This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

EXIM India, NAB, MUFG, Hyundai Capital and Others Launch $ Bonds

January 6, 2025

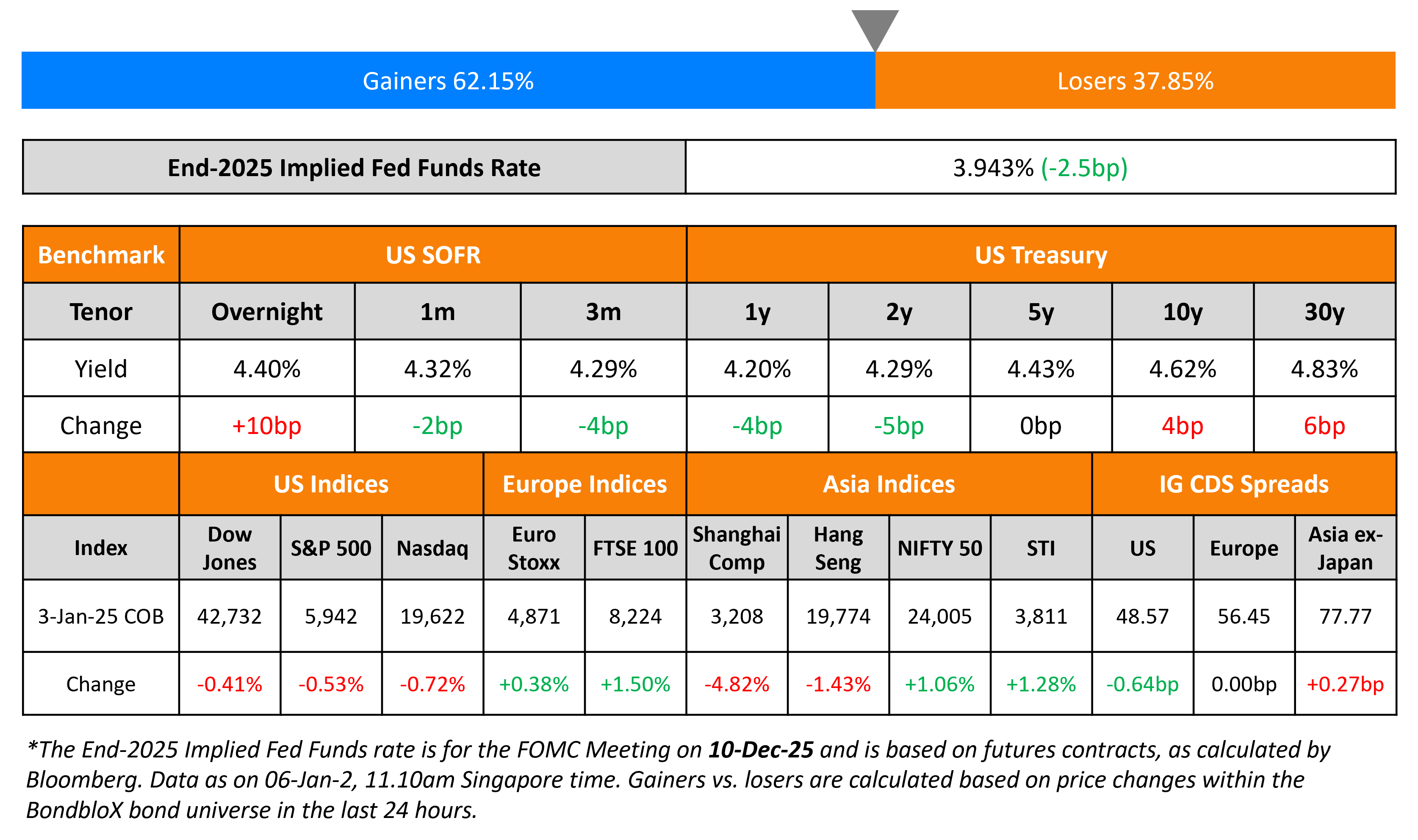

The US Treasury curve steepened on Friday, with the 10Y yield up 4bp while the 2Y yield eased by 5bp. The US ISM Manufacturing Index reading for December improved to a nine-month high of 49.3, better than expectations of 48.2 and the prior month’s 48.4. Among the sub-components, the inflationary ISM Prices Paid reading came-in higher at 52.5 vs. expectations of 51.8. Besides, Fed speakers including Kruger, Daly and Barkin indicated that the inflation battle was not over yet and that policy might continue to be restrictive for longer.

US IG and HY CDS spreads tightened by 0.6bp and 4.2bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 1.3% and 1.8% higher respectively. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads were broadly unchanged. Asian equities have opened lower this morning. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

-

Export-Import Bank of India $ 10Y at T+130bp area

-

NAB $ 5Y/5Y FRN/11NC10 at T+75/SOFR Equiv/155bp area

-

Hyundai Capital America $ 3Y/3Y FRN/5Y at T+100/SOFR Equiv/120bp area

- MUFG $ 6NC5/11NC10 at T+100/120bp area

-

China Hongqiao $ 3Y at 7.5% area

-

LBBW € 2Y FRN at 3mE+45bp

GM Financial raised $2.5bn via a three-part deal. It raised:

- $1.2bn via a 5Y bond at a yield of 5.377%, 25bp inside initial guidance of T+125bp area. The new bonds are priced at a new issue premium of ~7bp over its existing 5.85% 2030s that yields 5.31%.

- $300mn via a 10Y bond at SOFR+129bp vs. inside initial guidance of SOFR equivalent area.

- $1bn via a 10Y bond at a yield of 5.919%, 25bp inside initial guidance of T+160bp area.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

Ford Motor Credit raised $2.5bn via a two-trancher. It raised $1.25bn via a short 5Y bond at a yield of 5.885%, 20bp inside initial guidance of T+170bp area. It also raised $1.25bn via a 10Y bond at a yield of 6.509%, 22bp inside initial guidance of T+215bp area. The senior unsecured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes. The new 5Y bond was priced 11bp tighter to its existing 9.625% 2030s that yields 6%.

New Bonds Pipeline

- Mitsubishi HC Capital UK hires for $ 3Y bond

- Dai-ichi Life Insurance hires for $ PerpNC10 bond

- Clifford Capital hires for $ 5Y bond

- YPF SA hires for $ 9Y bond

- IIFL Finance hires for $ 3.5Y bond

Rating Changes

-

Moody’s Ratings assigns a Baa2 IFSR to Unipol Assicurazioni and upgrades its senior unsecured debt rating to Baa3

-

Walgreens Boot Alliance Inc. Downgraded To ‘BB-‘ On Weaker Forecast, Elevated Credit Metrics; Outlook Stable

-

Fitch Downgrades Andrade Gutierrez Engenharia Ratings to ‘C’

-

Xerox Senior Unsecured Notes ‘B+’ Rating Placed On CreditWatch Negative On Potential Acquisition Financing

-

Fitch Removes Buckeye from Rating Watch Negative; Outlook Stable

Term of the Day: Leveraged Loan

A leveraged loan is a loan extended to a company that has short-term or long-term debt on its books and that has a poor credit rating. S&P classifies a loan as leveraged if the issuer’s credit rating is junk (BB+ or lower) or if the rating is investment grade (BBB- or higher) but has a spread >= Libor+125bp and is secured by a first or second lien.

Talking Heads

On How Low Can Bond Spreads Go?

Mohammed Kazmi, Union Bancaire Privee

“You don’t necessarily need much in spreads to get close to double-digit returns. It’s mostly a carry story. And even if you do see wider spreads, you have the buffer from the all-in yield.”

Gurpreet Garewal, Goldman Sachs Asset

“While fixed income spreads are tight, we believe a combination of deteriorating fundamentals and weakening technical dynamics would be needed to trigger a turn”

On Companies Repeated Defaults at Record Level in 2024 – JPMorgan

Risky companies defaulted more than once at a record rate in 2024… Around 35% of the year’s defaults and distressed exchanges were repeat offenders.. That’s while the leveraged loan default rate is at a roughly four-year high.

On Spike in Failed Trades Showing Persistent 20Y US Bond Shortage

Steven Zeng, Deutsche Bank

“It’s reasonable to say the fails will continue until Treasury increases 20-year supply through larger auction sizes, which we anticipate could potentially start growing later this year”

Top Gainers and Losers- 06-January-25*

Go back to Latest bond Market News

Related Posts: