This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

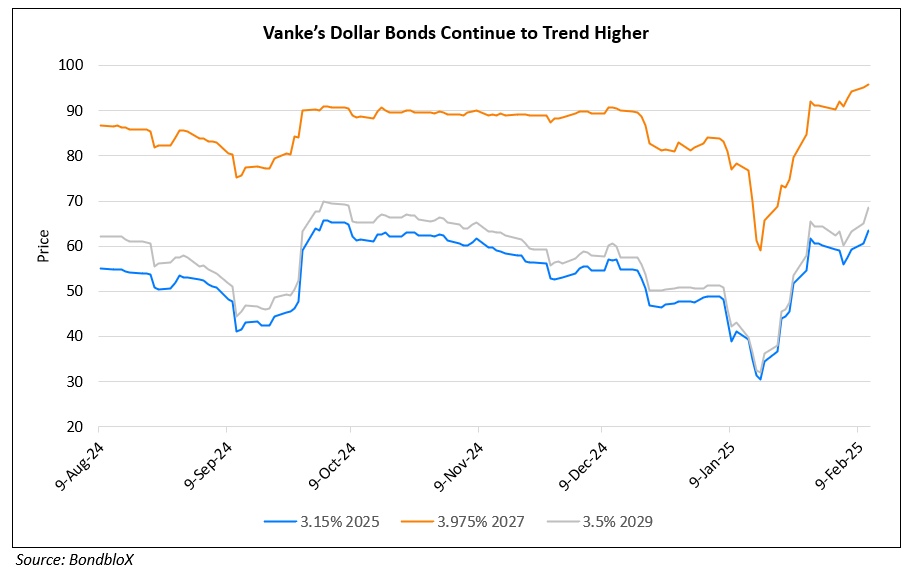

Vanke’s Dollar Bonds March Higher on Securing Additional Support

February 11, 2025

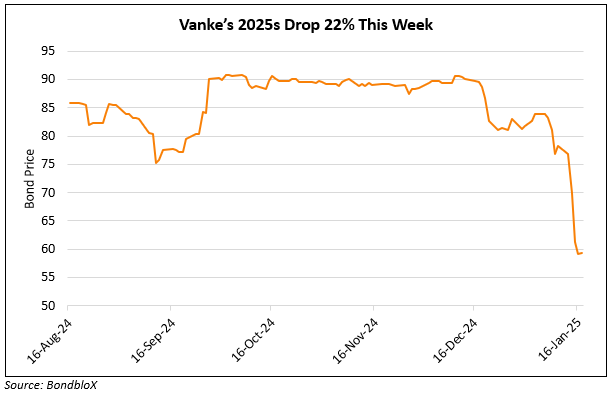

China Vanke’s dollar bonds marched higher by 3-4 points after it secured additional support of up to RMB 2.8bn ($380mn) from its largest state shareholder, Shenzhen Metro Group. This support will help Vanke repay its debt and comes via a 3Y secured loan, where Vanke will offer up to RMB 4bn ($550mn) in collateral, including an 18% stake in its property management unit, Onewo. The loan agreement is seen as the best way for Vanke to raise funds as it faces the repayment of $4.9bn in bonds maturing throughout the year. The support from Shenzhen Metro follows Vanke’s top-management executive changes and a forecasted $6.2bn loss. Vanke has been struggling financially, with concerns over a potential default causing a drop in bond prices earlier this year. However, Vanke’s dollar bonds have been trending higher of late thanks to reports of a possible government takeover and talks of selling its logistics arm to ease liquidity pressures.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Vanke Downgraded to B3 by Moody’s

January 20, 2025

Vanke in Talks to Sell Its Logistics Arm

January 24, 2025