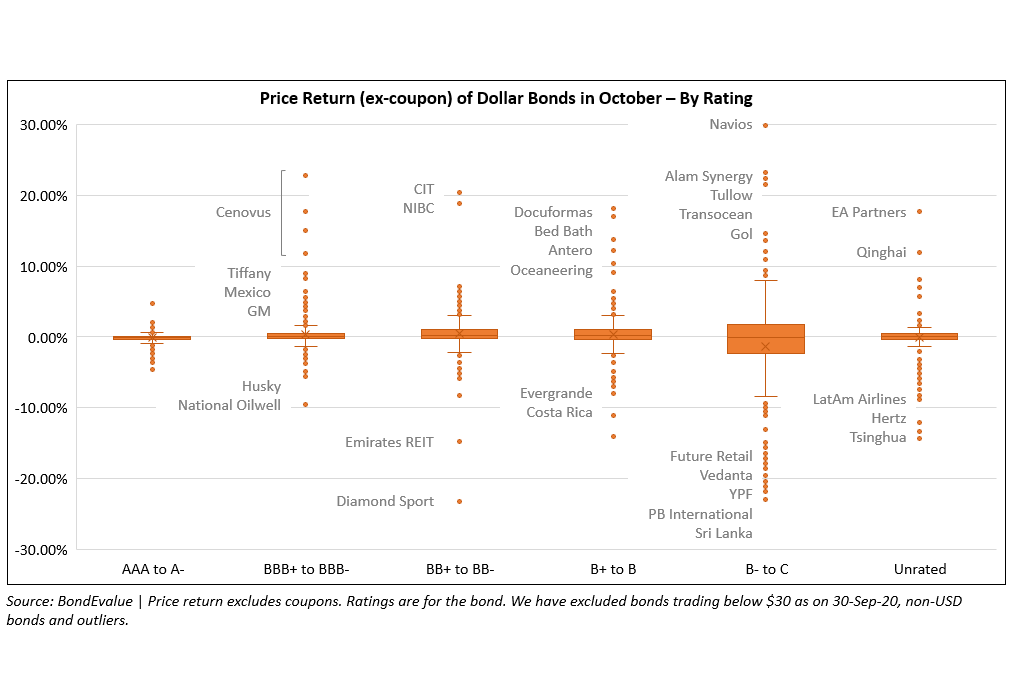

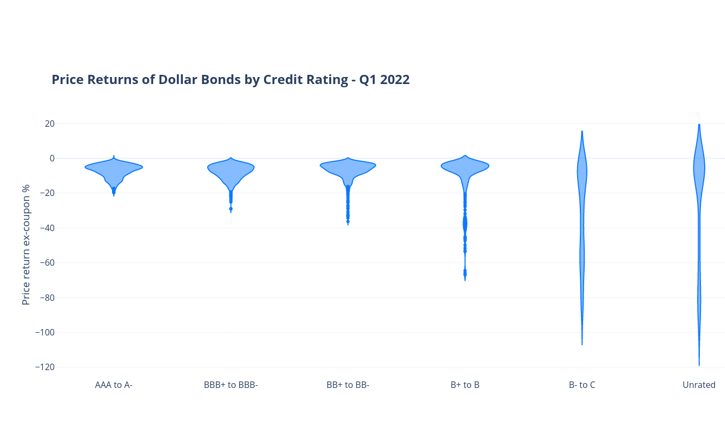

The month of August was a tale of two divergent performances – 80% of all Investment Grade (IG) dollar bonds in our universe ended the month in the red and in contrast, 58% of High Yield (HY) ended the month higher. The credit risk focused junk bond segment thus significantly outperformed the investment grade universe last month. Broadly, 63% of dollar bonds in our universe delivered a negative price return (ex-coupon). Benchmark yields shifted higher across the board, as the curve bear flattened. The 2Y Treasury yield touched 3.5%, higher by 58bp during the month, while the 10Y yield saw a 35bp move higher. This move in short-term rates primarily occurred due to the talking point of the month – the Jackson Hole meeting. Markets were split between the expected size of the Fed’s September rate hike. The probability of a 50bp vs. 75bp hike swayed through the month with the latter gaining steam as the month progressed. On August 1, the probability of a 50bp hike stood at 71%. By end-August, the probability of a 75bp hike was at 73%. During the meeting however, Fed Chair Jerome Powell did not specifically point out the quantum of the rate hike, but delivered a hawkish speech overall. He said, “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy”. He indicated that the FOMC’s focus was to bring inflation back down to 2% target and that the rate hike decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. Besides, recession fears also continue to exist, thereby putting pressure across all risk-assets.

-png.png)

As the 10Y Treasury yield saw a sharp 35bp jump in August, investment grade dollar bonds which are more sensitive to benchmark yields compared to high yield bonds, witnessed losses across the spectrum. Among the prominent gainers within the AAA to A- category were bonds of China Great Wall AMC that inched 5% higher although it posted a loss of RMB 8.6bn ($1.2bn) for 2021 against a profit of RMB 2.1bn ($300mn) in 2020. It released its results after missing the deadline twice due to worsening asset quality and fair value losses. Other gainers included Petronas that is planning a $3bn sale of Engen Ltd., South Africa’s largest gas station chain. Among the losers were long duration bonds of highly rated tech corporates like Amazon, Apple, Alphabet and Intel. From the BBB+ to BBB- category, gainers included Central Plaza (Beijing Capital) and energy companies like DCP and KazMunay Gas., where the former's rating outlook was revised to 'positive' from 'stable' by Moody's. Chinese property developer Longfor saw its dollar bonds tick higher after China's pilot rescue program where the company raised RMB 1.5bn ($219mn) via 3Y bonds. Among the losers were China Huarong's dollar bonds after the AMC warned and ultimately reported a $2.7bn loss for 1H 2022. US retailer Nordstrom's bonds fell 10% after it slashed its full year financial forecast due to an inventory glut. Besides them, telecom companies AT&T and Verizon also saw their bonds dip.

-png.png)

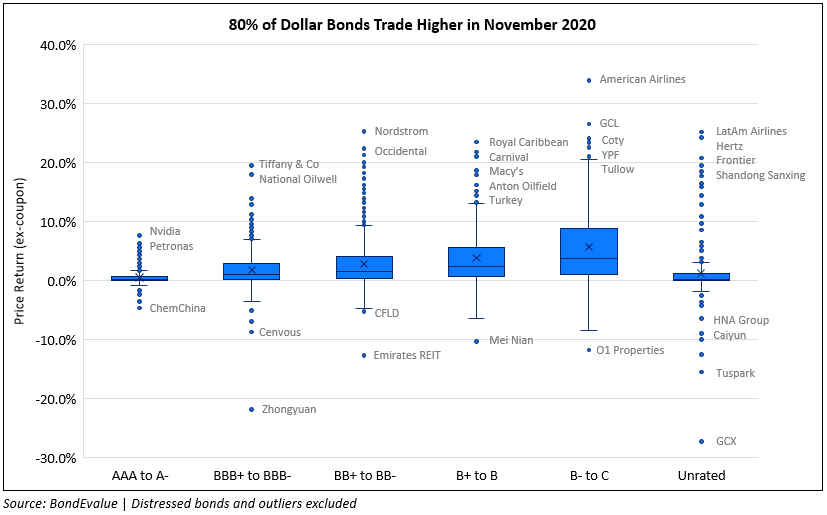

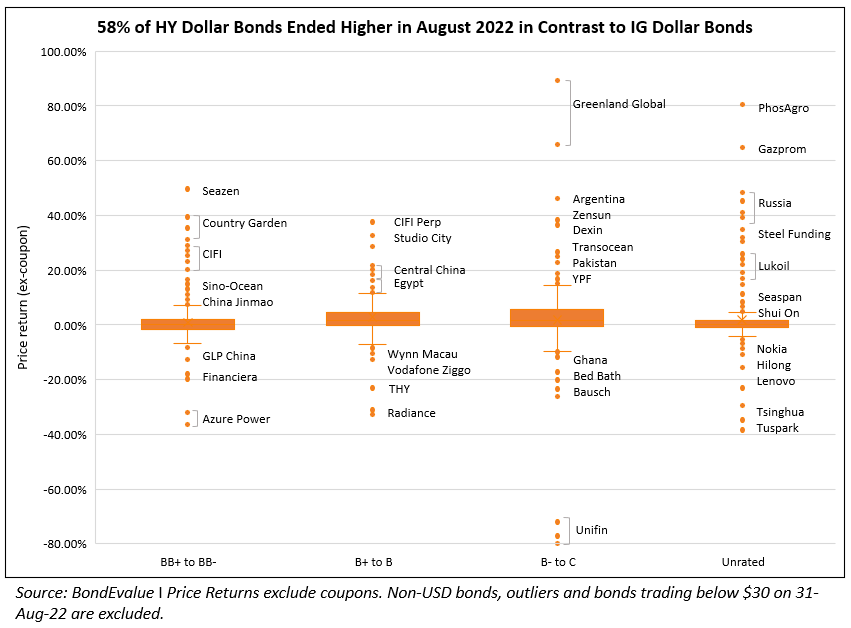

High yield bonds on the other hand had a better month than the investment grade space and also did better than July. 58% of HY dollar bonds delivered a positive price return in August vs. 51% of bonds ending in the green last month. Among the notable gainers were Russian government and corporate bonds like PhosAgro, Gazprom, Lukoil etc. after the US Treasury opened a three-month window for banks to help investors with Russian bonds to wind down their positions after having imposed sanctions on the trading of Russian debt. Chinese developers like Seazen, Country Garden, CIFI etc. saw a jump in prices after Beijing's pilot rescue program for 16 select developers. Among the largest losers were bonds of Unifin that fell over 70% after the company suspended debt payments ahead of a likely restructuring. Azure Power's dollar bonds fell nearly 40% after Moody's placed the company under review for a downgrade. Besides, Macau casino operator Wynn Macau's bonds also fell after China continued its anti-corruption campaign and zero-COVID policy. Bed Bath & Beyond's bonds fell 20% due to its weak liquidity which was evidenced by a rating downgrade to CCC from B- by S&P. Also, among the biggest losers were dollar bonds of Tus-Holdings (Tuspark) due to expectations of default on its dollar debt and an impending rejection of bond extension proposal.

-png-1.png)

Issuance Volumes

Global corporate dollar bond issuances picked up from July, standing at $172mn for the month of August. This represents a 4% increase YoY and a 25% increase MoM. Given the volatile market conditions, persistent inflation and uncertainty on the size of the Fed's September rate hike, only 6% of the issuances came from the high yield space while 90% of the issuances came from the investment grade space. The balance 4% were unrated deals.

APAC ex-Japan & Middle East G3 issuance stood at $3.96bn, a massive drop of 65% MoM and 74% YoY. Investment grade issuances dropped 79% MoM to a meagre $2.26bn while high yield issuances were at $612mn, modestly higher than July's $366mn in deals. The issuance volume from the region is the lowest since December 2021 which saw $3.47bn in deals.

Largest Deals

The largest deals in August 2022 was led by Meta's $10bn jumbo issuance, followed by UBS raising $5bn to via a three-tranche deal. HSBC and Credit Suisse followed, by raising $4.75bn each via dual-tranchers. This was followed by two supranationals, ADB and EIB that raised $4.5bn and $4bn respectively and Palladium Global's $3.25bn deal.

In the APAC & Middle East region, the largest deals were led by KT Corp raising $500mn, followed by First Abu Dhabi Bank raising $368mn and Zhengzhou Urban Construction's $350mn deal. Several Chinese SOE's made the list including Jinan Hitech , Changde Urban, Suzhou City Construction etc. raising amounts ranging from $200mn-350mn. Overall, deal volumes were minimal and weak from the entire region.

Top Gainers & Losers

Globally, Russia's sovereign and corporate dollar bonds were among top gainers in August after the US Treasury's OFAC opened a three-month window for banks to help investors with Russian bonds to wind down their positions after having imposed sanctions on the trading of Russian debt. Moscow based PhosAgro, Europe’s phosphate-based fertilizers' largest producer, saw its 2023s gain the most having jumped 80.6%, This was after the company launched a bondholder consent solicitation for the appointment of a new trustee and to modify its payment mechanism, besides posting strong 1H 2022 results. Russian government bonds broadly rallied over 40% and its state owned oil & gas major Gazprom saw its notes surge over 50%. Also, Lukoil's notes were over 30% higher after it offered a discount of more than 20% as it seeks to repurchase $6.3bn of its outstanding bonds. Other oil companies like Transocean saw its bonds jump over 25%, after it reported a reduction in its Q2 net loss. Also, Pakistan's dollar bonds saw a jump of over 15% on positive developments such as narrowing trade deficit, Saudi Arabia investing $1bn and IMF releasing $1.17bn as part of a 1Y bailout package.

Amongst the top losers globally were bonds of Unifin, which tanked ~80% after suspending all coupon and principal payments on its debt that later led to a rating downgrade to RD by Fitch. Tuspark's dollar bonds fell over 35% due to expectations of default on its dollar debt and an impending rejection of bond extension proposal. Renewable energy producer Azure Power saw a sharp fall of over 30% fall in its notes after Moody’s placed the company on review for a rating downgrade. Ecuador’s 2040s fell 29.5% during the month after Luxembourg based banks were ordered to freeze all Ecuadorian assets. American retailer Bed Bath and Beyond was downgraded to CCC by S&P in August with its bonds dropping over 15%. Also, Ghana’s widening fiscal and external imbalances led to S&P downgrading the sovereign from B-/B to CCC+/C, with its bonds down over 10%.

Given the extreme volatility seen in Chinese property developers' dollar bonds, we have excluded those bonds from the Global and APAC & Middle East tables. Instead, we have put together a separate list of top gainers and losers within the Chinese real estate space, added further below.

Among the gainers were 2022s and 2023s of certain developers like Greenland Global, Seazen Holdings and Zensun. Dollar bonds of Country Garden, CIFI, Seazen, Longfor etc. saw a jump in its prices after China decided to begin a pilot rescue program for 16 select developers where their local bond issuances will be state-backed by China Bond Insurance Co. Among the biggest losers were Radiance's bond due July 2024, which fell 33% followed by Lai Sun's 2026s that dipped 16%.

-png.png)

-png.png)

-png.png)

Go back to Latest bond Market News

Related Posts: