This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CapitaLand India Trust Launches S$ bond

August 22, 2024

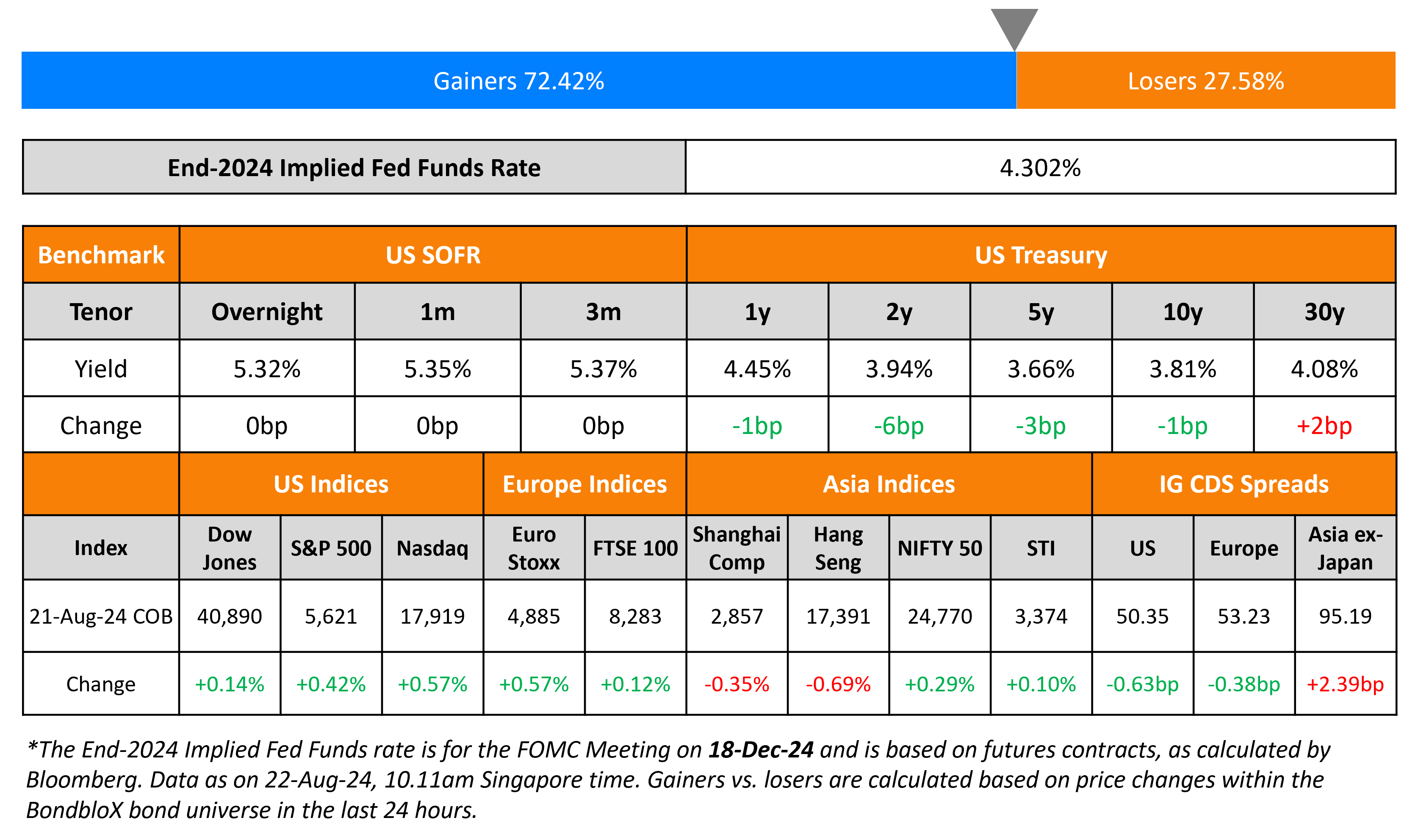

The US Treasury yield curve bull steepened, with the 2Y yields down 6bp while the 10Y yield held steady. The FOMC’s July meeting minutes noted that a majority of officials believed that easing policy at the next meeting would likely be appropriate assuming data continued to come in as expected. Besides, several officials said that the recent cooling-off on inflation and rise in the unemployment rate made a potential case for cutting rates by 25bp in July itself. Separately, US payrolls fell by 818k during the 12-month period through March, its largest downward revision since 2009. US IG CDS spreads tightened by 0.6bp while HY CDS spreads tightened by 2.1bp. Looking at US equity indices, the S&P and Nasdaq were up by 0.4% and 0.6% respectively.

New Bond Issues

- CapitaLand India Trust S$ at 3.9% area

Rabobank raised $1.25bn via a two-part offering. It raised $500mn via a 2Y bond at a yield of 4.333%, 22bp inside initial guidance of T+65bp area. It also raised $750mn via a 2Y FRN at SOFR+62bp vs. initial guidance of SOR equivalent. The senior preferred bonds are rated Aa2/A+/AA-. Proceeds will be used for general corporate purposes.

Rating Changes

- Hyundai Motor Co. And Kia Corp. Ratings Upgraded To ‘A-‘ On Improved Market Position And Profitability; Outlook Stable

- Hyundai Capital Upgraded To ‘A-‘ And Hyundai Card Upgraded To ‘BBB+’ Following Action On Group Members; Outlook Stable

- Rolls-Royce PLC Upgraded To ‘BBB/A-2’ On Rising Profitability, Strong Cash Generation, Deleveraging; Outlook Positive

Term of the Day: Bull Steepening

Bull Steepening refers to a change in the yield curve where short-end rates move down faster than long-end rates. This not only has a steepening effect on the entire yield curve but also has a net effect of interest rates moving lower and bond prices moving higher. Similar terms include Bear Steepening, Bull Flattening and Bear Flattening. If the yield curve moved lower and bond prices moved higher, it is considered a bull move, while the opposite is a bear move. If the effect of the move is to steepen the curve, it would either be a Bear Steepening or a Bull Steepening. If the effect was to flatten the curve, it would be a Bear Flattening or Bull Flattening.

Talking Heads

On Covid Hobbled Profitable Bond Trade Being Revived by High Interest Rates

Althea Spinozzi, Skydance Media

“As the economy slows, downgrades are unavoidable. For sure we are going to see more fallen angels.”

Mike Scott, Man Group

Many fallen angels will come from telecommunications, cable and real estate, “segments that are somewhat challenged fundamentally”

Yuri Seliger, BofA

“We just went through a period of very few downgrades… there are signs that maybe the risk of downgrades is now rising”

On Bond Funds Piling Into Swath of EM Asia for First Time Since 2021

Charlie Robertson, FIM Partners

“Many global investors would have been underweight lower yielding Asian bonds — but once Fed cuts became more certain, they had to reduce that underweight… US dollar weakness has also re-opened the prospect of rate cuts”

On Democrats gather, investors gauge market impact from a Harris administration

Frank Kelly, DWS Group

“She seems to be on a track to be more aggressive than the Biden administration on a lot of these consumer issues that go right to the market”

Peter Tuz, Chase Investment Counsel

“Anything that reduces earnings should … have a negative impact on the stock market”

Top Gainers & Losers-22-August-24*

Go back to Latest bond Market News

Related Posts: