This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

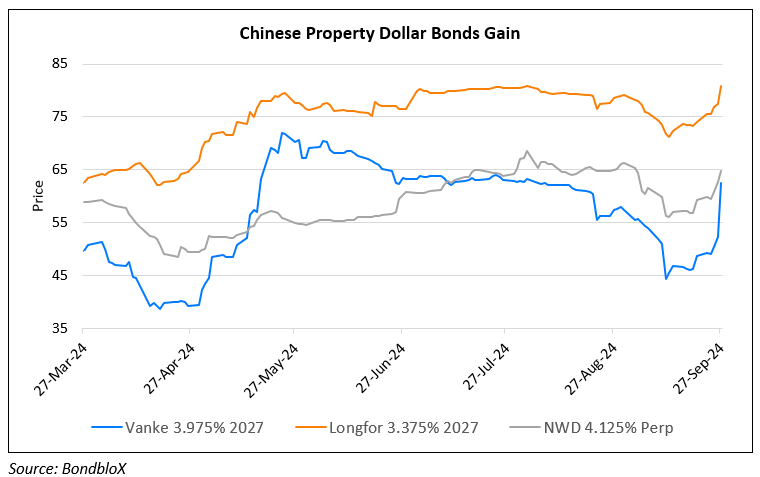

China Property Bonds Continue to Trend Higher

September 27, 2024

Bonds of Chinese property developers like Vanke, Longfor, etc. continued to trend higher during the week, gaining by almost 10-18 points over the past two weeks. The latest rally comes after China announced an aggressive stimulus package to pull the economy out of deflation and boost its economic growth. China’s central bank lowered interest rates and introduced liquidity measures. The recent Politburo meeting also revealed plans to issue approximately RMB 2tn ($284.4bn) in special sovereign bonds this year. The property market support package included a 50bp reduction on average interest rates for existing mortgages, and a cut in the minimum down-payment requirement to 15% on all types of homes, among other measures.

In a related development, Country Garden won the bondholders’ approval to push back payments on its nine yuan bonds by six months, according to the sources. Bondholders approved a payment extension on its 4.5% 2026s late Wednesday after its main onshore unit delayed the voting deadline multiple times. Payment delays on eight other bonds were granted earlier this month, the sources added. This will give the developer more time to map out an onshore debt overhaul. It’s dollar bonds continue to trade at deeply distressed levels of 7-8 cents on the dollar.

Go back to Latest bond Market News

Related Posts: