This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ecopetrol, Muthoot, Goldman, MS, Price $ Bonds

October 17, 2024

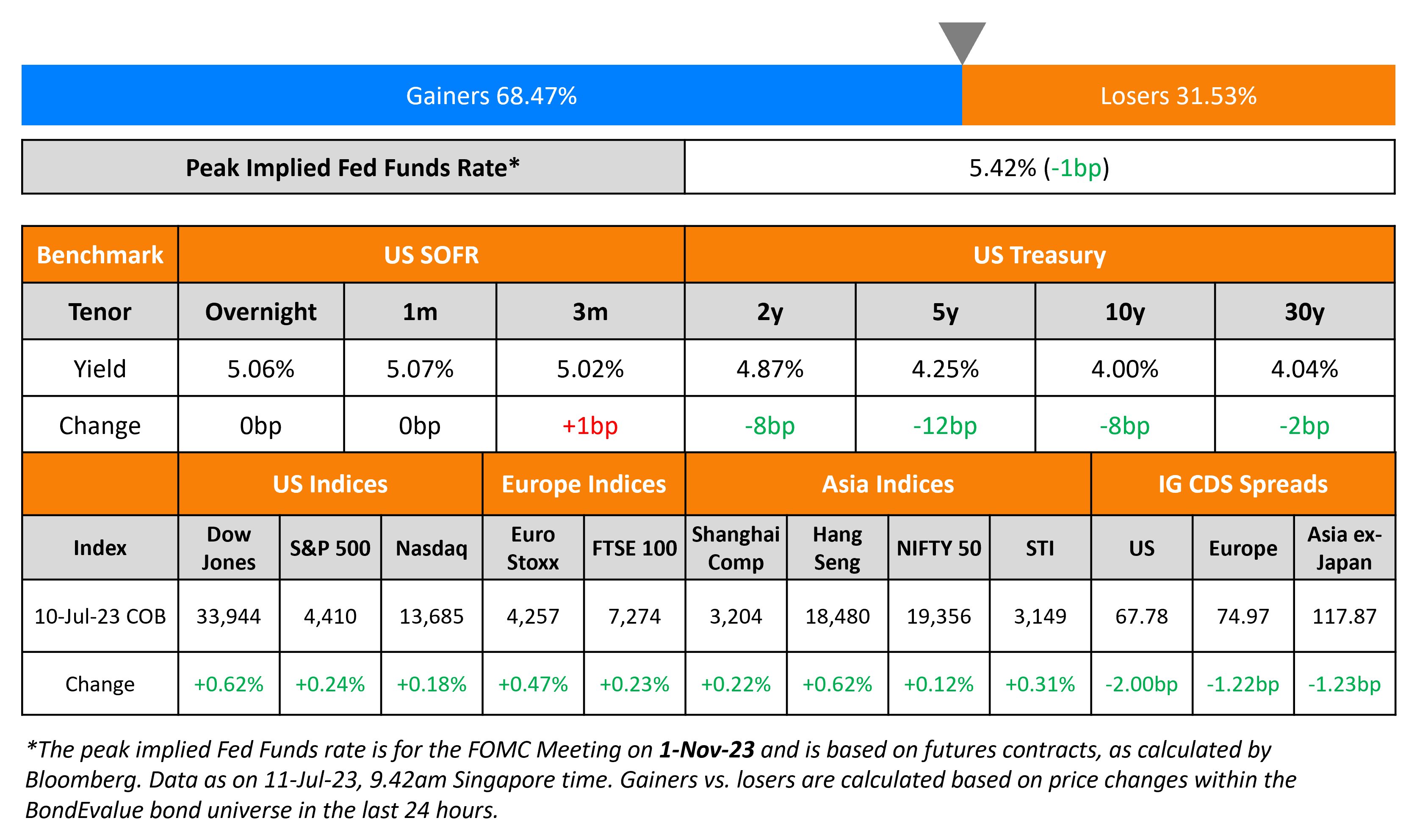

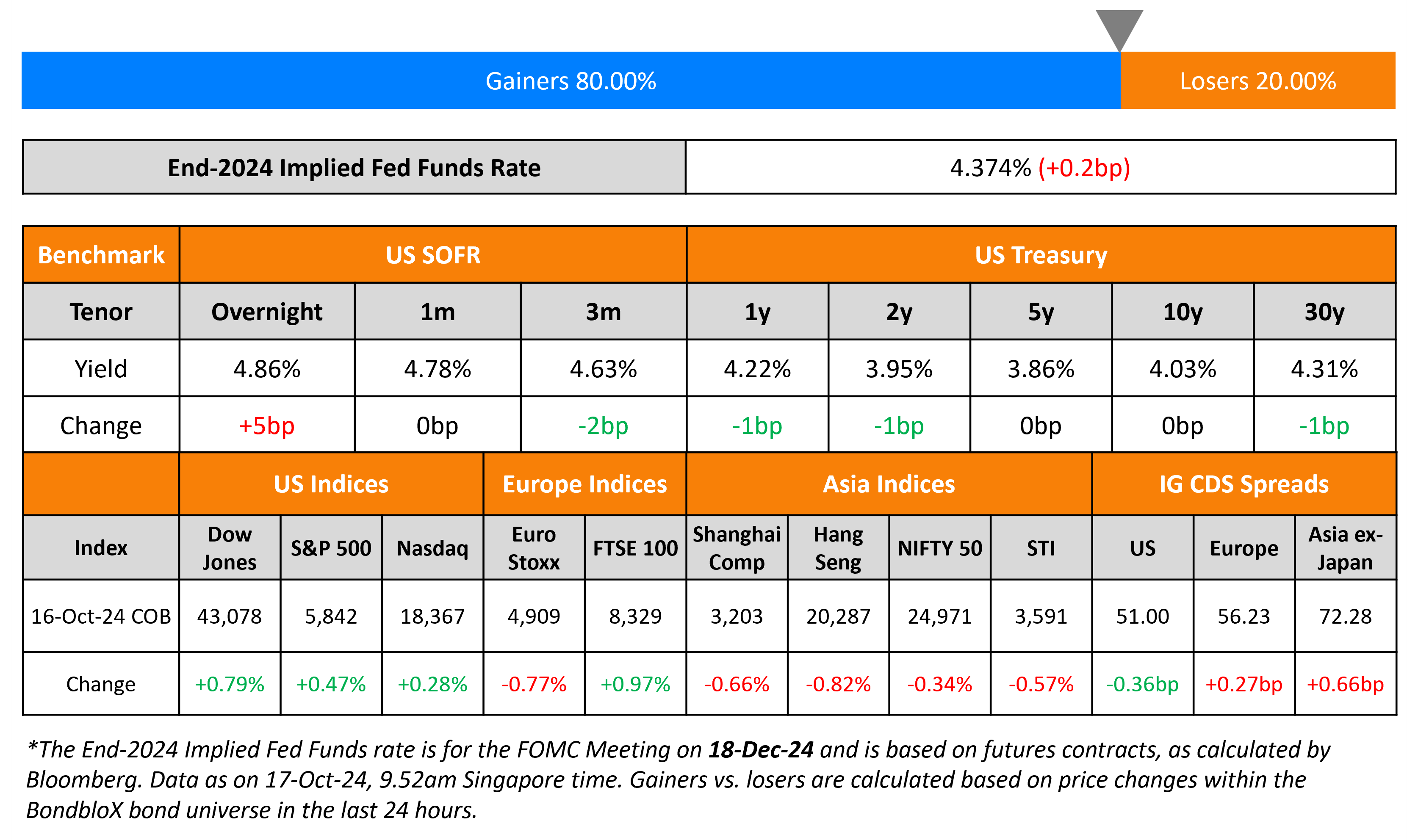

US Treasuries were broadly unchanged on Wednesday. The US SOFR benchmark jumped 5bp, from 4.81% to 4.86%, with analysts noting that it reflects the upward pressure placed on repo agreements amid T-bill settlements, and thereby tightening in liquidity. US IG and HY CDS tightened by 0.4bp and 3.3bp respectively. US equity markets closed higher, with the S&P and Nasdaq up by 0.5% and 0.3% respectively.

European equities ended broadly mixed. In terms of Europe’s CDS spreads, the iTraxx Main widened by 0.3bp and Crossover spreads tightened by 0.1bp. Asian equities have opened mixed this morning. Asia ex-Japan IG CDS spreads were 0.7bp wider.

New Bond Issues

Ecopetrol raised $1.75bn via a long 7Y bond at a yield of 7.80%, inside initial guidance of low-8% area. The senior unsecured bonds are rated Ba1/BB+/BB+. Proceeds will be used to (a) purchase the notes under its tender offer and pay related expenses (b) prepay a portion of the outstanding principal amounts of its 2030 loan and/or (c) finance expenditures outside its investment plan. The offering was launched last week and postponed thereafter due to an investigation into the Columbian President and Ecopetrol’s CEO. At the time, the bonds were expected to price at 7.65%, 15bp tighter to the latest level. The new bonds are priced at a new issue premium of 40bp over its existing 4.625% 2031s that currently yield 7.40%.

Muthoot raised $400mn via a 4.5Y bond at a yield of 6.375%, 42.5bp inside initial guidance of 6.7% area. The senior secured notes are rated BB/BB (S&P/Fitch), similar to the issuer’s ratings of Ba2/BB/BB. Proceeds will be used towards onward lending, in accordance with approvals and relevant external commercial borrowing guidelines. The bonds amortize by 20% each in months 42, 45, 48, 51 and 54. The bonds have a change of control (CoC) that would occur when the founder group collectively no longer holds control of issuer or at least 50% of voting rights. A CoC trigger event implies both a CoC event and a rating decline. The covenants include the following:

- Capital adequacy ratio to be maintained at a level complying with RBI requirements

- Security coverage ratio greater than or equal to 1x (reviewed quarterly and annually)

- Minimum security coverage ratio to be calculated on collateral excluding portion classified as NPAs or stage 3 assets

Goldman Sachs raised $5.5bn via a two-trancher. It raised $2bn via a 6NC5 bond at a yield of 4.692%, 25bp inside initial guidance of T+110bp area. It also raised $3.5bn via a 11NC10 bond at a yield of 5.016%, ~27.5bp inside initial guidance of T+125/130bp area. The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes. The new 6NC5s are priced ~5bp wider to its existing 5.049% 2030s (callable in July 2029) that yield 4.64%. The new 11NC10s are priced roughly in-line with its existing 5.33% 2035s (callable in July 2034) that yield 5.03%.

Morgan Stanley raised $5.75bn via a three-part offering. Details are given below:

- Morgan Stanley Bank NA raised $1.75bn via a 3NC2 bond at a yield of 4.447%, 23bp inside initial guidance of T+75bp area.

- Morgan Stanley Bank NA raised $1bn via a 3NC2 FRN at SOFR+68.5bp vs. initial guidance of SOFR equivalent area.

- Morgan Stanley raised $3bn via a 6NC5 bond at a yield of 4.654%, 18bp inside initial guidance of T+100bp area. The new bonds are priced ~4bp wider to its existing 5.656% 2030s (callable in April 2029) that currently yield 4.61%.

Both the 3NC2 senior bank notes are rated Aa3/A+/AA-, while the senior unsecured 6NC5s are rated A1/A-/A+. Proceeds will be used for general corporate purposes.

Sembcorp raised S$350mn via a 12Y green bond at a yield of 3.65%, 25bp inside initial guidance of 3.90% area. The senior unsecured notes are unrated. Proceeds will be used to finance or refinance eligible green projects as set out in its green financing framework. The notes can be redeemed for tax reasons at the issuer’s option in whole, but not in part, at par.

Santander raised S$300mn via a 6NC5 bond at a yield of 3.6%, 20bp inside initial guidance of 3.8% area. The senior non-preferred notes are rated Baa1/A-/A-. Proceeds will be used for general corporate purposes. Proceeds will be used for general funding purposes of the group. The notes have a one-time call option, at par, in whole and not in part, at the issuer’s discretion subject to prior consent of relevant regulators.

City Developments Ltd (CDL) raised S$300mn via a 5Y bond at a yield of 3.397%. The senior unsecured bonds are unrated. Proceeds will be used to finance general working capital requirements and corporate funding, and/or to refinance existing borrowings of CDL and its subsidiaries.

New Bonds Pipeline

- China Huadian hires for $ PerpNC3 bond

Rating Changes

-

Fitch Upgrades Lippo Karawaci to ‘B- ‘; Outlook Positive

-

Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-‘ On Sustained Low Leverage And Conservative Financial Policies; Outlook Stable

-

Co-operative Group Ltd. Upgraded To ‘BB’ On Improved Profitability And Lower Leverage; Outlook Stable

-

Moody’s Ratings downgrades AMC Networks’ CFR to B2; outlook is stable

-

Fitch Revises Societe Generale’s Outlook to Stable; Affirms at ‘A-‘

-

Fitch Revises La Banque Postale’s Outlook to Negative; Affirms IDR at ‘A’

-

JBS S.A.Outlook Revised To Stable From Negative On Significant Cash Generation; ‘BBB-‘ Ratings Affirmed

Term of the Day

Standby Letter of Credit (SBLC)

Standby Letter of Credit (SBLC) is a note issued by the buyer’s bank to the seller’s bank, where the former guarantees to pay a sum of money to the latter if the buyer defaults on the agreement. Particularly in the shipping of goods, SBLCs are used to reduce risks associated with the transaction on unforeseen events leading to a default. Bonds backed by the above structure are called SBLC-Backed Bonds. Unlike guarantees, which are direct obligations of a bank to cover the timely payment of related bonds, SBLCs require trustees of the bonds to provide demand notices to the banks in the event that issuers fail to make bond payments.

Talking Heads

On Market ‘Very Convinced’ Trump Will Win – Duquesne Family Office CEO, Stan Druckenmiller

Market seems “very convinced Trump is going to win… You can see it in the bank stocks, you can see it in crypto… I’ll probably write in someone when I go to the polls”

On UK budget unlikely to shock markets, gilts look attractive – PIMCO

“We do expect the fiscal outlook in the UK to be tight, and we continue to expect the deficit to fall in future years… will be surprised if the government announced anything that would lead markets to question the fiscal credibility that we’ve seen”

On expecting series of consecutive 25bp Fed cuts ahead – Goldman Sachs

Expects the US Fed to deliver consecutive 25bp rate cuts from November 2024 through June 2025 to a terminal rate range of 3.25-3.5%. Also expects the ECB to cut rates by 25bp at its meeting on Thursday.

Top Gainers & Losers – 17-Oct-24

Go back to Latest bond Market News

Related Posts: