This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FOMC Minutes Agree on Gradual Pace of Rate Cuts

November 27, 2024

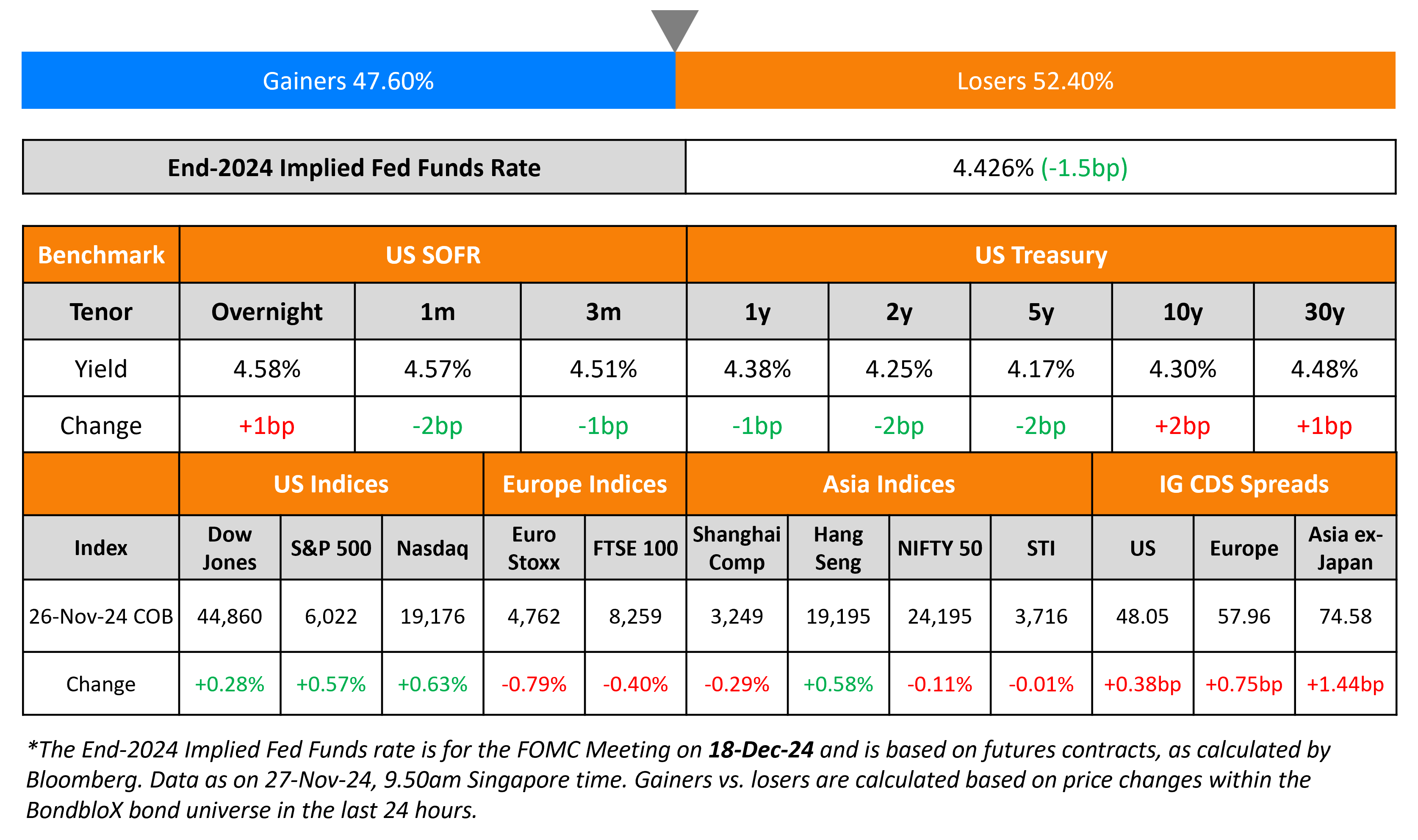

US Treasuries remained largely stable yesterday after an initial slip as President-elect Donald Trump announced additional tariffs on goods from China, Mexico and Canada. He announced additional tariffs of 10% on Chinese goods, as well as 25% on Mexican and Canadian products, stating that it would help curb illegal migrants and drugs. The three countries combined are said to be contributing to 40% of all US trade. In addition to this, the FOMC’s November meeting minutes were released, showing that policymakers agreed to a more gradual pace in rate cuts moving forward. It noted that the risk to the inflation outlook was “little changed” and that downside risks to the employment rate have quelled to an extent.

US IG and HY CDS spreads widened by 0.4bp and 0.6bp respectively. In terms of the US equity markets, the S&P and Nasdaq closed higher by ~0.6% each. European equities closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.8bp and 2bp respectively. Asian equities opened mixed this morning. Asia ex-Japan CDS spreads widened by 1.4bp.

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades El Salvador’s rating to B3; outlook stable

-

American Express Upgraded To ‘A-‘ On Strength Of Its Franchise And Stellar Risk-Adjusted Profitability; Outlook Stable

-

United Airlines Holdings Inc. Upgraded To ‘BB’; Outlook Stable

-

Moody’s Ratings upgrades Total Play’s ratings to B3; stable outlook

-

Howmet Aerospace Inc. Upgraded To ‘BBB’ From ‘BBB-‘ On Strong Demand, Debt Reduction; Outlook Stable; Debt Rating Raised

-

Ares Capital Corp. Upgraded To ‘BBB’ On Long Operating History And Strong Financial Flexibility; Outlook Stable

-

Panama Ratings Lowered To ‘BBB-/A-3’ On Higher Interest Burden; Outlook Stable

-

Moody’s Ratings takes rating actions on 7 Adani Group entities

-

Philippines Outlook Revised To Positive On Improved Institutional Assessment; ‘BBB+/A-2’ Ratings Affirmed

-

Brazilian Electric Utility CEMIG Outlook Revised To Positive On Stronger Credit Metrics; ‘BB-‘ Ratings Affirmed

-

Fitch Revises Outlook on Nissan Motor to Negative; Affirms IDR at ‘BBB-‘

New Bonds Pipeline

- Bahrain hires for $ 7Y Sukuk

- Vista Energy hires for $ bond

Term of the Day: Credit Default Swap (CDS)

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On EM caught between economic giants, to face tough 2025 – JPMorgan

“EM growth faces significant uncertainty in 2025, caught between two giants – China and the U.S. – with policy changes in the latter potentially delivering a large negative supply shock that will have spillovers across EM”

On China Companies Cut Foreign-Currency Debt Just in Time for Trump

Le Xia, BBVA

“This will help Chinese companies handle risks from foreign debt repayment and FX volatility after Trump takes office”… Businesses will turn more cautious toward raising foreign-currency debt in the coming years

Xing Zhaopeng, ANZ Banking Group

“The front-loading of debt payment due to exchange rate fluctuation could be less… impact on the yuan’s exchange rate could also be smaller”

On Trump tariffs might harm all involved, say US trade partners

Mexican President Claudia Sheinbaum

“To one tariff will follow another in response and so on, until we put our common businesses at risk”

Bank of Canada Deputy Governor, Rhys Mendes

“What happens in the U.S. has a big impact on us, and something like this would clearly have an impact on both economies”

Top Gainers and Losers- 27-November-24*

Go back to Latest bond Market News

Related Posts:

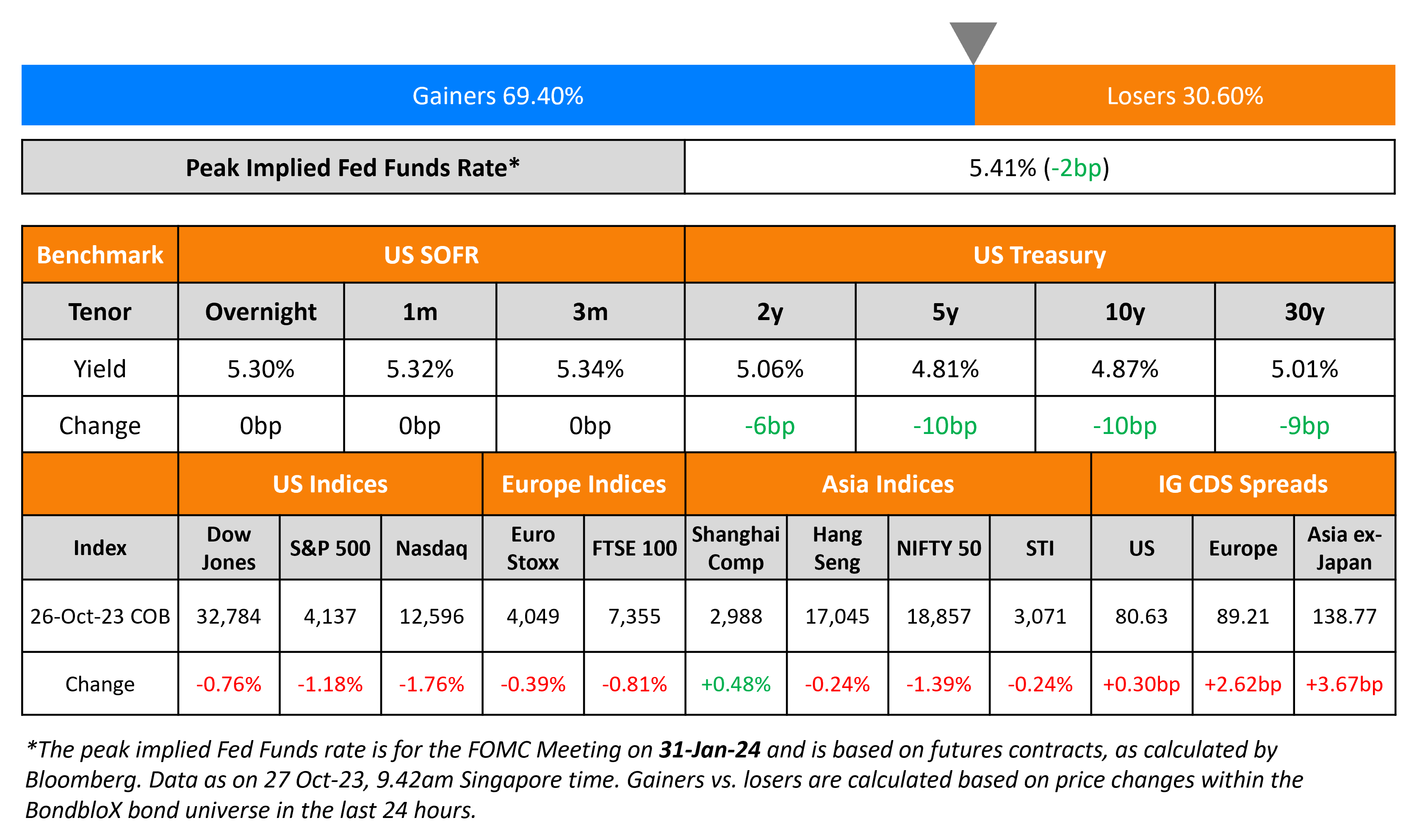

US Economy Grew at 4.9% in Q3; Treasury Yields Move Lower

October 27, 2023

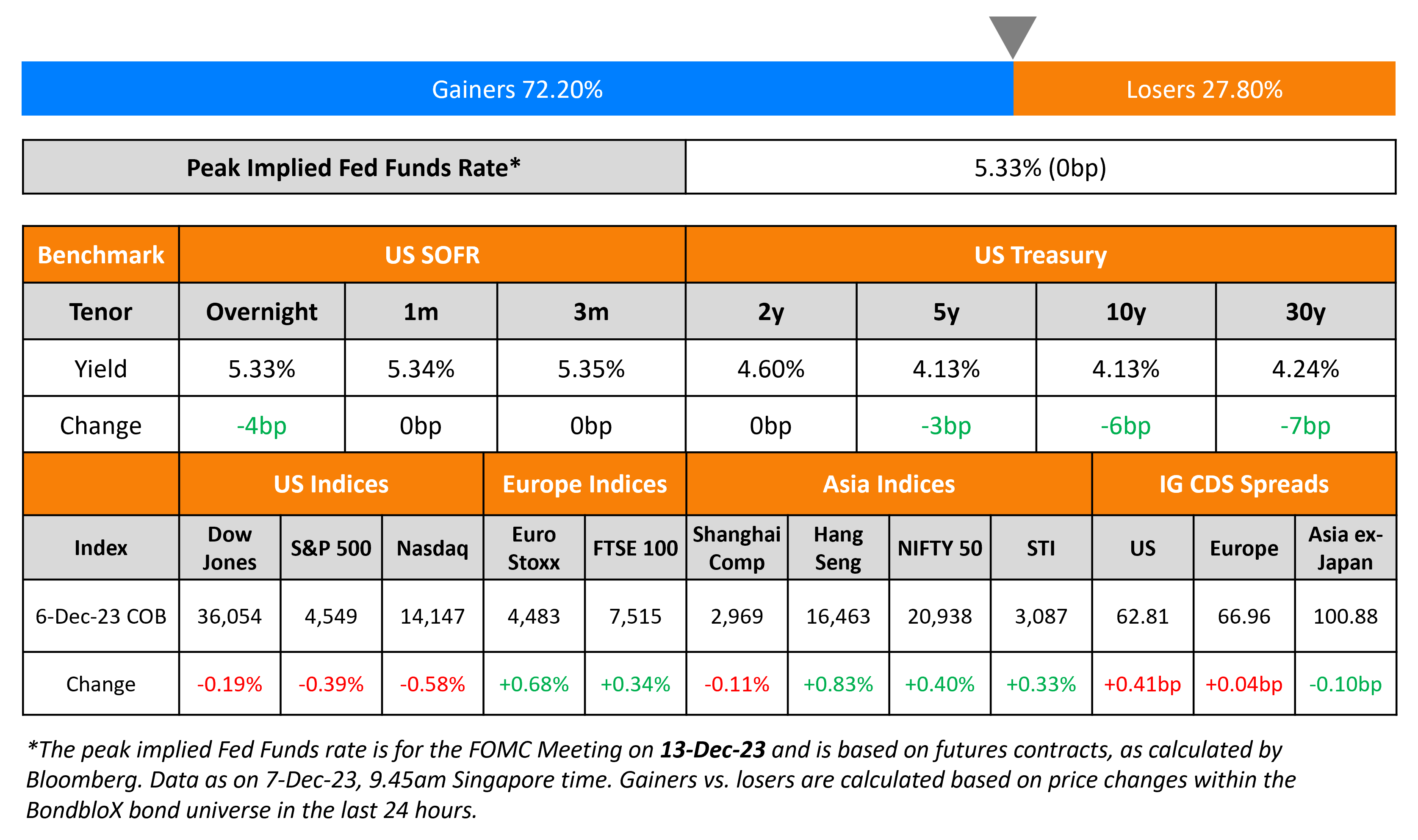

ADP Payrolls Softer Than Expected

December 7, 2023