This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Speakers Indicate Need for More Data to Decide on Cuts

May 17, 2024

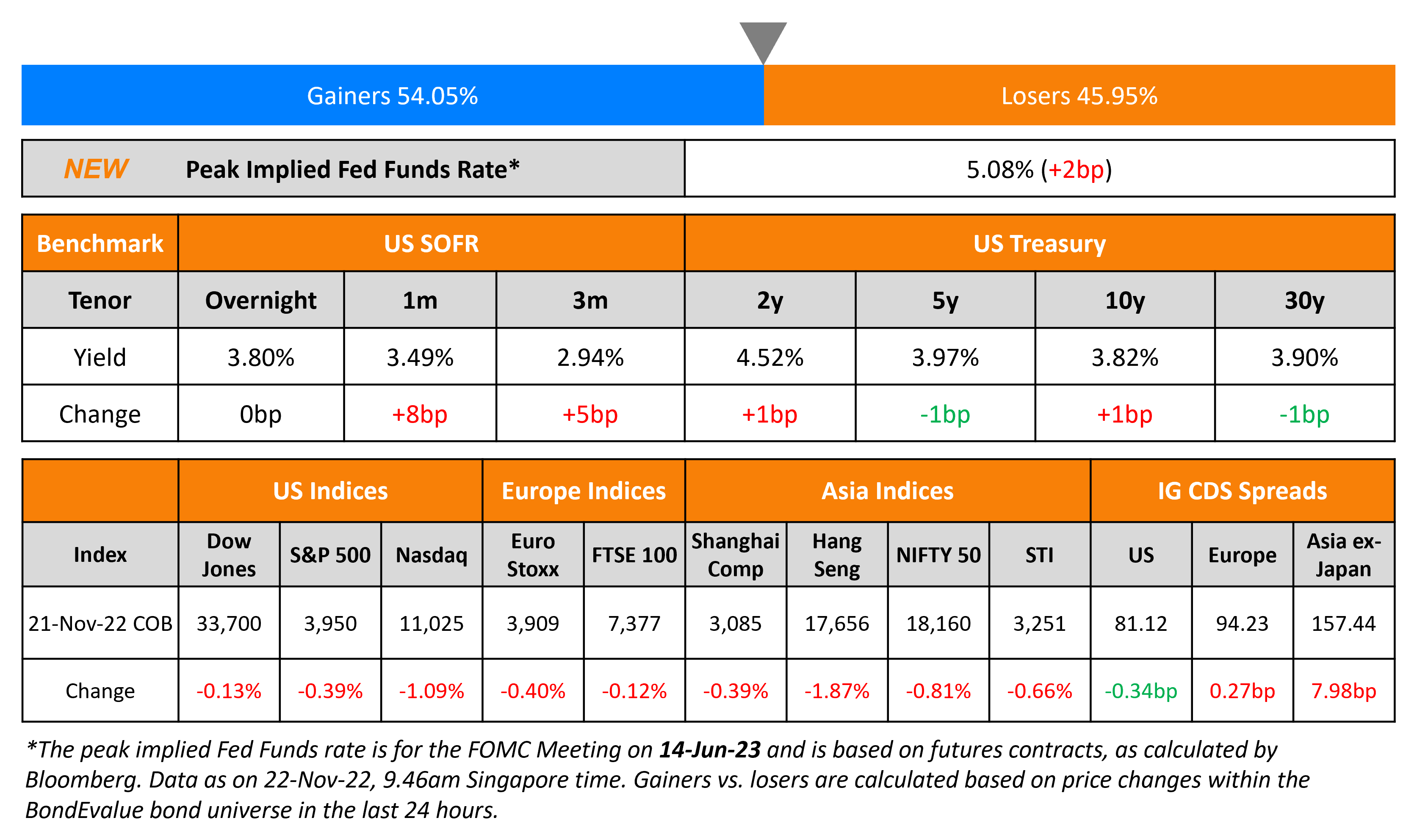

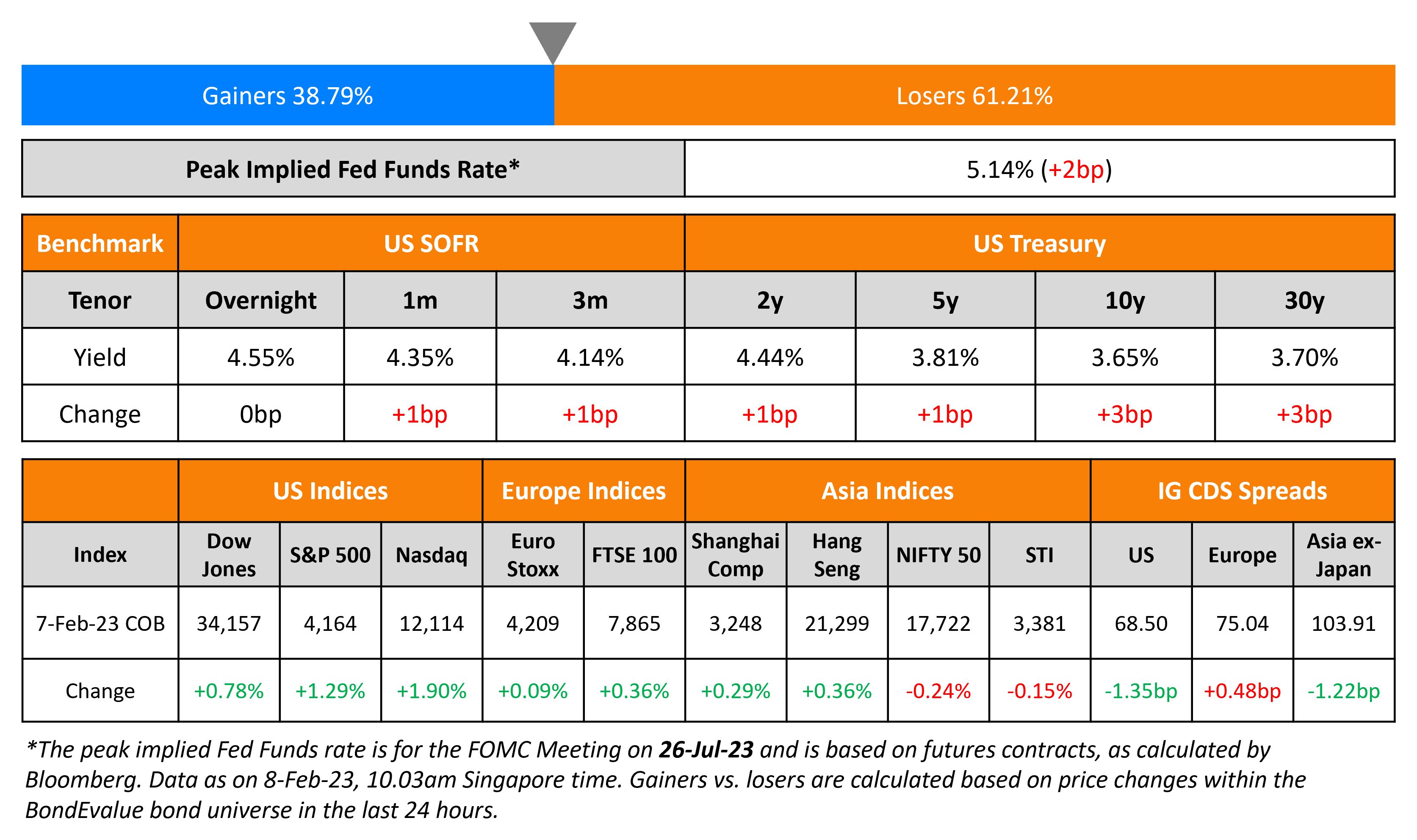

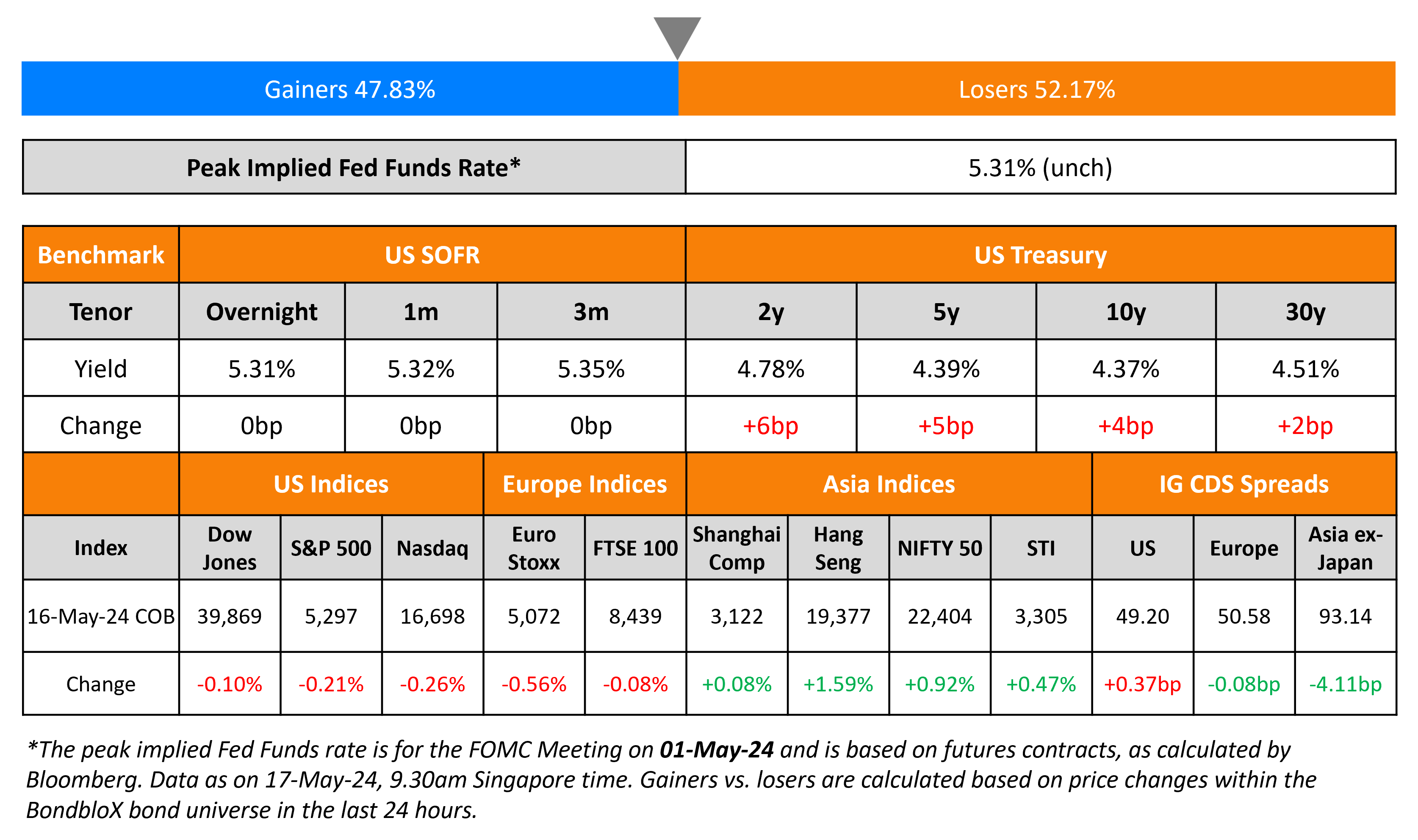

US Treasury yields ticked higher by 4-6bp on Thursday, as Fed speakers indicated that more economic data remains to be seen to decide on the need for rate cuts. New York Fed President John Williams said that while the latest CPI report was a “positive development”, it was not enough to call for rate cuts soon. Similarly, Cleveland Fed President Loretta Mester said that she is seeking more evidence that inflation pressures are easing. She added that she expects “progress on inflation over time, but at a slower pace than we saw last year”. Also, April’s MoM change in the Import Price Index saw an increase of 0.9% vs. expectations of 0.3%. The Import Price Index ex-Petroleum saw an increase of 0.7% vs. expectations of 0.1%. Also, the March numbers for the indexes were revised higher, indicating that some inflationary pressures still remain. Separately, initial jobless claims for the previous week rose by 222k, worse than expectations of 220k. S&P and Nasdaq were down 0.2-0.3%. US IG CDS spreads widened 0.4bp and HY spreads were 3bp wider.

European equity markets were lower too. Europe’s iTraxx main CDS spreads were 0.1bp tighter and crossover spreads were 1.3bp tighter. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 4.1bp tighter.

Happening Today

.png)

New Bond Issues

ICBC raised ~$1.36bn via a multicurrency two-trancher. It raised $1bn via a 3Y green FRN at SOFR+48bp, 47bp inside initial guidance of SOFR+95bp area. It also raised €300mn via a 3Y green bond at a yield of 3.697%, 25bp inside initial guidance of MS+90bp area. Both the senior unsecured notes are rated A1 by Moody’s. The dollar-denominated 3Y FRN is issued by ICBC HK branch and the euro-denominated notes are issued by ICBC London branch. Proceeds from both notes will be used to finance and/or refinance eligible green assets as defined in green bond framework of ICBC.

AES Corp raised $950mn via a 30.5NC5.5 green bond at a yield of 7.6%, ~33.75bp inside initial guidance of 7.875-8% area. The junior subordinated notes are rated Ba1/BB/BB. Net proceeds will be used to finance one or more eligible green projects (as defined in the Red). Any remaining amount post-allocation for green projects, will be used for general corporate purposes.

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

Rating Changes

- Moody’s Ratings downgrades Agile’s ratings to Ca/C; outlook remains negative

- Moody’s Ratings changes Staples’ outlook to stable; affirms B3 CFR

Term of the Day

NAIRU

Non-Accelerating Inflation Rate of Unemployment (NAIRU) refers to the level of unemployment below which the rate of inflation is expected to rise. NAIRU is determined by several factors including demographics, productivity, bargaining power, monetary policy, supply-side pressures etc. NAIRU is sometimes referred to as the natural rate of unemployment.

Talking Heads

On Bond Yield Volatility Having Fund Managers Overhauling Trading Strategies

Tim Magnusson, CIO at Garda Capital Partners

“It’s more of a trader’s market now… been a bit of a transition that fixed income folks have had to endure”

Vincent Mortier, CIO at Amundi

“We have to be much more active in management, quicker to add, cut or modify positioning on the curve”

John Madziyire, a PM at Vanguard

“Volatility is also an opportunity. If you are a long-term investor it gives you better entry levels”

On China Property Stocks and Bonds Higher on Home Purchases Proposal

Raymond Cheng, head of China property research at CGS International Securities HK

“The move, if implemented, is an important step to rescue the sector as it could address excess inventory and developers’ liquidity issues”

Ziqi Jiang, CIO of Regent Capital Management

“Beijing has realized how challenging it is to clear housing inventory and thus we see measures rolling out now… wants to support the sector but not overstimulate it”

On More Companies Selling Shares to Cut Debt

Morne Engelbrecht, CFO of Metals Acquisition

“The equity markets were screaming out for a copper name. I took those high interest-bearing liabilities out, and we’ve still got that opportunity”

Tom Snowball, head of the UK equities at BNP Paribas

“Are companies going to need to turn to equity if rate cuts keep being pushed out? That remains to be seen”

Top Gainers & Losers- 17-May-24*

Go back to Latest bond Market News

Related Posts: