This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bond Investors See $164bn in Gains in 2023 Thanks to Late Rally

December 21, 2023

2023 has been a good year for bond investors, especially for those who caught the recent rally since late-October. Based on analysis of dollar bond price returns (ex-coupon) from our universe of nearly 5,000 bonds, bond investors have earned a staggering $164bn* in unrealized gains through 2023. Most notably, the returns are almost entirely attributable to the performance of dollar bonds in Q4. The last quarter saw global dollar bonds deliver a total return of 7.9%, as seen by the Bloomberg Global Aggregate Credit Total Return Index. In dollar terms, looking at our bond universe, the fourth quarter led to uncrystallized gains of an eye-watering $418bn*. To put this into perspective, the first nine months of the year saw the index witness a total return of just 0.5%.

Below is a violin plot of Investment Grade (UG) and High Yield (HY) dollar bonds through the quarters in 2023 where each dot represents a bond. You can hover over each dot to view the respective bond’s details and its performance.

The stellar performance can be attributed largely to the dovish stance of the Fed at its November meeting and more so, at its December meeting, where its dot plot revealed 75bp of cuts expected by FOMC members in 2024. Prior to that, the rally in bonds was supported by other factors including: (a) The US Treasury surprising markets with a slowdown in the pace at which it issues longer-term debt, (b) the 3-month moving average of US Non-Farm payrolls (NFP) dropping to about 200k through Q4 from over 300k in Q1, indicating a broad softening in the job market and; (c) inflation easing to 3.1% in November from 6.4% in January. The 10Y Treasury yield, which had soared to highs of 5% in mid-October, tightened by over 60bp in a span of just two weeks, and is now down 108bp from those levels . This has led to corporate bonds and other risk assets rallying across the spectrum. The chart below shows how the Treasury yield curve moved through the quarters, with the current curve indicated in orange.

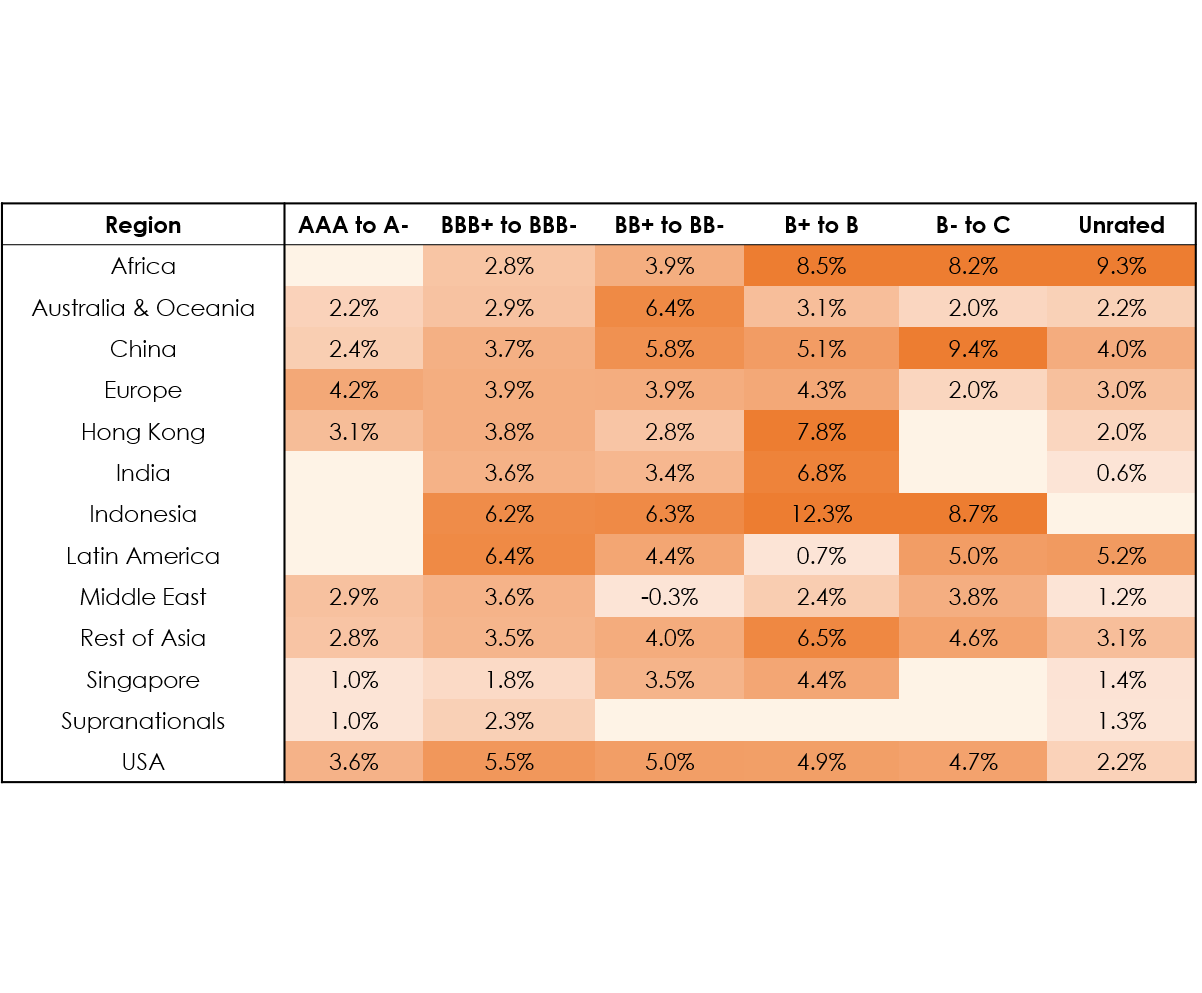

In terms of overall performance by region, US HY outperformed all the other regions with an annual return of 12.5%. LatAm, with an annual return of 10.4% came in second. As observed from the violin chart, Q4 delivered the best returns, followed by Q1; Q3 was the worst quarter in terms of price returns while Q2 was mixed.

In terms of overall performance by region, US HY outperformed all the other regions with an annual return of 12.5%. LatAm, with an annual return of 10.4% came in second. As observed from the violin chart, Q4 delivered the best returns, followed by Q1; Q3 was the worst quarter in terms of price returns while Q2 was mixed.

Both, US IG and US HY clocked a positive performance in Q1 with a return of 3.5% and 3.6% respectively. Over the next 2 quarters, while US IG delivered a negative return of -0.1% and -3.1%, US HY was able to escape a drawdown and delivered a positive return of 1.8% and 0.5% respectively. In Q4 both the indices performed exceedingly well, returning 5.2% and 6.3% respectively.

Moving east, Asian dollar bonds underperformed their US counterparts. Within the region, IG outperformed HY through 2023, mainly on account of continued stress among Chinese property developers. Q1 saw Asia IG and Asia HY bond indices delivering a positive return of 2.7% and 2.6% respectively. In 2Q23 and 3Q23, Asia IG returned 0.7% and -0.5% while Asia HY delivered a negative return of -0.7% and -3.9% respectively. In Q4, both these indices had a positive return of 2.7% and 4.6%.

Issuance Volumes and Largest Deals

The year saw $2.3tn in global dollar bond issuances, a 12% YoY increase. The largest deal globally in 2023 was led by Pfizer’s jumbo $31bn eight-tranche issuance, the fourth largest bond deal ever, to finance a portion of its Seagen merger. The second largest deal this year was Amgen’s jumbo $24bn eight-part deal, followed by Intel’s $11bn jumbo seven-part deal. Large banks also contributed to the largest issuances in the quarter. This list included BofA’s $8.5bn two and four-trancher deals each in Q2 and Q3, Morgan Stanley $7.5bn three-tranche deal and Wells Fargo’s $6bn two-part deal. Several other banks also made the list including HSBC, Barclays, UBS, Citibank and many others.

In the APAC & Middle East region, issuance volumes stood at $234bn, up 8% YoY. In the region, the largest deals were dominated by sovereigns/quasi-sovereigns, led by the Saudi Government’s $6bn six-trancher, Saudi PIF’s $5.5bn three-trancher and Hong Kong SAR’s $4.3bn multi-currency issuance. Other notable deals included Philippines’ $3bn three-tranche issuance, Indonesia’s $3bn and $2bn deals each and UAE’s $1.5bn issuance.

We have further analyzed the performance of sovereign bonds and bank capital (AT1s and Tier 2s) of popular European and Asian issuers. Click on the links below to access the reports

Performance of European Bank AT1s and Tier 2s

Performance of APAC and Middle East Bank AT1s and Tier 2s

Performance of EM Sovereign Dollar Bonds

What Does 2024 Have in Store for Bond Markets?

Markets are currently pricing-in at least 100bp in rate cuts by the Fed next year, going by CME probabilities. Besides, they also expect inflation to continue easing and a probable soft-landing in the second half of 2024. With this backdrop, analysts continue to favor bonds, signaling that the probability of Treasury yields going lower is higher than the likelihood of it going much higher. Below are some excerpts:

- Ralph Axel and Meghan Swiber, BofA Strategists – “The Treasury market has rallied substantially after the last hike in each of the five hiking cycles back to the 1988 cycle… It is a simple application of historical moves… lingering inflation pressures could limit the rally”

- Ashish Shah, Goldman Sachs Asset Management strategist – “What I think we’re seeing right now is not just a slowing in the economy, but inflation that is actually coming down, and that sets up a fantastic total return for the bond market… Take every opportunity you can when people get scared about what the Fed’s doing to build your position… this coming year is going to be the year of bonds. So don’t mess it up”

- UBS Wealth Management – We prefer fixed income to equities in our global strategy for 2024. We like opportunities in the 1–10-year duration segment in high grade (government) and investment grade. Our preferred spot is the 5-year point.

- Morningstar Investment Management 2024 Outlook – “Say Yes to Bonds… The material increase in bond yields has improved their attractiveness versus other assets, and for portfolio risk management more generally… They (corporate bonds) have a place as a middle ground—providing some extra yield versus government bonds and a duration profile that can help in portfolio construction… inverted yield curve can be a sign of recessionary pre-conditions, with longer-dated bonds expected to provide a necessary hedge”

Individual investors looking to invest in bonds can now sign up directly on BondbloX to trade fractional (starting with $1,000) and full-sized bonds electronically with low fees and transparent pricing (no hidden spreads!). Click here to learn more.

*Calculated as the sum of [price return in 2023 x amount outstanding of all dollar bonds in our universe]

Disclaimer

The materials and information contained herein are solely for general information reference and educational purposes only, and not intended to constitute nor as a substitute for legal, commercial and/or financial advice from an independent licensed or qualified professional. The information, opinions and views expressed herein are not, and shall not constitute an offer or a recommendation to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, or a recommendation, to purchase or sell any investment product or service or engage in any investment strategy. Nothing herein has been tailored to the investment objectives or financial situation of any specific individual, are current only as of the date hereof and may be subject to change at any time without prior notice. No representation, warranty or claim whatsoever is made nor implied as to the accuracy or completeness of any material or information contained herein, nor we have no liability whatsoever for any error, inaccuracies or omissions. No reliance should be made on the materials or information herein for any investment decision, and we accept no liability whatsoever for any direct or indirect loss whatsoever which may arise from the use or reliance of any such material or information. The business of investing is a complicated matter that requires serious financial due diligence for each investment. No representation whatsoever on the suitability or otherwise of any securities, products, or services for any particular investor. Each investor is solely responsible for its own independent investment decision based on its personal investment objectives, financial circumstances and risk tolerance, and should seek its own independent legal, tax and other professional advice prior to any such decision.

The inclusion of any hyperlinks or external links should not be seen as an endorsement or recommendation of that website or the views expressed therein. We do not have any control over the content or actions of the websites we link to and will not be liable for anything that occurs in connection with the use of such websites.

All intellectual property rights, title and interest (including but not limited to copyrights, trademarks, patents and other proprietary rights) in and to these materials and the contents therein, shall remain the sole and exclusive ownership of and are fully reserved by Bondevalue Pte. Ltd.. No licence or rights whatsoever in or to these materials or their contents or any part thereof is granted or deemed to be granted to any recipient. No form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of these materials or any part of its contents, shall be permitted.

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019