This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOC Aviation Launches $ Bond; US Durable Goods Jump Higher

August 27, 2024

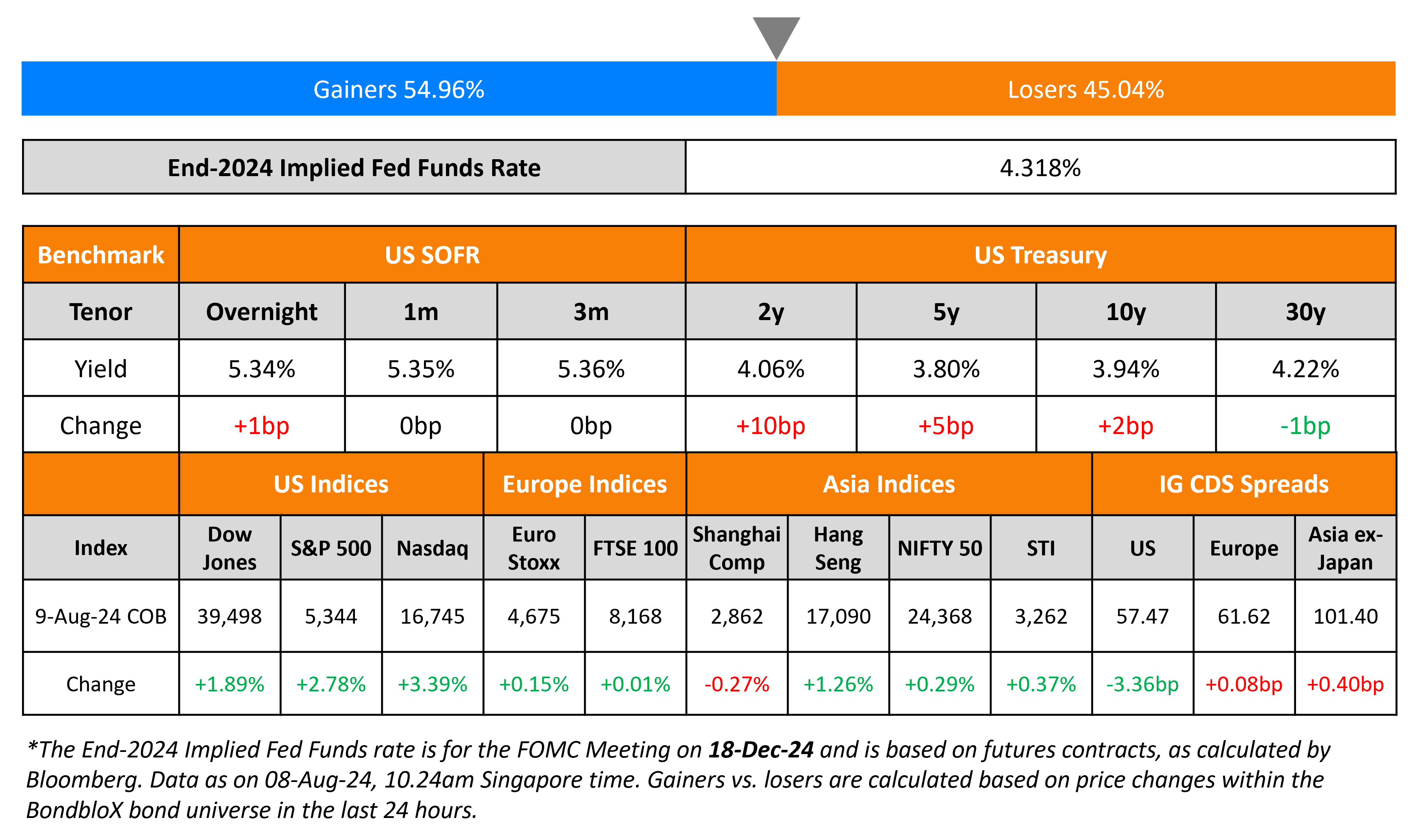

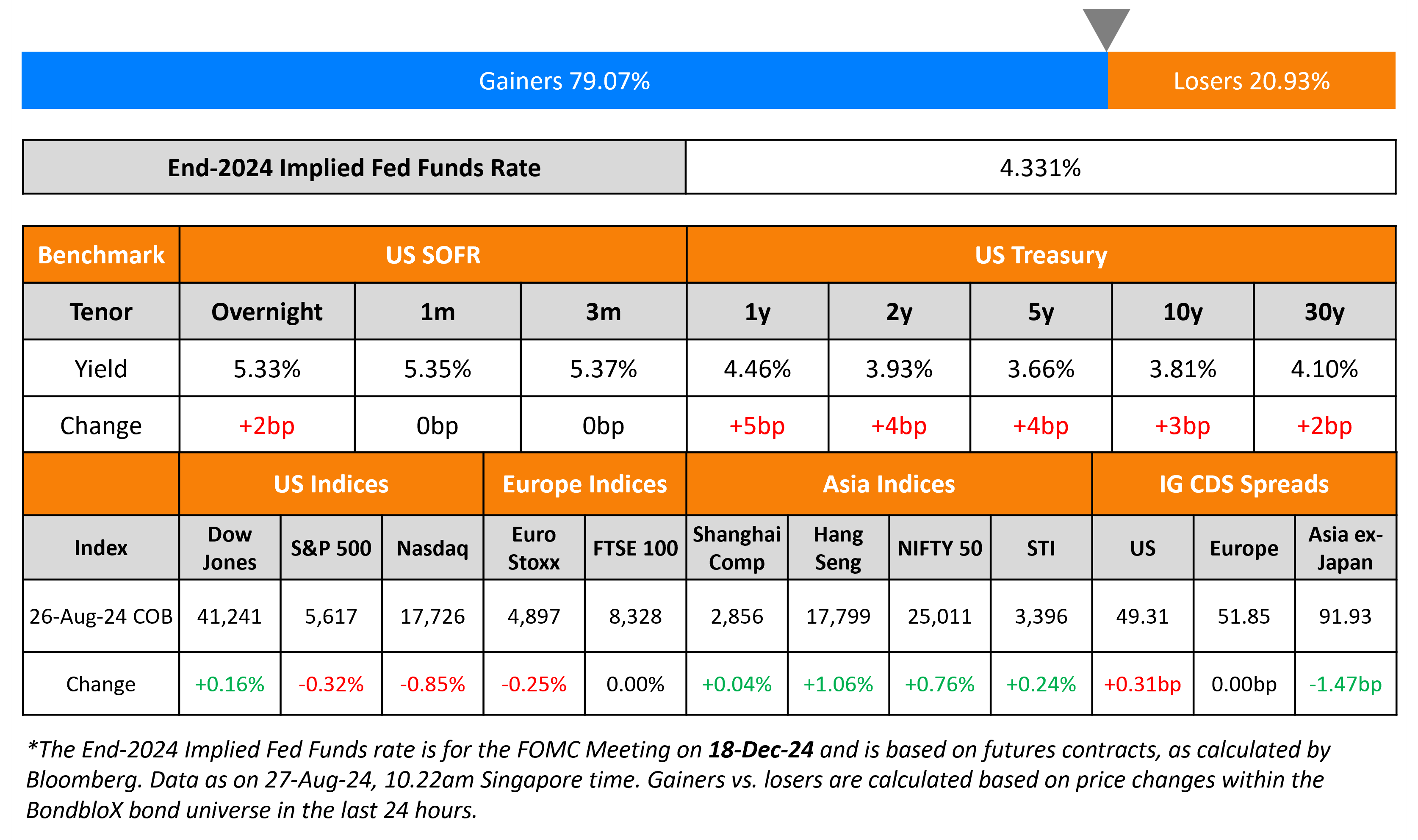

US Treasury yields inched higher by 3-5 across the curve, partly retracing the move seen post the Jackson Hole symposium. On the data front, US preliminary durable goods orders in July rose by 9.9% MoM vs. expectations of 5.0%, primarily driven by aircraft orders. Ex-transport durable goods orders fell 0.2% vs. expectations of a 0.1% drop. US IG CDS spreads widened by 0.3bp while HY CDS spreads widened by 2bp. Looking at US equity indices, the S&P and Nasdaq were down by 0.3% each.

European equity markets ended lower. Europe’s CDS market was closed due to summer bank holidays. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were 1.5bp tighter.

New Bond Issues

- BOC Aviation $ 7Y at T+140bp area

- Ganzhou Urban Investment $ 3Y at 6.6% area

New Bond Pipeline

-

Cathaylife Singapore Pte Ltd hires for $ 15NC10 bond

-

Jera hires for $ 5Y bond

-

Far East Horizon hires for $ bond

Rating Changes

- Del Monte Foods Inc. Issuer Credit Rating Raised To ‘CCC’ On Debt Restructuring; Outlook Negative; New Debt Rated

- Fitch Downgrades Albemarle Corporation’s Ratings to ‘BBB-‘; Outlook Stable

- Gray Television Inc. Downgraded To ‘B’ On Elevated Leverage, Outlook Negative

- Moody’s Ratings downgrades Yuexiu REIT’s ratings to Ba3; outlook remains negative

Term of the Day

Formosa BondA Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange.

Talking Heads

On Powell’s Pivot Leaving Traders Debating Size, Path of Rate Cuts

Jack McIntyre, Brandywine Global

“Markets need to digest this speech and remind themselves they — and the Fed — are still data dependent”

John Velis, BNY Mellon

“The 25bp versus 50bp is still an open debate”

Calvin Yeoh, Blue Edge Advisors

“Asia and the rest of emerging markets will likely see this as an open bar paid by US dollars”

On Return to 2% Inflation Target Not Yet Secure – ECB’s Philip Lane

“The return to target is not yet secure… monetary stance will have to remain in restrictive territory for as long as is needed to shepherd the disinflation process… return to target needs to be sustainable”

On Emerging Market Currencies Trade Mixed as Powell Rally Fades

Juan Perez, Monex USA

“Currency volatility is everywhere due to the great uncertainty, which has increased after the events (weekend)”

BBVA strategists

“Even though global risk appetite has fully recovered, some currencies have lagged, including the Mexican peso”

Top Gainers & Losers-27-August-24*

Go back to Latest bond Market News

Related Posts: