This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BofA Prices $10bn Five Trancher; Treasury Yields Tick Higher

January 20, 2025

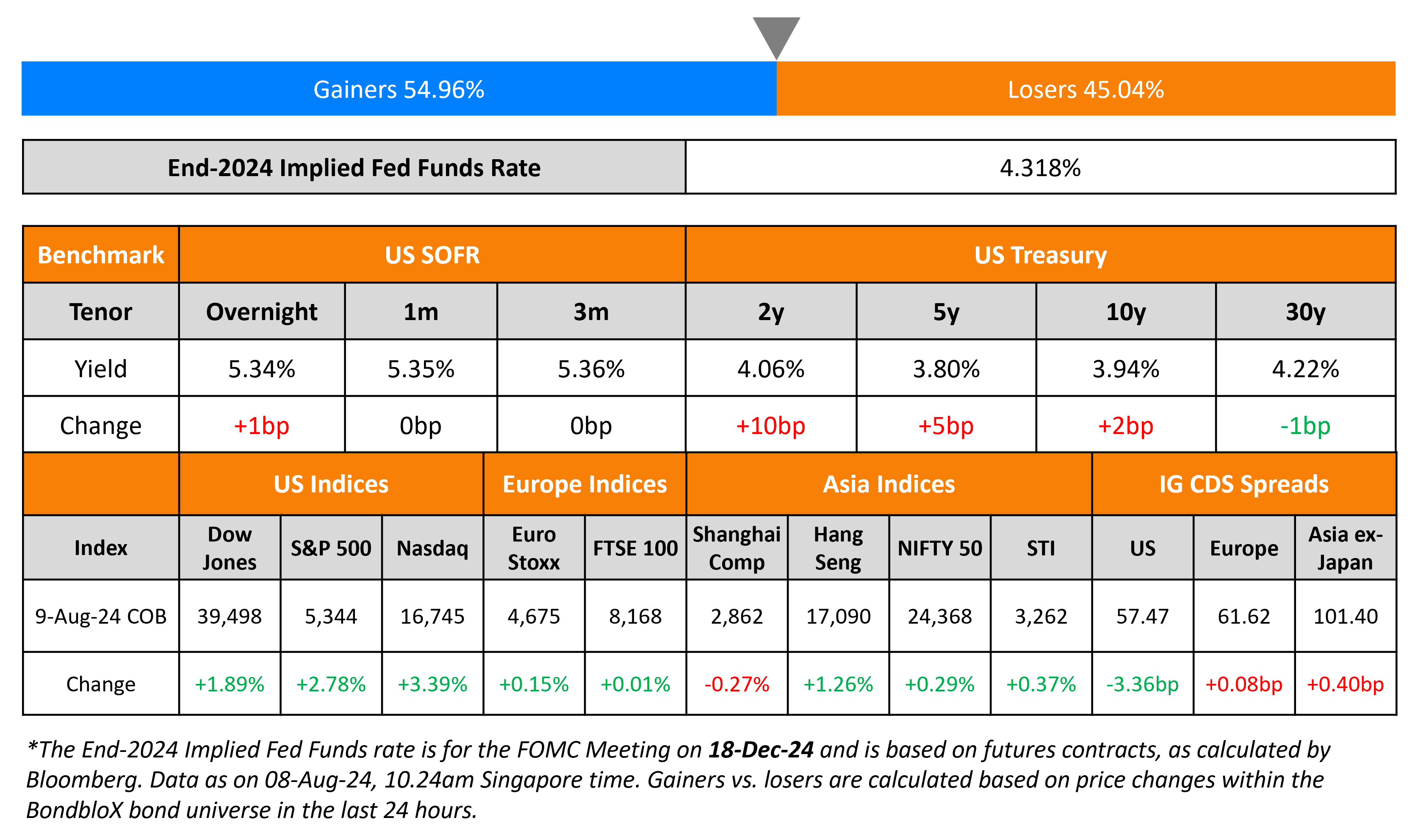

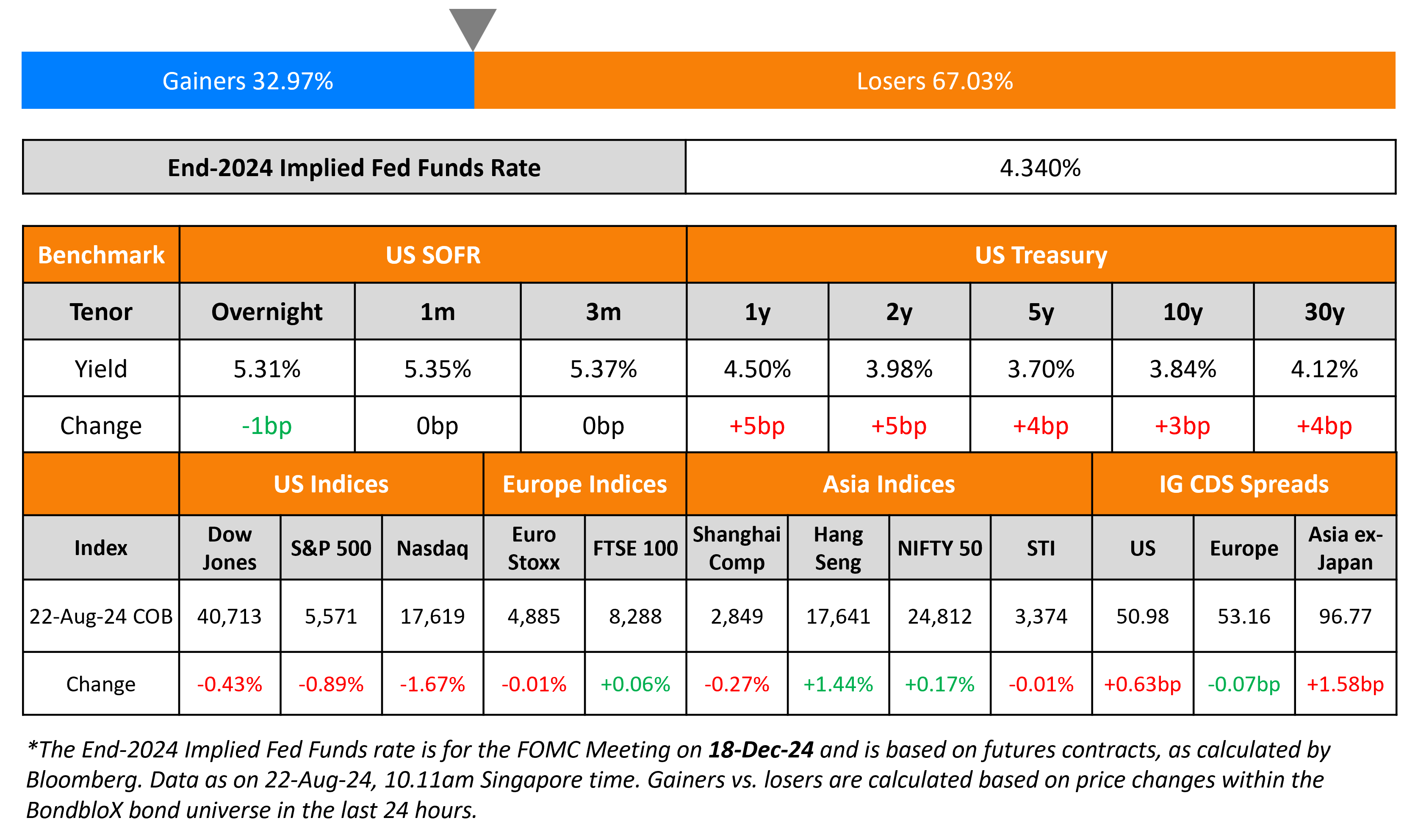

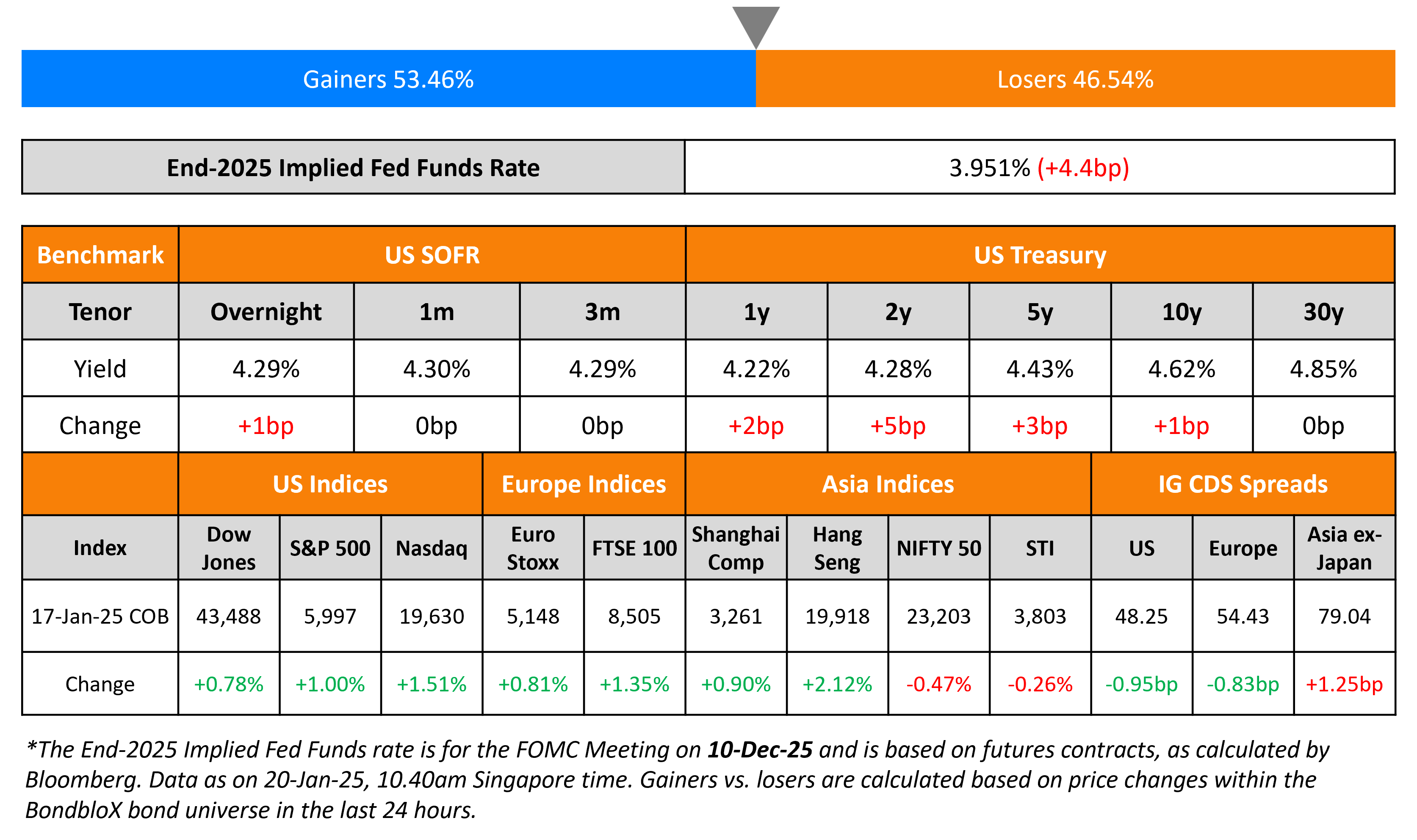

US Treasury yields ticked higher, with a bear flattening of the curve, as the 2Y rose by 5bp while the 10Y was up 1bp. US industrial production came-in higher at 0.9% MoM in December vs. estimates of 0.3% and the prior month’s 0.2%, thanks to higher civilian aircraft production after the Boeing strike was resolved.

US IG and HY CDS spreads tightened by 1bp and 3.6bp respectively. US equity markets ended higher, with the S&P and the Nasdaq up by 1% and 1.5% respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.8bp and 11.8bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 1.3bp wider.

New Bond Issues

The senior unsecured bonds are rated A1/A-/AA-. Proceeds will be used for general corporate purposes.

Bapco Energies raised $1bn via a 10Y sukuk at a yield of 6.25%, 50bp inside initial guidance of 6.75% area. The senior unsecured bonds are rated B+ (Fitch), and received orders of over $4bn, 4x issue size. Proceeds will be used for general corporate purposes and to finance its concurrent tender offer.

Rating Changes

-

Fitch Upgrades Expedia ‘s IDR to ‘BBB’; Outlook Stable

-

KUO S.A.B. de C.V. Upgraded To ‘BB’ On Global Scale And To ‘mxA’ On National Scale Following Sale Of Its Aftermarket Business; Outlook Stable

-

Moody’s Ratings upgrades Minas Gerais’ BCA to caa1, affirms its B1 ratings and changes its outlook to positive

-

Moody’s Ratings downgrades China Vanke’s ratings to B3/Caa1; outlook negative

-

Moody’s Ratings appends limited default (LD) to Accell’s C-PD PDR following distressed debt exchange

Term of the Day: Neutral Rate

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Traders Ditching EM in Rocky Start of the Year

Pablo Goldberg, BlackRock

“It’s hard for the market to take big bets in front of big events… right now we’re still in a very uncertain period”

Carlos Legaspy, Insight Securities

I’d rather buy a a two-year Treasury with a yield near 4%… then to wait and give Trump 100 days to see if he starts delivering on his threats

Arif Joshi, Lazard Asset

“The magnitude and timing of those changes are highly uncertain… not wise at this time to have duration or FX risk in emerging markets”

On US Set to Exceed World War II Debt Levels by 2029 – CBO

“The fiscal situation is daunting, the debt trajectory is unsustainable. It’s just the economy is a bit bigger than we thought it was last June, and therefore there’s more revenue.”

On Regional Banks Facing Headache From Rising Treasury Yields

Steven Kelly, Yale Program

“Rising long-term yields certainly leave the banking system more fragile in the short run, if more profitable in a base case economic scenario”

Tomasz Piskorski, Columbia Business School

“Instead of escaping this area of bank fragility, we are moving toward an increasing area of bank fragility”

Top Gainers and Losers- 20-January-25*

Go back to Latest bond Market News

Related Posts: