This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

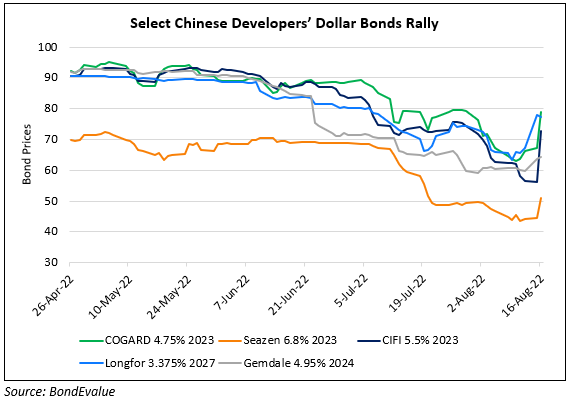

Country Garden, CIFI and Seazen’s Dollar Bonds Extend Gains

September 1, 2022

Dollar bonds of Chinese property developers like Country Garden, CIFI Holdings and Seazen topped the gainers list yesterday. While Country Garden had reported a 96% drop in its 1H 2022 profits, it also announced that it planned to issue RMB 5bn ($724.3mn) in state-backed guaranteed notes this year. CIFI and Seazen have also planned issuances of these notes backed by China Bond Insurance Co. This positive update was announced a week ago and the impact of it continues to be seen in the dollar bonds developers that decide to raise money via these bonds.

Go back to Latest bond Market News

Related Posts: