This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

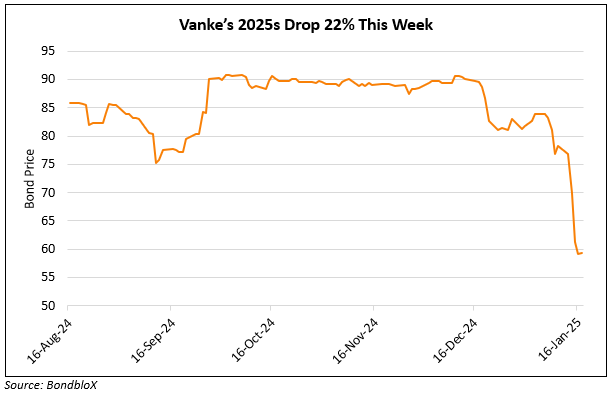

China Vanke Downgraded to Caa1 by Moody’s

February 12, 2025

China Vanke was downgraded by a notch to Caa1 from B3 by Moody’s. The rating agency also downgraded the senior unsecured bonds issued by Vanke to Caa2 from Caa1. This is the second downgrade by Moody’s since the start of the year. The downgrade reflects China Vanke’s weak credit profile, as evidenced by its worse-than-expected 2024 financial results and sustained weak liquidity. China Vanke’s contracted sales dropped 35% to RMB 246bn ($33.65bn) in 2024. The company’s net loss increased significantly to ~RMB 45bn ($6.2bn), up from RMB 17.9bn ($2.5bn). This decline is attributed to volatile market conditions, lower profit margins, asset disposals, and impairment losses. These losses negatively affect the company’s equity base and financial metrics, including debt leverage and interest coverage. The company’s liquidity is weak, with cash balances of RMB 77bn ($10.5bn) as of September 2024, insufficient to cover land payments and refinancing needs for the next 12-18 months.

However, Vanke’s dollar bonds have been on an uptrend due to certain positive developments like management changes and potential state support via its largest shareholder Shenzhen Metro. Its 3.5% 2029s were trading at 66.7 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Vanke Downgraded to B3 by Moody’s

January 20, 2025

Aoyuan Downgraded to B- by Fitch

November 22, 2021