This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BEA, Prudential, Xerox Price $ Bonds; Powell Comments on Fed Path

March 7, 2024

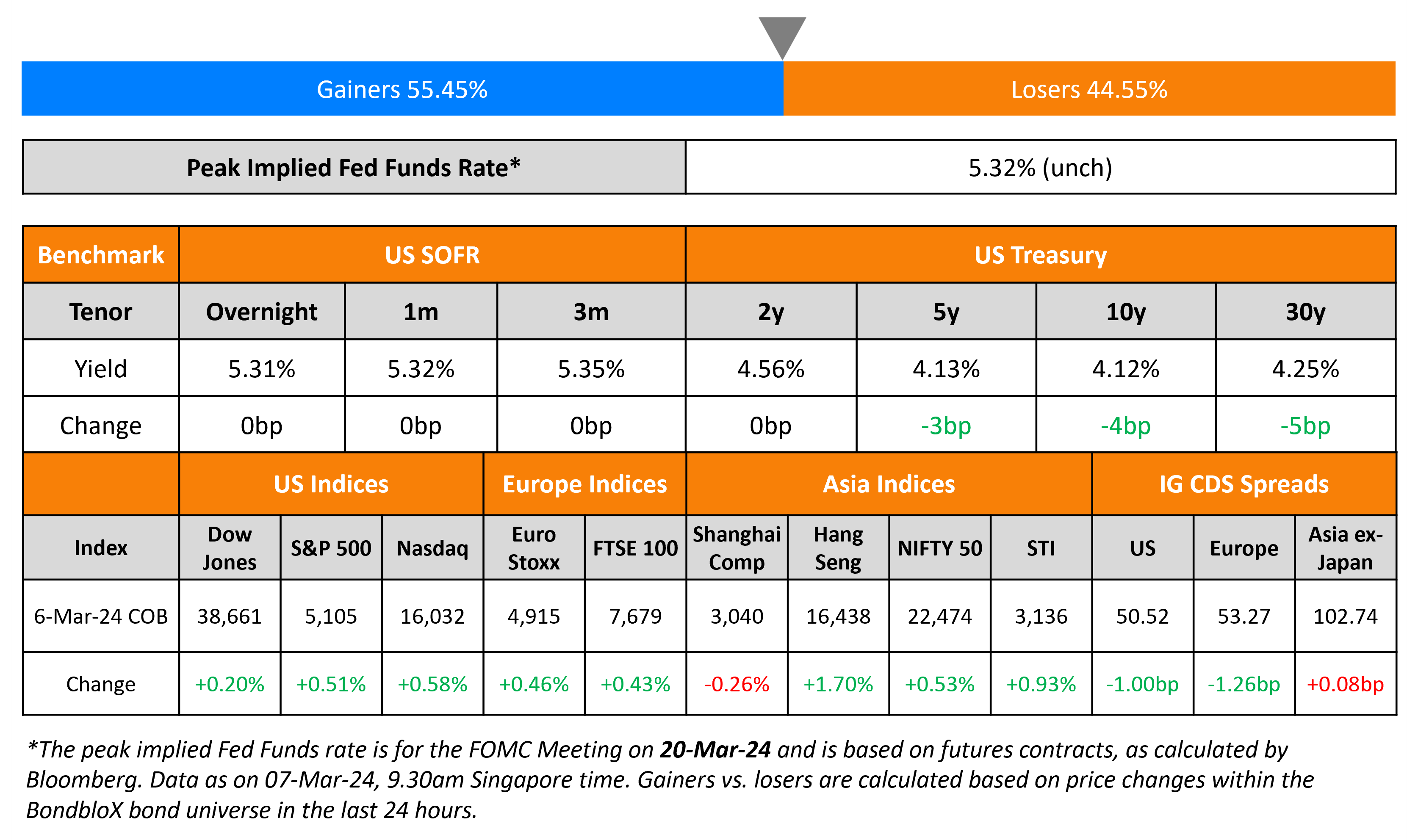

US Treasury yields were slightly lower across the curve. US ADP Employment change for February came at 140k, lower than the expected 150k reading. Fed Chairman Jerome Powell also commented on the Fed’s policy during his congressional testimony hearing. He said that rate cuts will “likely be appropriate” later this year and “if the economy evolves broadly as expected. However it will ultimately “depend on the path of the economy”, adding that he “would like to see more data” to confirm and make them more confident that “inflation is moving sustainably down to 2%”. Looking at credit markets, US IG CDS spreads tightened 1bp and HY CDS spreads were 4.5bp tighter. Equity markets closed higher with the S&P and Nasdaq up 0.5-0.6% respectively.

European equity markets ended higher. Credit markets in the region saw the European main CDS spreads tighten 1.3bp and crossover spreads tighten by 6bp. Asian equity markets have opened lower today. Asia ex-Japan IG CDS spreads were 0.1bp wider. BOJ policymaker Junko Nakagawa said that Japan’s economy was making steady progress towards achieving the pricing target with Reuters noting that there is speculation that the BOJ could end negative interest rates as soon as this month.

New Bond Issues

Prudential Financial raised $1bn via a 30NC10 bond at a yield of 6.5%, 37.5bp inside initial guidance of 6.875% area. The junior subordinated notes are rated Baa1/BBB+/BBB. Proceeds will be used for general corporate purposes, which may include the redemption/repurchase of $1bn of its outstanding 2045s. The bonds may be redeemed in whole, but not in part, at any time prior to 15 March 2034, within 90-days of the occurrence of a “tax event” or a “regulatory capital event” at par or a “rating agency event” at 102% of par. The new bonds are priced 30bp wider to its 6.75% subordinated notes due March 2053 that currently yield 6.20%.

Bank of East Asia raised $500mn via a 3NC2 loss-absorbing note at a yield of 6.847%, 40bp inside initial guidance of T+270bp area. The subordinated notes are rated Baa2/BBB. The bonds have an early redemption clause on the occurrence of certain taxation reasons/loss absorption disqualification event, subject to prior written consent of the HKMA. The bonds are callable at par in whole, but not in part, on 13 March 2026, subject to prior written consent of the HKMA. The new bonds offer a new issue premium of 11.7bp over its existing 6.75% note due 2027 (callable in March 2026).

Xerox raised $500m via a 5.6NC2.6 at a yield of 8.875%, ~25bp inside initial guidance of 9-9.25% area. The senior guaranteed notes are rated B1/BB. Proceeds will be used to fund tender for 3.8% 2024 and a portion of 5% 2025.

AES Andes raised $500mn via a 5Y green bond at yield of 6.322%, ~30bp inside initial guidance of T+250bp area. The senior unsecured bonds are rated Baa3/BBB-/BBB. Proceeds will be used to finance/refinance new or existing Eligible Green Projects. The remainder after this may be used to purchase all of (a) up to $100mn in aggregate principal of its $328.407mn 6.350% 2079s (b) any and all of the $117.49mn in aggregate principal of its 5% 2025s, that are tendered under its concurrent tender offers launched by AES Andes, and (iii) to repay certain bank debt.

Al Rajhi raised $1bn via a sustainability sukuk at a yield of 5.047%, 30bp inside initial guidance of T+120bp area. The senior unsecured bonds are rated A1/A- (Moody’s/Fitch). Proceeds will be used to finance and/or refinance, in whole or in part, eligible sustainable projects mentioned in its sustainable finance framework.

Lazard raised $400mn via a 7Y bond at a yield of 6.007%, ~27.5bp inside initial guidance of T+215-220bp area. The senior unsecured notes are rated Baa3/BBB+/BBB+. The bonds have a change of control put at 101. Proceeds will be used (a) to repurchase all its 2025s that are validly tendered under its Tender Offer (b) to repurchase, redeem, repay at maturity or retire any 2025s that may remain outstanding after the tender offer and (c) to pay fees and expenses related to the foregoing. Lazard Group intends to use the remaining amount of net proceeds for general corporate purposes.

New Bond Pipeline

- Aston Martin hires for $ 5Y/7Y bond

Rating Changes

- Enlink Midstream LLC Upgraded To ‘BBB-‘ Given Lower Leverage And Expectation For Stable Performance; Outlook Stable

- Moody’s upgrades Nvidia’s senior unsecured rating to Aa3; outlook positive

- Fitch Downgrades Paramount’s IDR to ‘BBB-‘; Outlook Negative

- Moody’s assigns Ba1 rating to Alcoa’s proposed new senior unsecured notes, downgrades ratings of existing senior unsecured notes to Ba1; outlook stable

Term of the Day

Shrinkflation

Shrinkflation is a term being used to denote inflation in disguise wherein, the quantity of a product has come down (shrinking) but the price remains the same as earlier. For instance, a bar of chocolate that has gone down in size or weight but the price continues to stay unchanged. In the UK, 76% of consumers noticed such shrinkage in September particularly for chocolates. Shrinkflation could also happen in operating hours, level of customer service and the quality of product offered for sale, Bloomberg notes.

Talking Heads

On Colombia Rally Fizzles as Fiscal Worries Leave Bonds in Limbo

Alejandro Arreaza, an Andean economist at Barclays

The bonds “are at a tipping point… If they send credible signals pointing in that direction, it would be well received by market. On the contrary, market pressures could re-emerge”

Jared Lou, PM for EM debt at William Blair

“The fundamentals trajectory still looks weak, with potential fiscal risk… It’s hard to get excited about the credit, especially if you think there’s more value”

Armando Armenta, an EM strategist at AllianceBernstein

There is “room for outperformance in fiscal accounts this year”

On Fed Impact Wanes as Local Factors Take Priority in EM Asia Bonds

Alvin Tan, head of Asia FX strategy at RBC Capital Markets

“I think inflation will continue to fall this year, but more slowly… Asian central banks will be looking to start easing policy, though most of them will likely wait for the first Fed rate cut”

Top Gainers & Losers- 07-March-24*

Go back to Latest bond Market News

Related Posts: