This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

eHi, LandSea Prices $ Bonds

March 20, 2024

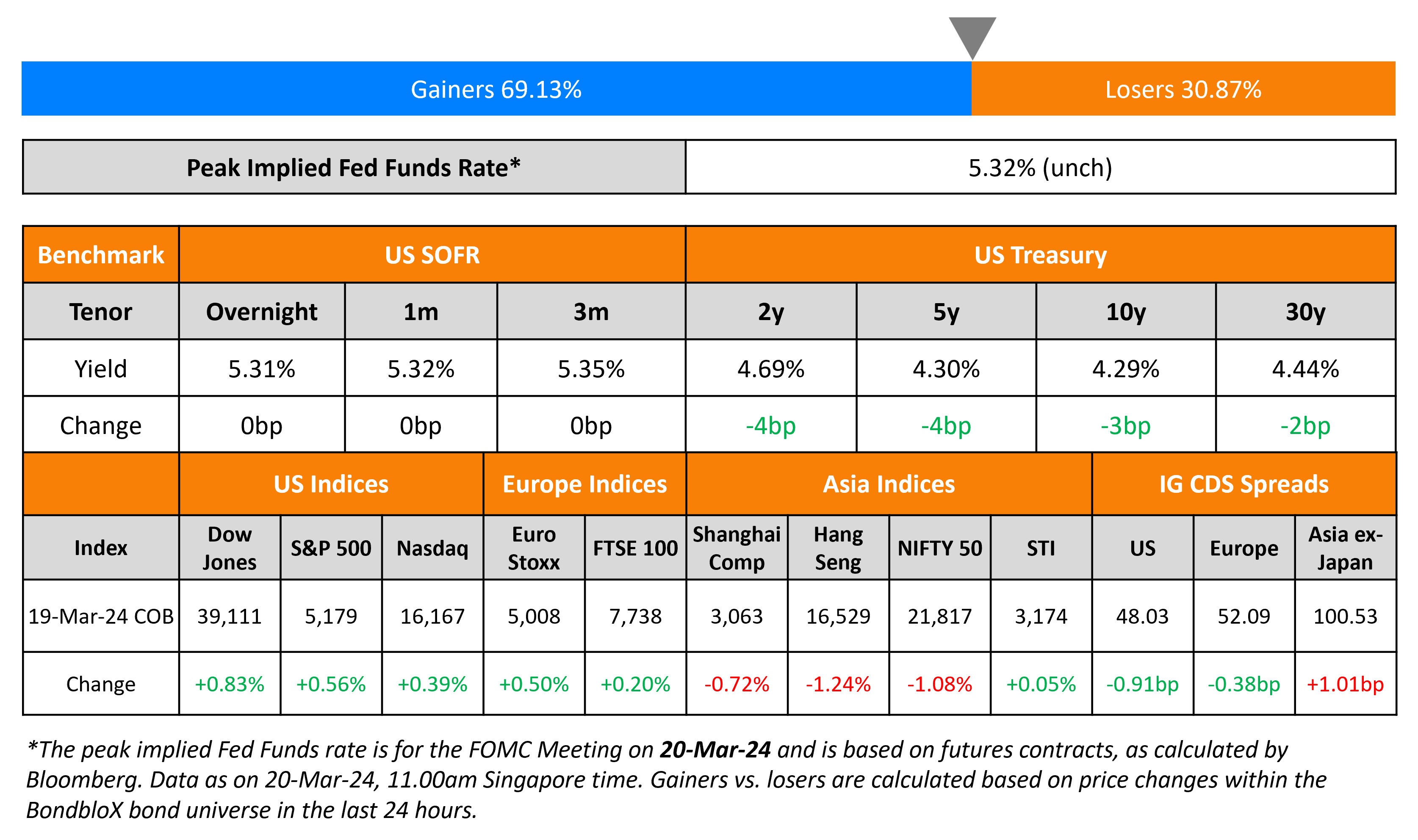

US Treasury yields moved lower by 3-4bp across the curve on Tuesday. Following the BOJ’s decision yesterday, the focus now shifts towards the Federal Reserve’s meeting where rates are expected to stay unchanged but the dot plots and Jerome Powell’s comments will be watched. Separately, new US home construction bounced back sharply last month, with residential starts increasing by 10.7% in February, the largest since May 2023. Credit markets saw US IG CDS spreads tighten 0.9bp and HY spreads tighten by 0.7bp. Looking at equity indices, S&P and Nasdaq rose 0.4-0.6%.

European equity indices closed higher. European IG CDS spreads tightened 0.4bp and HY spreads were 5.5bp tighter. Asian equity markets have opened in the green today. Asia ex-Japan IG CDS spreads were 1bp wider.

New Bond Issues

-

Shanghai Pudong Development Bank $ 3Y at SOFR+100bp area

LandSea Homes raised $300mn via a 5NC2 bond at a yield of 8.875%, inside initial guidance of 8.875-9% area. The senior unsecured notes are rated B/B+. Proceeds will be used to pay down a portion of the outstanding borrowings under its revolving credit facility.

Philippines’ BPI raised $400mn via a 5Y bond at a yield of 5.37%, 35bp inside initial guidance of T+140bp area. The senior unsecured notes are rated Baa2/BBB+/BBB-. Proceeds will be used to refinance existing debt and for general corporate purposes.

EHi Car Services raised $325mn via a 3.5NC1.5 bond at a yield of 13.471%. The notes are unrated, and proceeds are used to fund the exchange offer with respect to its existing 7.750% 2024s, to refinance remaining 2024 notes, and to optimize debt structure. The new bonds are priced 110.1bp wider to its existing 7% bond due September 2026 (callable on September 2024) and currently yield 12.37% to maturity.

Frasers Logistics raised S$175mn via a 5Y bond at a yield of 3.83%, 27bp inside initial guidance of 4.1%. The notes are rated BBB+. Proceeds will be used to refinance existing debt, finance/refinance acquisitions, investments, asset enhancement works and developments, and also working capital requirements and general corporate purposes. The new bonds are priced 7bp wider to its existing 3.76% bond due July 2028 that currently yield 3.76%.

New Bond Pipeline

- Korea National Oil hires for $ 3Y/5Y bond

- Indiabulls Housing hires for $ 3.25Y bond

- Deqing Construction hires for $ bond

Rating Changes

- Fitch Downgrades Intrum to ‘B’; Places on Rating Watch Negative

- Outlooks On Five Kazakhstani Banks Revised To Positive On Better Asset Quality, Regulatory Oversight; Ratings Affirmed

Term of the Day

Asset Backed Securities (ABS)

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on.

Talking Heads

On Pimco Saying BOJ Rate Hike Has Put Japanese Bonds Back on the Map

Tomoya Masanao, Pimco’s co-head of APAC portfolio management

“Should usher in a period of normalization for Japanese bond markets, eventually attracting investors at higher yields… Japanese investors are generally underweight Japanese bonds and should consider increasing their allocations over time”

On Bond Traders Stepping Up Short Bets

“The bond market is bracing for a hawkish Fed message Wednesday”

Bryce Doty, Sr. PM at Sit Investment Associates

Tom Simons, senior economist with Jefferies

“If the Fed were to keep rate forecasts unchanged, they would risk another renewed push to even easier financial conditions that would work against their effort to get inflation back down to 2%”

On Trading Floors Buzz With Excitement after BOJ Ends Negative Rates

Calvin Yeoh, who helps manage the Merlion Fund at Blue Edge Advisors

“The market’s reaction is akin to waiting so long to meet Santa Claus, you’re already an adult”

Motonari Sakai, Mitsubishi UFJ Trust & Banking

“While other countries such as the US are cutting interest rates, only Japan is raising interest rates”

Kellie Wood, money manager at Schroders Plc.

“Seems like the BOJ has done a good job in managing market expectations”

Top Gainers & Losers- 20-March-24*

Go back to Latest bond Market News

Related Posts: