This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Boeing Prices $10bn 6-Part Deal; Kookmin Raises $600mn

April 30, 2024

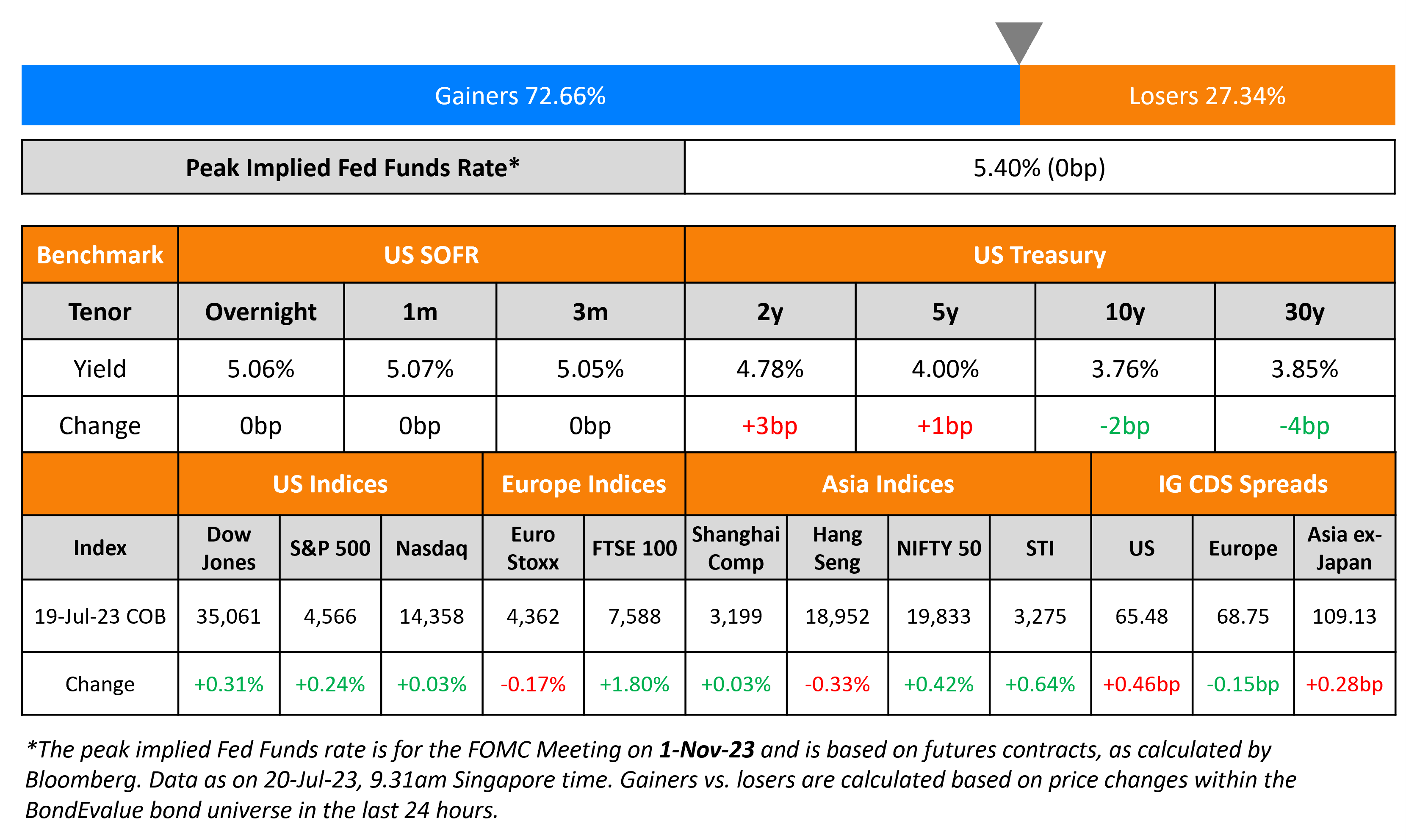

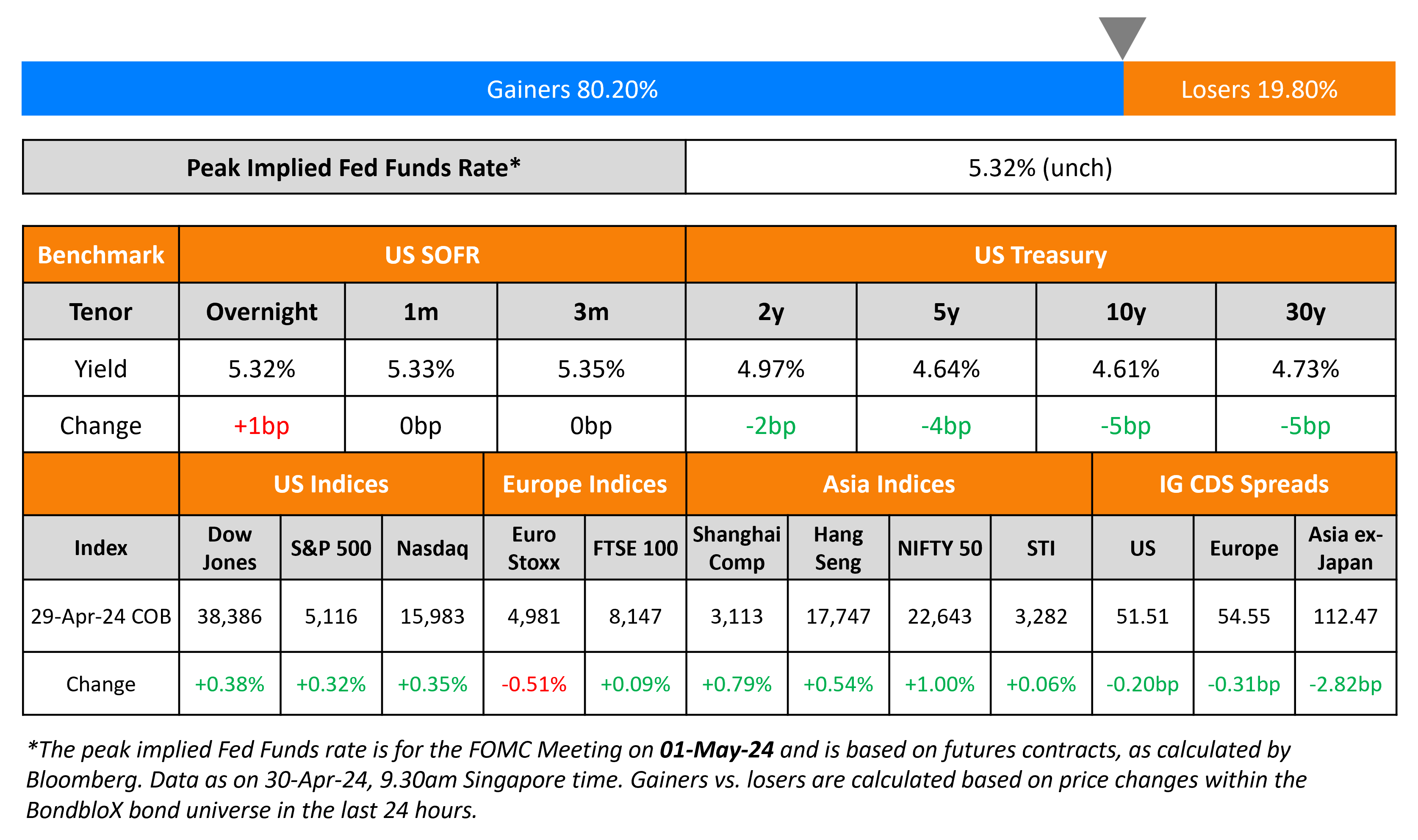

US Treasury yields continued to ease slightly by ~4-5bp across the curve. The Dallas Fed Manufacturing Activity Index for April came in lower at -14.5 vs. expectations of -11.2 and the prior month’s -14.4. Risk assets continued to perform well. S&P and Nasdaq continued to march higher, up by 0.3-0.4%. US IG CDS spreads tightened 0.2bp and HY spreads were 2bp tighter.

European equity indices ended mixed. European IG CDS spreads tightened 0.3bp while crossover spreads were 3.4bp tighter. Asian equity markets have opened broadly higher today. Asia ex-Japan IG CDS spreads were 2.8bp tighter.

New Bond Issues

Boeing raised $10bn via a jumbo 6-part issuance, the fourth largest deal this year.

The senior unsecured notes are rated Baa3/BBB-/BBB-. Proceeds will be used for general corporate purposes. The bonds have coupon step-ups of 25bps per rating agency (Moody’s and S&P), per notch below IG, capped at 100bp per agency i.e., 200bp in total. Coupon step-ups fall away permanently at Baa1/BBB+.

Kookmin Bank raised $600mn via a two-part deal. It raised $300mn via a 3Y bond at a yield of 5.409%, 25bp inside initial guidance of T+85bp area. It also raised $300mn via a 5Y bond at a yield of 5.298%, 30bp inside initial guidance of T+95bp area. The new 3Y bonds are priced inline with its existing 2.375% bond due February 2027 that yields 5.40%. The new 5Y bonds are also priced roughly inline with its existing 4.625% bond due April 2028 that yields 5.32%. The senior unsecured notes are rated Aa3/A+, and proceeds will be used for general corporate purposes.

Jiujiang Municipal Development raised $300mn via a 3Y bond at a yield of 6.55%, 55bp inside initial guidance of 7.1% area. The notes are unrated, and proceeds will be used to refinance existing debt.

New Bonds Pipeline

- Korea Expressway hires for $ 3Y/5Y bond

Rating Changes

- Fitch Upgrades Medco Energi to ‘BB-‘; Outlook Stable

- CITIC Group Corp. And Core Subsidiaries Upgraded To ‘A-‘ On Improving Capital Strength; Outlook Stable

- China Merchants Bank, Subsidiaries Upgraded To ‘A-‘ On Improved Liquidity; Outlook Stable

Term of the Day

Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls.

Talking Heads

On ‘Very Risky’ to Trade Chatter on Yen Intervention – Mark Dowding, CIO at RBC BlueBay Asset

“You can play the intervention trade, but you’re in very risky territory. When you’ve got the interest rate differential running against you as it currently is, it means that sitting long of yen is an expensive thing to do… There will certainly be a moment where you want to own the yen”

On Fed in holding pattern as inflation delays approach to soft landing

Citi Global Chief Economist Nathan Sheets

“The Fed has simply run into a brick wall. This is very strong data and it is not data that has given them any confidence they are meaningfully on their way to 2%…The Fed is simply going to have to wait”

J.P. Morgan economist Michael Feroli

“The post-meeting statement will be little changed from the one released after the previous meeting in March”

Top Gainers & Losers- 30-April-24*

Go back to Latest bond Market News

Related Posts: