This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ESR REIT Launches S$ 5Y; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 28, 2021

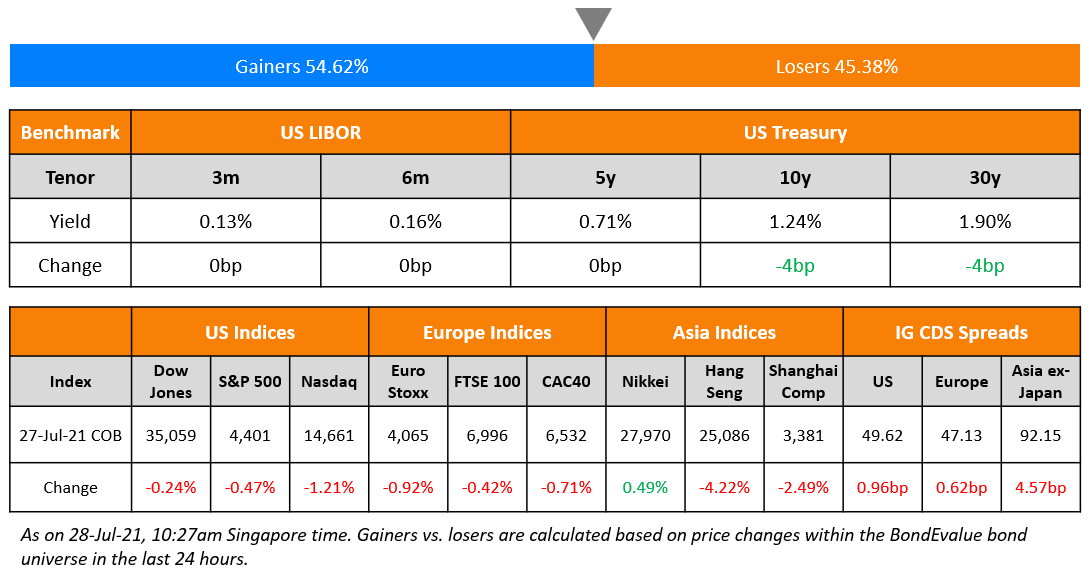

US markets broke the winning streak on a risk-off sentiment. S&P and Nasdaq were both down 0.5% and 1.2%. The fall was led by Consumer Discretionary, IT, Energy and Communication Services, down more than 1%. Real Estate and Healthcare, up 0.8% and 0.4% respectively, provided support to the markets. Apple, Microsoft and Alphabet’s earnings beat Wall Street expectations (details below). Facebook, Paypal and Boeing earnings are due today alongside the FOMC decision. US 10Y Treasury yields eased 4bp to 1.24%. US IG CDS and HY spreads widened 1bp and 5.8bp respectively. European stocks also ended ~0.5% lower – the CAC, DAX and FTSE were down 0.7%, 0.6% and 0.4% respectively. EU Main and Crossover spreads widened 0.6bp and 3.8bp respectively. Brazil’s Bovespa was down 1.1%. Saudi TASI was up 0.2% while UAE’s ADX was flat. Asia Pacific stocks started mixed – the Nikkei and Singapore’s STI were down 1.2% and 0.3% respectively, while Shanghai was broadly flat and HSI was up 0.8%. Asia ex-Japan CDS spreads were 4.6bp wider.

%20(1).jpg?width=1520&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

New Bond Issues

ESR-REIT S$ 5yr IPG 2.75% area

ABM Investama $ 5NC3 at 9.875% area, alongside concurrent tender offer

AVIC International Leasing raised €200mn ($236mn) via a 364-day bond at a yield of 0.95%, 40bp inside initial guidance of 1.35% area. The bonds have expected ratings of A-, and received orders over €520mn, 2.1x issue size. The bonds are issued by wholly owned subsidiary Soar Wise and guaranteed by AVIC International Leasing. Proceeds will be used for financing working capital and general corporate purposes.

Chongqing Wansheng ETDZ raised $89mn via a 3Y SBLC-backed bond at a yield of 1.93%, 27bp inside initial guidance of 2.3% area. The bonds are unrated and are supported by an irrevocable standby letter of credit from Industrial and Commercial Bank of China Chongqing branch. Proceeds will be used for debt refinancing.

New Bonds Pipeline

-

Gemdale Corp hires for $ green bonds

-

India Cleantech Energy/ACME Solar Holdings hires for $ amortizing 5Y green bond

-

Chindata Group hires for $ green bonds; calls today

-

Chongqing International Logistics Hub Park Construction hires for $ bonds; calls today

Rating Changes

- Automaker Daimler Upgraded To ‘A-‘ By S&P As Strong Cash Flows Fund Accelerating Electric Vehicle Transition; Outlook Stable

- Fitch Upgrades RSA Insurance Group’s plc Subordinated Notes (XS1120081283); Corrects Error

- Fitch Revises SABIC’s Outlook to Stable; Affirms IDR at ‘A’

- Fitch Revises Saudi Aramco’s Outlook to Stable; Affirms IDR at ‘A’

- AVIC International Outlook Revised To Positive By S&P On Improving Financial Prospects; ‘BBB-‘ Rating Affirmed

- Moody’s revises China Minmetals’ outlook to positive from stable; Baa1 ratings affirmed

- Fitch Affirms Orazul ‘BB’; Removes Watch Positive; Outlook Stable

- Trinidad and Tobago ‘BBB-/A-3’ Ratings Affirmed By S&P; Outlook Revised To Negative From Stable On Weaker Economy

-

Moody’s downgrades PEMEX’s ratings to Ba3; outlook remains negative

Term of the Day

Kangaroo Bond

Kangaroo bonds are bonds issued in Australia by non-Australian issuers denominated in Australian Dollars. These bonds give foreign issuers access to another country’s capital markets and helps them diversify their capital base and could reduce borrowing costs. Although, the currency risk is borne by the issuer.

KfW priced an A$350mn Kangaroo Bond at a 0.41% today.

Talking Heads

“It would therefore be desirable to discuss the possibility of our future purchase programs retaining some of the flexible elements,” he said. “Our new forward guidance is the first example of our determination to take action,” he said. “The market and analysts need time to process all the new features included in our strategy review and to analyze its implications,” he said.

“One thing about predicting Fed moves is to separate what you think they will do versus what you think they should do.” “If we are just looking at ‘should,’ I believe it’s time for the Fed to end QE (quantitative easing) purchases. Reverse repo volume is now over $900 billion a day. The liquidity the Fed is providing through QE is just recirculating back to the Fed via RRP.”

On China bond bulls unfazed by Xi’s crackdown on capital markets

Gustavo Medeiros, deputy head of research at Ashmore

“The Chinese bond market is very resilient.” “Chinese bonds are the only major bonds in the world that will actually provide a proper protection in a global systemic event because it’s the only central bank in the world that still has a big bazooka. And Chinese bond yields are trading at a higher level than the European or U.S. bonds.”

Yan Wang, chief emerging-market and China strategist at Alpine Macro

“The recent events shouldn’t have any long-term impact on the yuan or bonds.” “China hasn’t done large-scale fiscal and monetary stimulus. Compared with the massive fiscal deficit and massive current-account deficits in the U.S., the yuan is fundamentally sound.”

Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd

“Half of foreign ownership of Chinese government bonds are foreign sovereign institutions, who are real money and long-term investors.” “Despite the recent rout, the long-term outlook for China bonds remains the same as there won’t be any changes to index inclusion even with rising tensions with the U.S.”

“What’s happening is a good thing.” “What the Chinese government is doing is cracking down on the big companies that dominate various sectors at the exclusion of smaller companies. So the regulatory crackdown is probably in the long run going to be good for the Chinese market.”

“There is a widespread rumor in the market that some U.S. funds are selling Hong Kong and China assets aggressively, as the U.S. may restrict investments in these places.” “Although we can’t verify if it’s true or not, the market fears that foreign capital will flow out from the Chinese stock market and bond market on a large scale, so the sentiment is badly hurt.”

“It’s sort of like putting a Band-Aid on the situation for now,” Renert said of distressed exchanges. “It improves short-term liquidity and reduces debt but doesn’t really fix a company’s problems.” It also gives lenders receiving a higher position in the capital stack “the ability to foreclose down the road.”

Top Gainers & Losers – 28-Jul-21*

Go back to Latest bond Market News

Related Posts: